On Thursday, the company announced that it had agreed be acquired by the sovereign wealth fund of Singapore GIC and Oak Street in a cash transaction valued at approximately 14 billion dollars. STORE Capital shares jumped 20% on the news.

Under the agreement, STORE Capital shareholders will receive $32.25 per share in cash, 20.4% more than the closing price of the shares on the previous trading day. The agreement also includes a 30-day “buy-in” period, during which STORE Capital may solicit competitive bids. The transaction is expected to close in the first quarter of 2023 if approved by STORE Capital shareholders. As of June 30, Buffett’s Berkshire Hathaway owned 6,928,413 shares of STORE Capital.

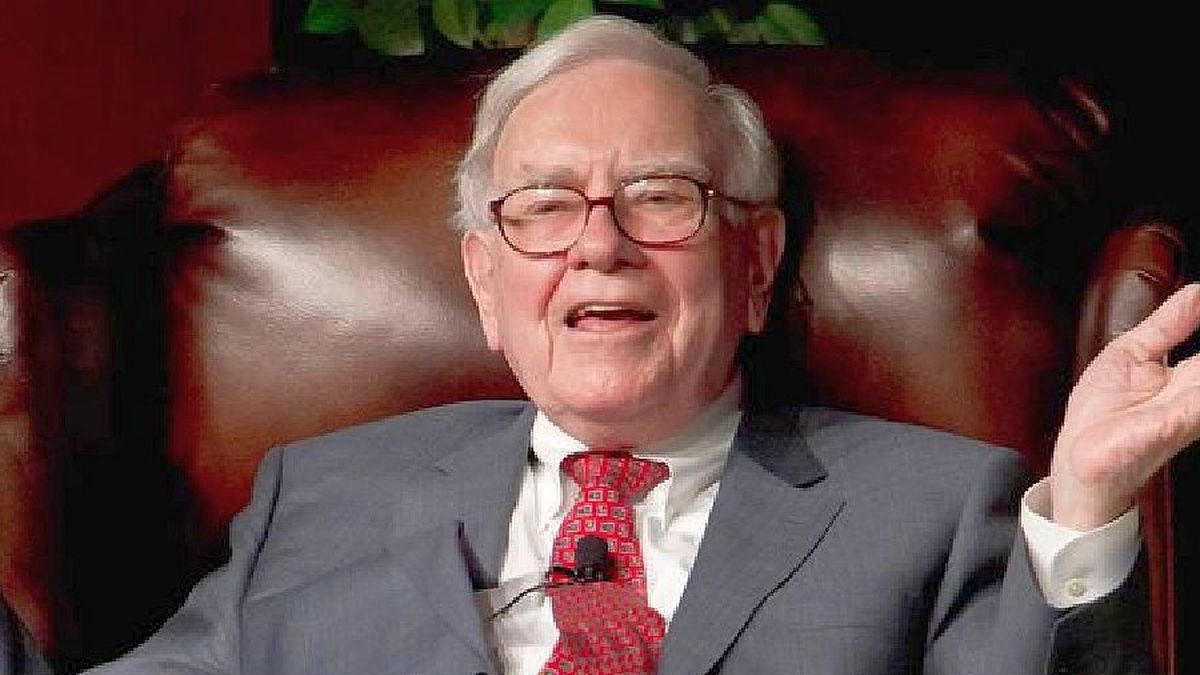

Another sign from Buffett

Warren Buffett has placed most of his Berkshire Hathaway company’s cash in short-term US Treasury bonds. While the news doesn’t directly affect Bitcoin, for analysts it could be a clue to short-term bearish potential.

This move is likely a response to the massive rise in bond yields since August 2021 in the wake of the Federal Reserve’s (Fed) tightening policies aimed at curbing inflation.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.