Thus, between January and June, there was a widening of the gap between adding and deleting accounts, and sustained growth as of April. Taking this dynamic into account, a net growth of 10,354 banked companies was recorded.

inter 2.jpg

When comparing the distribution of companies by segment in the financial system at the end of last June, SMEs and Micro-SMEs represented 96.6% of the accounts registered, while large and medium-sized companies accounted for the remaining 3.4%.

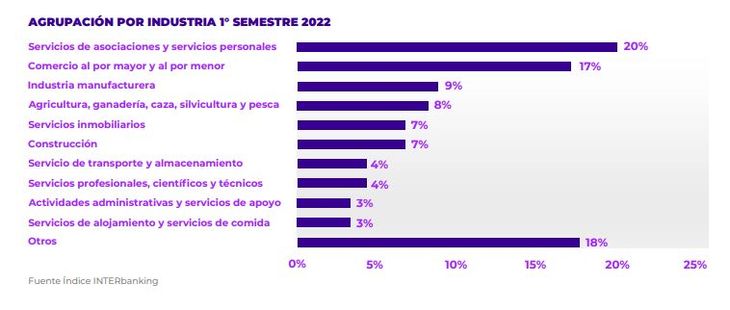

The items that stand out for their evolution are: Commerce (11.6%), Construction (11.2%) and Accommodation and food services (15.6%), with a great influence due to the reopening of post-pandemic activities.

inter 3.jpg

“There is a marked trend towards the digitization of financial transactions in the Argentine corporate sector. In the first half of 2022 alone, digital transactions in the sector exceeded 60 million, a difference of 11.2% more than the first half of the previous year”, said Pablo Carretino, CEO of Interbanking.

Depending on the region where the companies are established, 81.5% of them were registered in CABA, Province of Buenos Aires, Córdoba, Santa Fe and Mendoza. These 5 provinces show us 3.7% more companies than the previous year. However, if we compare the growth with respect to the first half of 2021, we observe that the greatest variation occurs in the provinces of Chaco (12.9%), Salta (9.2%) and Tierra del Fuego (8.8%).

inter 4.jpg

The Interbanking Index will have a semi-annual periodicity, in which the behavior of the corporate sector in the financial system during the specified semester and in comparison with the previous year will be analyzed.

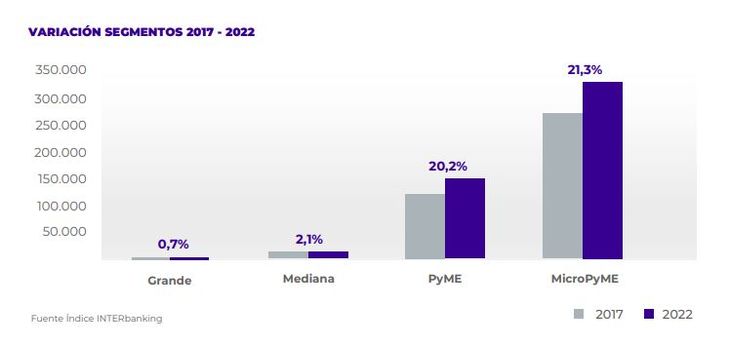

Evolution in the last five years

According to the Interbanking report, the historical evolution of recent years marks a sustained increase in the use of banking services by companies, especially in the banking sector. SMEs and Micro-SMEs, which grew by more than 20% in the last five years.

interior 1.jpg

Through the Interbanking network -of which 57 banking entities are part- 497,944 companies currently operate, which until June this year had a total of 3.7 million accountsa number that increased by a 64% in the last 5 years. Following the data, this amount represents a average of 7 bank accounts per company, compared to the 5 that were recorded in June 2017.

“Digital transformation crosses all sectors of the economy, and companies need an integrated, connected and secure financial system, with agile tools and dynamic methods that adapt to their management needs. At Interbanking we want companies to be able to concentrate all their banking operations in one place”, Carretino pointed out.

The Interbanking platform allows entities to manage their accounts from the same place, and access administration services such as salary payments, billing and management of checks, payments and collections from the same virtual space.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.