In this context there are several questions. For how long will the blue continue without moving in the face of the advance of the dollars and inflation? To this is added, With the rise in financial dollars and the expectation that the blue will recover the upward trend. Is the fixed term suitable? Or can it be “short” in a short time?. In Ambit We consult the analysts.

“With the rate hike of 550 points by the BCRA on Thursday, there are two particular situations. On the one hand, the nominal annual rate (TNA) reaches 75% per year for fixed terms of individuals and leliqs, and 107% the effective annual rate (TEA) that indicate that the first is below year-on-year inflation, that is, it is not positive in real terms, but on the other hand, projecting annual inflation one year ahead, the TEA is at least 10% higher. So, it may happen that the increase in fixed-term deposits continues (8.5% last month) and that more and more savers choose this option,” said the economist Frederick Glustein to this medium.

dollar-investments-finances-dollar blue.jpg

NA

“On the other hand, despite the rise, the rate is lower than monthly inflation, that is, the August CPI was 7% and the monthly rate is 6.25%, so the saver loses 0.75 percentage points per month by choosing the traditional fixed term. In that sense, assuming that inflation can be 6% per month, annualized somewhat above 100%, it would be a real return of around 3%, but if inflation were 6.5%, it would be below again, for which the differential is very fine“, he added.

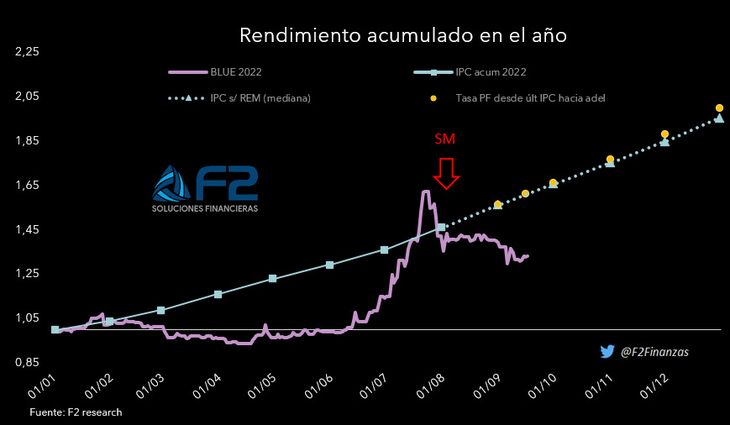

“In turn, the dollars have risen little compared to inflation. While financials have climbed just over 40% so far this year, the blue has done so around 37%. That is, all prices they were below the IPC accumulated in the year up to 20% In terms of investment, for a small saver and who is not daily aware of market movements, the UVA fixed term is a correct choice because it pays 1% plus inflationbut it is necessary to take into account the minimum of 90 days immobilized the resources, so it can be complemented with a traditional 30-day fixed term. In addition, due to what was said above, if the expected inflation is 6% per month or less, the traditional 30-day renewal would be an opportunity, although it will depend on maintaining rates in this order.

“It is possible that if inflation falls, then rates do so, then it is no longer as profitable, but if the BCRA raises rates again next month with the September CPI, it may be even more attractive. Much depends on the decision of the BCRA in relation to the interest while the UVA is flat profitability”, concluded Glustein.

The blue dollar could rise this week

In another order, Isaiah Marine, economist of Ecoviews stated that the rise in rates “has more effect in containing the gap.” “A part of the movement of financial dollars is explained by the strong issue derived from the purchase of the soybean dollar by the Central Bank, but the expectation of some restriction or rise in the tourist dollar also made noise. And it is the latter, together with the prohibition of accessing the official dollar or operating with securities in dollars for those who maintain energy subsidies, which can make the blue dollar move even more in the coming days”, advance.

“But in the short term, an investment can hardly beat the traditional fixed term that already yields 6.2% per month, in line with the expected inflation for the coming months, and that does not have the disadvantages of the UVA fixed term. And although the blue would seem cheap relative to the July peaks, it is key to remember that those were run levels. The risk is that it jumps as we approach the World Cup. The saver must put that on the balance, but at least today with the fixed term he knows that he can protect the value of his savings, “he added.

Inflation puts pressure on the dollar

The Economist Andres Reschini in dialogue with Ambit, maintains that the new rate increase by the Central “attempts to place the yield of the PF slightly above the projected CPI.” “The drawback is that we started the year with expectations of around 40% inflation for 2022 and we are already talking about 100%, the Central Bank issued 12% of the monetary base in 9 soybean dollar wheels to acquire US$2. 155M under this scheme and the CCL rose around 7% in the week to close around $300, with which we could think that the blue will not last too long in these values if this dynamic continues in the financials and even less taking into account the new restrictions on access to the exchange and TCO for beneficiaries of rate subsidies”.

dollarblueIPCjpeg

According to the analyst, “the traditional PF would be yielding 6.16% in 30 days, but we already know that if the blue “wakes up” it can evaporate that yield in a very short time. We don’t know if it will, but ingredients are not lacking.”

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.