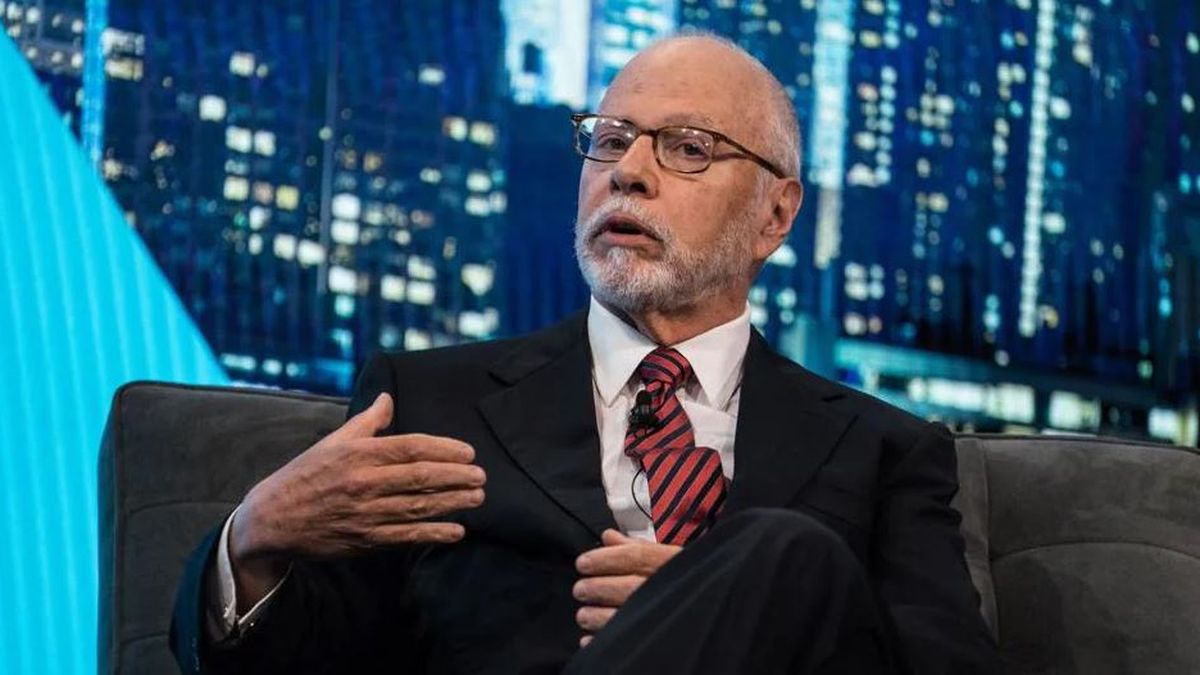

The firm, run by billionaire Paul Singer and Jonathan Pollock, told clients “investors shouldn’t assume they’ve ‘seen it all'” because they’ve been through the ups and downs of the 1987 crash, the dot-com boom and the 2008. Global Financial Crisis and Past Bear and Bull Markets.

They added that the “extraordinary” period of cheap money is coming to an end and “hhas made possible a series of outcomes that would be at or beyond the limits of the entire post-World War II period.”

The letter said the world is “on a path to hyperinflation,” which could lead to “global social collapse and civil or international conflict.”

They estimated that the markets have not yet fallen far enough and that the equity markets could fall more than 50% would be “normal”, adding that they could not predict when that would happen. The S&P 500 fell 19% from its peak earlier in the year.

Elliott executives warned customers that the idea that “‘We won’t panic because we’ve seen this before’ is inconsistent with current facts.”

At the same time, they blamed the Fed for the current global economic situation and said it had been “dishonest” about the reason for high inflation. They said lawmakers had shied away from responsibility by blaming supply chain disruption caused by the pandemic rather than loose monetary policy imposed two years ago during the peak of COVID-19.

The hedge fund is posting returns of 6.4% so far this year and has only lost money for two years in its 45-year history.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.