According to a recent report by IOL investoronline in comparison with its peers, “in the last 12 months, it has managed to rise 69% in dollars, while the main US indices have fallen between 10% and 19% respectively in the same period of time.

The best local companies

Yields in pesos:

- Galician Financial Group (47.6%)

- Macro Bank (42%)

- Transener (41.8%)

- YPF (39.9%)

- BYMA (37.9%)

bonds

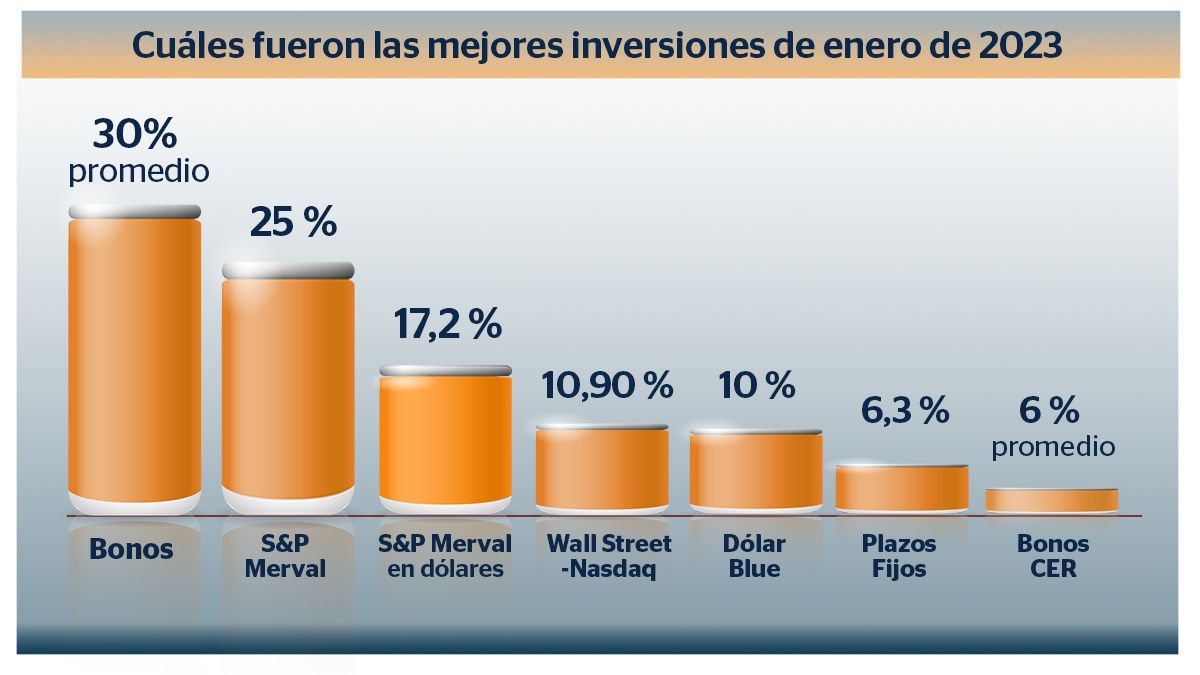

Starting the analysis by sovereign bonds, the biggest gainers of the month, with an average yield of 30% in dollars. According to IOL Invest Online, “a few months ago there has been a build-up of positions in these bonds, which occurred in a context where the parities were at historically low values. Therefore, we understand that this increase in demand ( reflected in prices) was caused by players who began to position themselves already thinking about a certain electoral expectation, to which was also added a favorable context of what is fixed income from emerging countries”.

Regarding the CER bonds, they had an average yield of 6% in pesos.

Wall Street

Wall Street also started the year with optimism. After what was a rather negative 2022 for international markets, in a year in which high inflation and an aggressive monetary policy by the Federal Reserve (FED) were in charge of causing the most important correction in the North American markets since 2008.

In the first month of the year, the markets seem to have turned the page, recording a more than positive month as inflation, one of the main problems threatening the global economy, began to be brought under control.

Regarding its monthly performance, the technological index Nasdaq 100, registered a strong rise of 10.90%. In the case of the other two relevant selectives on the New York Stock Exchange, the S&P 500 and the Industrial Dow Joneshave also closed November on the rise, with a rise of 6.18% and 2.83% respectively.

CEDEARs

Under this somewhat more encouraging scenario for the stock market, we have had some CEDEARs that have stood out above the rest during January. In fact, the ones that have performed best are companies that had just suffered a significant fall and have recovered a good part of your losses.

The company that rose the most during the first month of the year was the manufacturer of electric vehicles, Tesla (TSLA)with a rise of 49.70%.

Second, we have Free Market (MELI), the e-commerce platform founded by Marcos Galperín. In January, the company has had a solid performance and its CEDEAR appreciated 48.6%.

While, finally, in third place, the semiconductor manufacturer Cedear stands out, Nvidia (NVDA)with an appreciation of 43.65%.

cryptocurrencies

After a 2022 to be forgotten in the crypto world, cryptocurrencies closed the month with strong rises after the rally in recent days that led them to recover. The market managed to add US$280 million in the month, managing to recover the 1,000 million of market capitalization lost after the bankruptcy of FTX. Some altcoins made gains of more than 100% while Bitcoin managed to break the $23,000 barrier.

The cryptocurrencies with the highest performance during the first month of the year were:

1. Solana (SUN): 141.67%2

2. Avalanche (AVAX): 83.54%

3. Cardano (ADA): 55.94%

4. Shiba Inu (SHIB): 47.17%

5. Polygon (MATIC): 46.86%

Dollar and fixed terms

As for parallel dollars, they had a strong rise of 10%, generating a good return for those who have their savings in hard currency, above expected inflation.

For their part, financial dollars closed January with a slightly leaner rise compared to the blue of 6.2% for the MEP and 8.2% for Cash with Settlement (CCL).

Finally, in relation to fixed terms with an annual rate of 75%, they yield 6.3% in the month, above the inflation expectation for January and while waiting for the official numbers. This acceptable yield will be as long as the Central Bank does not decide to reduce the rate.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.