CEDEARS

August was not a good month for Cedears. Stock markets in the US started higher, but after reaching a maximum in the middle of the month, they began a correction that stopped at the end of the month. After a few days of rebound and above all, after the bad US inflation data this week, investors take profits.

Considering that the CCL dollar rose only 1.6% in August, any rise above this figure that any Cedears has experienced corresponds to a rise in the US stock. Let’s remember that the price of a Cedear is determined by the share price on Wall Street by the exchange rate counted with liquidation.

As we can see in the graph, August was good only for the oil and energy sector. Apart from these and considering the most traded in our country, Mercado Libre, Alibaba (which had been hit hard) and Disneyperformed well, exceeding local inflation.

download (12).jpg

LOCAL ACTIONS

The local stock market as a whole rose 11.2%, outpacing inflation. It was driven by YPF, which advanced 47% in August (it continues to rise in September).

As on Wall Street, the companies that rose the most were oil and energy. Let us remember that last month, YPF signed an agreement for lithium exploration in Catamarca.

download (13).jpg

INSTRUMENTS CER

Within this group we have bills and bonds issued by the National Treasury and FCI that invest in these papers. These instruments managed to overcome the crisis that began with the departure of Guzmán and today many of them are trading above the levels of early June, when the crisis broke out.

After twists and turns, massive bailouts by the FCIs and sales at auction prices, these assets recovered due to the high demand for hedging against inflation since we are going through months of high inflation and the expectations for the coming months are not encouraging.

Investors seek refuge and they find it in these papers since they adjust principal and interest by the CER coefficient, which measures inflation. The demand for UVA fixed terms is also very high, where banks have already set some limits. UVA in August rose 6.5%.

Of the entire strip, the winners were the long bonds, which were behind the Lecers, who were able to recover faster. It is that the demand is concentrated in short papers.

download (14).jpg

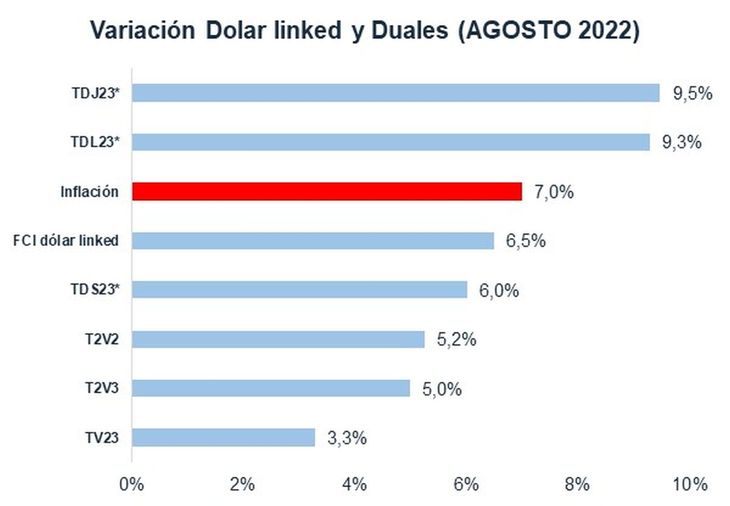

DUAL AND DOLLAR LINKED

Dollar-linked bonds are demanded as a hedge against a devaluation of the peso. In August, they yielded somewhat less than the official devaluation, which was 5.7%. The increases in dual bonds stand out (those that pay the maximum between devaluation and inflation) that rose between 6 and 9.3% since their IPO, in the middle of the month. This gain also has to do with the high demand for coverage.

download (15).jpg

financial advisor

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.