First Horizon National Corporation is another good merger arbitrage option, as Toronto Dominion Bank is buying the bank in a deal that is expected to close by the end of the quarter. This comes after Soros’s fund successfully held merger arbitrage positions in Duke Realty, Twitter and Biohaven Pharmaceutical Holding Co Ltd last quarter.

The Soros fund also nearly doubled its position in Alphabet, increasing the position in Class A shares by 73% and adding a small position in Class C shares.. The data in this presentation predates the recent ChatGPT uproar, and Alphabet is up just 7% this year, trailing the Nasdaq. The Soros Fund cut its position in Amazon by more than half, from 1.98 million shares in the company to 901,000.

Other new holdings have been Altra Holdings Inc, common stocks and stakes in Capital One Financial Corporation and Discover Financial Services, and a new buy position in Tesla. Soros Fund Management also increased its positions in Cboe Global Markets Inc, Tesla common stock, 3D Systems, Ford Motor Company and the Walt Disney Company.

The fund has trimmed positions in DR Horton Inc, Qualcomm, Salesforce and Nike. It also sold positions in Atlassian, Bank of New York Mellon, Global Blood Therapeutics and Zoom Video Communications Inc.

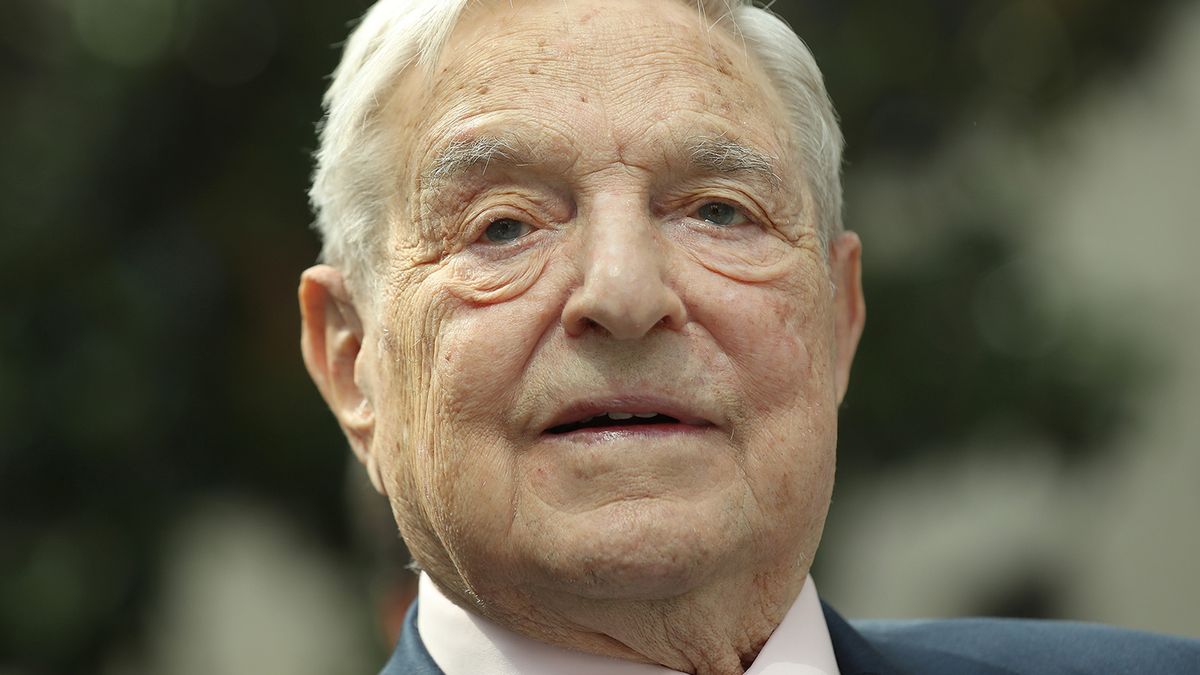

Although public information on George Soros’s performance last year is limited, according to InvestingPro’s monitoring, the value of his holdings measured on a quarterly basis has risen 9.5% this past year, compared with -3% for the S&P500.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.