Some of the most relevant advantages of obtaining financing in the Capital Market for SMEs are, first of all, the certainty that it is a transparent alternative since the Market where SME financing instruments are traded publishes the rates in each term every day, and according to each type of instrument, highlighted a BYMA report.

It is a competitive financing rate because the instruments are discounted in the Market in the auction mode, which guarantees price-time priority of purchase orders, ensuring the best rate for SMEs with absolute transparency.

On the other hand, SMEs have advice to be able to operate in the Market through contact with a ALYC or broker that provides all support so that the financing adjusts to the needs of the entrepreneur.

Last but not least, the advantage is that they are 100% online operations. Digital instruments like the Echeq, the Electronic Promissory Note and the Electronic Credit Invoice, They allow SMEs to obtain financing in the Capital Market from anywhere in the country in an agile and secure manner, eliminating operating and management costs.

All these instruments are available on the EPYME online platform of Caja de Valores, the BYMA Group’s depository entity. It is free to access and through it SMEs can finance themselves in the Capital Market with a simple click. It is developed with blockchain technology and is the link that allows you to enter the Echeqs from the Bank to your ALYC, and generate digital Promissory Notes to also negotiate them through your ALYC.

Echeqs

The most used instrument is the Echeq, an electronic check that can be your own, or received in part as payment by a client, which had an exponential growth in the amounts deposited in the custody of Caja de Valores since January 2022. The discount of checks represents the predominant instrument of SME financing in the market. The check can have a term of up to 360 days.

In July 2022, the maximum peak is found with respect to the amount deposited since the launch of the instrument, which reached $36,314,444,516, but not so in the amount, which occurred in June 2021. In March, the amount deposited increased by 47 .87% and in June 27.26%. If we compare January and July, income in the first month of the year and the peak, the growth was 87%.

ECHEQ.jpg

Promissory notes

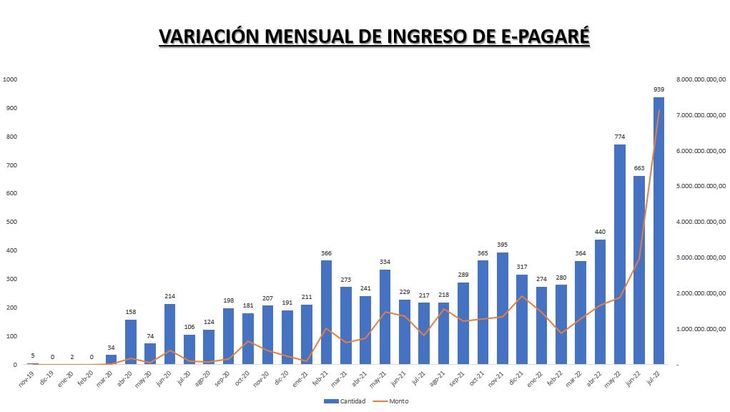

The Digital Promissory Note is also an instrument used, although to a lesser extent than the Echeq. However, this last year has been reflecting considerable growth compared to the same period of the previous year. The term can be up to 3 years, which allows for longer-term financing. The advantage offered by this instrument is that it can be issued in both pesos and dollars (the latter, payable in pesos at the exchange rate selected at the time of issue).

There was an exponential growth in July 2022, but the growth in quantity is seen from February from this same year. In July 2022, the maximum amount and amount income peak took place, since the launch of the instrument. Comparing January and July, what was entered in the first month of the year and the peak, the growth was 271%. The comparison is always with respect to the previous month, with which the growth is very exponential.

PAGARE.jpg

Electronic Credit Invoice

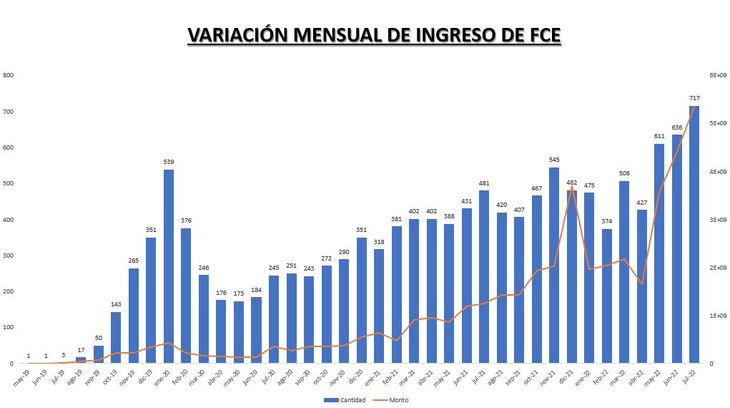

The Electronic Credit Invoice began to operate a little over a year ago and is aimed at large company suppliers being able to finance themselves with the same invoicing, without the need for an additional instrument. It is a short-term financing, typically 45 days.

The FCE has had significant growth in recent months and some of the reasons are as follows: FCE has a more accessible cost and is equivalent to cash. It is useful because it allows SMEs to convert them into cash simply and online, without having to wait for the payment terms of their large clients.

How does it work? As authorized by AFIP, a SME must issue an electronic credit invoice to a large company. The receiver will have 25 days to reject, observe or accept it: once admitted, it becomes an executable document, that is, discountable as it happens with a check, in banks, finance companies, trading platforms and the stock market, in a simple way, fast and online.

In addition, it is negotiable and defines the issuer. For example, if the person who bought this document (in general, institutional investors) fails to collect it after the stipulated date, they can only claim against the payer, that is, the client company to which the supplier SME initially issued it.

At the beginning of 2022 there was a drop in the amount deposited with respect to the last month of the previous year. As of May, there was an exponential growth both in amount and quantity. In this last month it was possible to see the maximum income peak of amount and quantity, since the launch of the instrument. Comparing January and July, what was entered in the first month of the year and the peak, the growth was 169%.

fce.jpg

Each of these instruments collaborates with different needs and turns out to be more effective depending on the scenario. The definition of the most useful instrument will be based on the need of the entrepreneur or SME: amount required, financing term (in general, the greater the amount financed, the longer term is needed), rates, among other factors.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.