The OPEC ordered this Monday, September 5, a production cut of 100,000 barrels per day for October, which crude oil values shot up by almost 3%. This group represents 40% of global oil production

Oil returned to the volatility it showed in recent weeks, when it reached US$102 per barrel to fall back to US$91.

For its part, stronger US Dollar, which rose about 0.6% on better-than-expected US service industry data, also put pressure on oil prices.

According to different analysts, OPEC’s cut shows that it feels comfortable with a barrel around $100, that it is not willing to give in to the pressure of consumer countries and that they take away their ability to influence prices, power that they had lost since the emergence of fracking in the United States.

“The organization stated that the production policy will be reviewed monthly in ordinary meetings, although the cartel does not rule out holding extraordinary meetings in the event of any variation in its scenario,” they comment on Banca March, according to Investing.

“Everything points to the fact that the producers that make up the OPEC+ alliance are not in favor of oil falling much more than it has already done in the last three months. Developed economies will have to live with these prices in the best possible way”, they warn in Link Securities.

Source: Ambito

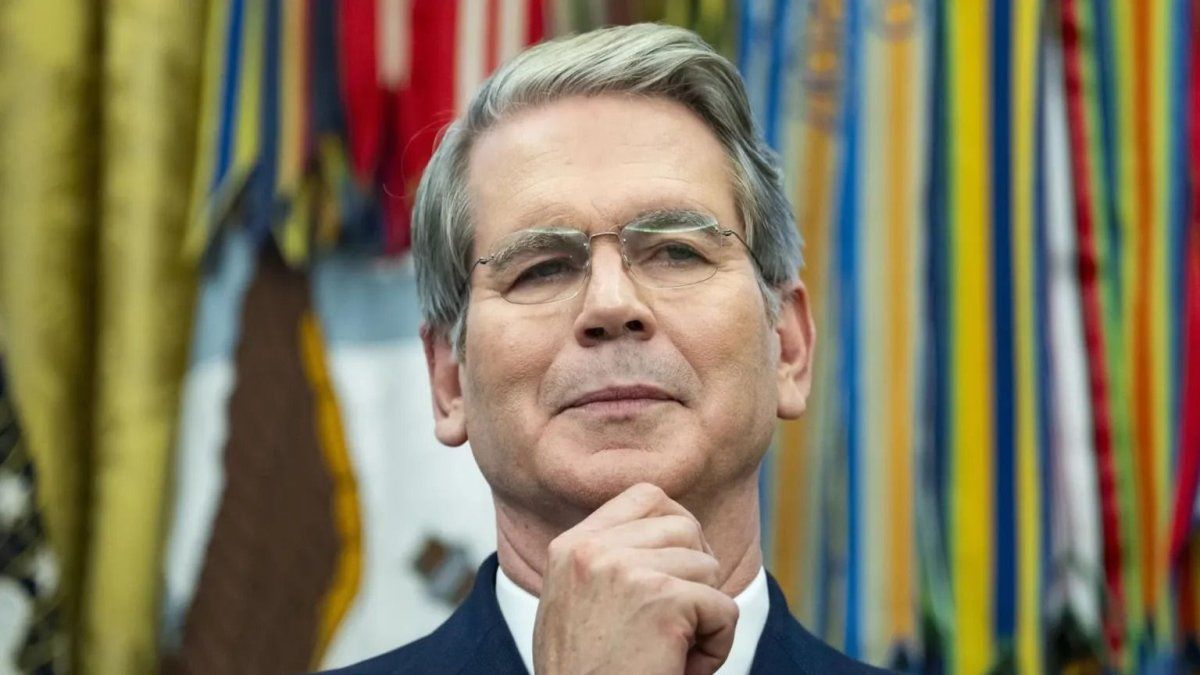

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.