According to a recent study by the Catholic University of Uruguay (UCU) On the price relationship between the two countries, the gap reached one of the highest points since 2015. On average, goods and services are up to 174% more expensive on the eastern side. The difference is almost three to one.

The Border Price Indicator for July showed that for a set of products that make up the Uruguayan basic basket, it is “63% cheaper to purchase said basket in the city of Concordia (Argentina) than in the city of Salto (Uruguay)”. The Salto-Concordia pass, also full of cars seeking to cross to the Argentine side, is another example that is also experienced in the border cities of Fray Bentos (UY) and Gualeguaychú (AR).

How the phenomenon is experienced from the Argentine side

A city of approximately 100,000 inhabitants receives Uruguayan tourists every day who arrive with their cars willing to buy the maximum allowed by the Uruguayan authorities.

According to official sources from the neighboring country consulted by this means, for border traffic (round trip from Fray Bentos-Gualeguaychú and vice versa) Uruguayans can enter up to 5kg of groceries per basic basket for a person over 18 years of age. Meanwhile, the tourist who enters Uruguay can enter up to US$300, alcoholic beverages, gifts and household appliances.

“In May, the number of people who crossed the bridge increased. Especially when the COVID insurance was removed, ”confirmed an official consulted. COVID insurance represented an impediment for Uruguayans since it was an impossible procedure to avoid and high cost. Until the month of August, for Uruguayans it represented US$6 per day and average value per person.

Among the products most purchased by residents when they arrive in Gualeguaychú are medicines, clothing, fuel and food. “From the merchant side, the off-season helped a lot. There is more movement. The restaurants are full, there are queues at the pharmacies. There are people who are going to see the negative side of everything, but in terms of the sale, it favored it,” said a Gualeguaychu merchant near the bus station.

“90% of the merchants are happy, it helped reactivate the city that was very down due to the pandemic. In the case of service stations, there was no problem of shortages related to tourism. But it favored us, we worked better and more quantity. There is no one in the city who is not favored by this,” added a stationer consulted by Ámbito. There was consensus, most of the merchants briefly interviewed were satisfied with the arrival of tourists to the city.

One fact, perhaps the most interesting to take into account: in Gualeguaychú, exchange houses are only closed on Sundays even out of season.

How do they buy when they arrive in Argentina?

It is vox populi that most Uruguayans exchange their dollars on the informal market. The so-called “little trees” and exchange houses are accessible to both Uruguayans and Argentines who are willing to exchange currency.

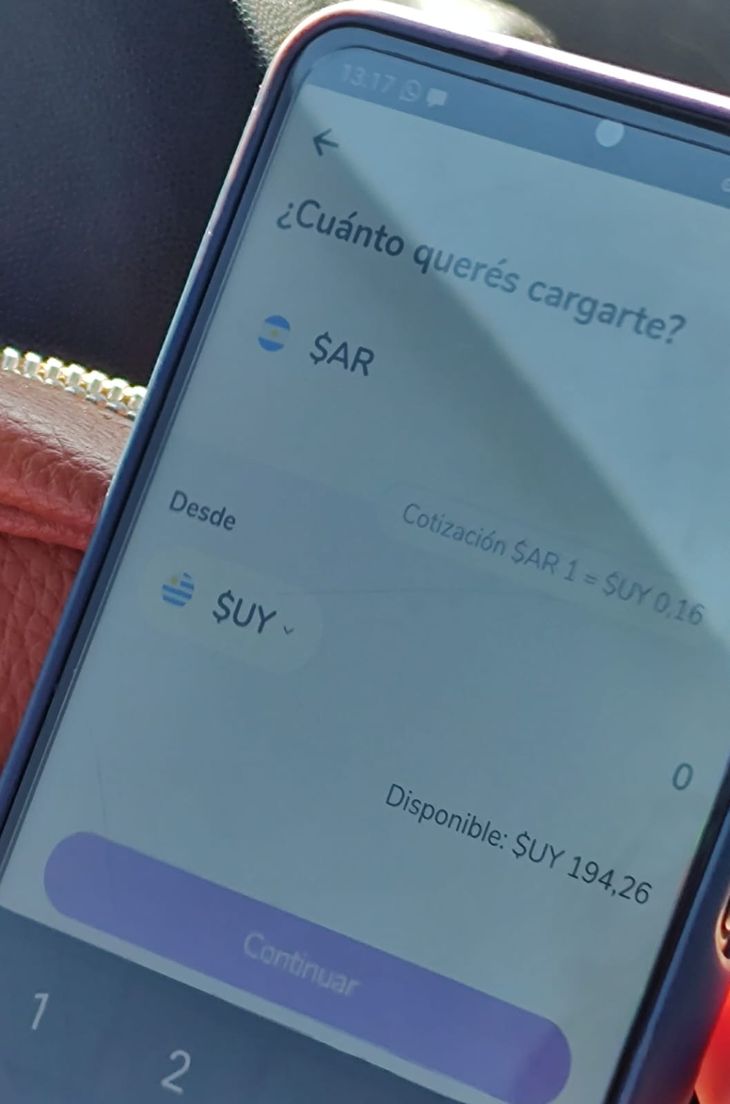

But there is a better alternative. “In order not to carry so much money with us, because they give us a lot of bills, we use Prex,” reflected a Uruguayan tourist consulted. This is the Prex fintech platform, where they can acquire a prepaid debit card (derived from a Mastercard) with which they can make payments on the Argentine side.

This application allows, without the need to have an associated bank account, to charge a certain amount in pesos or dollars that can later be spent in any currency in the world, operating like any international debit card.

In the case of Prex, $100 can be loaded onto his Uruguayan card and transferred to a second card based in Argentina. In this way, the user will receive Argentine pesos in exchange since the conversion is made considering the exchange rate “counted with settlement”, which is located above the blue. For Uruguayans, obtaining the card is quite simple: it is done online. However, they warned of delays of up to six months for it to reach the home and be able to use it.

Despite this inconvenience, the advantage most pointed out by them is their speed in operation and ease. They do not need to go to a bank, or have large sums of money on them. The money load is done through the application instantly.

prexcard.jpeg

cardprex2.jpeg

On July 21, the Central Bank announced a measure aimed at tourists entering Argentina where they can settle their foreign currency through authorized financial entities and exchange houses. As of the validity of the norm, foreign tourists will be able to access the sale of dollars at the price of the financial dollar through public and private financial entities, as well as exchange houses. The requirements are more flexible: present the identification documentation that proves entry into the country. At the International Bridge, of 10 Uruguayan tourists consulted while queuing to cross the Bridge, all were unaware of the measure. The clarification is worth: it is not a representative sample of all the tourists who cross into the country.

Fray Bentos: the most affected Uruguayan city

From the Uruguayan side they are not celebrating. Fray Bentos, a small town of just over 25,000 inhabitants, 30 kilometers from Gualeguaychú, suffers from the Argentine exchange rate. According to the Commercial Association of Río Negro (UY), there were 30% fewer sales in stores in Fray Bentos in the month of August.

According to the most well-known newspaper in Uruguay, El País, the main authorities of the border departments of Uruguay asked the Executive Branch to exempt basic products from VAT in order to mitigate and try to discourage Uruguayans from going to Argentina to make purchases.

At the moment, from the Uruguayan side they do not believe that measures can be carried out to mitigate the damage that the exchange difference is for Uruguayan trade. They consider that for much longer, due to the crisis Argentina is going through, it will continue to have “bargain prices” for those who cross the bridge with dollars. The Uruguayan Government has the challenge of making its products more competitive and cheaper for its own population. From the Argentine side, the debate continues to revolve around the Central Bank’s ability to capture those dollars from Uruguayans eager to spend in the country that continue to be channeled through the informal market.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.