In general, the vision of the monetary regulator is to keep the rate at 75% per year, as up to now, with an effective annual interest rate of 107%. But there would be nothing defined, for the moment, because there is different positions at the board of directors.

Fixed term: positions in favor of raising the rate

On the one hand, some members of that organization consider that it is necessary to give a strong signal from the BCRA to control inflation and also make sure the pesos don’t go to the dollar.

The economist Fabio Rodríguez, director of MyR Consultores, mentions that the Government has already given guidelines that it will not change the rates, given that the Vice Minister of Economy, Gabriel Rubinstein, “came out to say that core inflation is aligned with the rate and the exchange rate.

The issue, according to Rodríguez, is that they greatly influenced some seasonal factorsbut his vision is that “it is not clear that the acceleration also comes from food and expectations remain unanchored”, so he considers that it is understandable that there are positions that, based on the latter, want to “overreact and give a sign of more monetary hardness”.

Fixed term: the arguments against changing the rate

However, not everyone thinks alike and, one of the main reasons that makes a large part of the directors resist moving forward in this direction revolves around the fact that a rate hike could send the market the signal that the BCRA sees an acceleration of inflation and not a punctual rise in January which would be reversed in February due to the economic policies of negotiation with price makers.

And it is that, according to the director of the consulting firm Analytica, Claudio Caprarulo, “the fixed term interest rates remain positive in real terms. It should be remembered that the effective monthly rate of these instruments is 6.25%, against inflation of 6% per month. And, with the expectation of a slight slowdown in inflation for Februaryeverything would indicate that the BCRA would not need to touch the performance due to the bad result of January.

Likewise, although a raise would have a lower marginal cost in terms of the quasi-fiscal deficitsome estimate that raising four points would impact with an increase of 0.1% of that accumulated with respect to GDP.

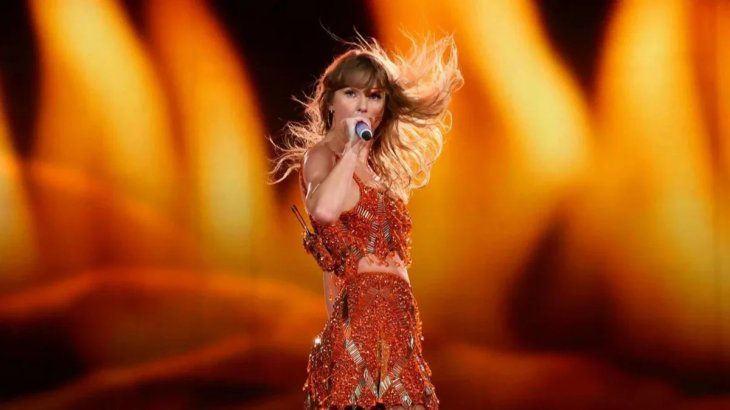

massa-rubinstein.jpeg

Sergio Massa’s deputy economy minister, Gabriel Rubinstein, gave indications that the rate would not be raised.

Regarding this issue, Caprarulo maintains that “the rate policy has to be consistent with the repurchase of securities in the secondary market that the BCRA is doing and the increase in remunerated liabilities that is required to remove those pesos from the market.”

And, although he mentions that, today, the paid liabilities they are at almost 9% of GDP, one percentage point more than a year ago and still far from the peak of 11% of 2018, he considers that “the trend should be towards a decrease.” This, taking into account, above all, that some sectors of the market have recently begun to suggest that it is likely that the cost of sterilizing the issue is one of the factors that influence the feeding of inflation.

“The concrete thing is that the retail inflation of the last 3 months has been high, but it is necessary to take into account that the effective monthly rate that currently yields a traditional fixed term is higher than the January price index and higher than that of the UVA fixed term, since because the latter is based on inflation”, points out the economist Pablo Ferrari.

To what has been said, the economist Christian Buteler contributes, for his part, that “perhaps anticipating that the price data for January could be worse than that of December, the BCRA did not lower the performance of the traditional fixed term as suggested by a large part of the market a few months ago and now they have the margin, thanks to that, to maintain it”.

What will the BCRA finally do with the rate?

Thus, there is consensus among analysts that, It is not necessary for now to raise the rate to protect the small saver and fight inflation and Rodríguez considers that, “probably, in the next few days they will wait to see if inflation will subside in February.” He believes that “they should wait another month or two to see if they converge to 5% and then lower” to decide on rate changes.

In short, there is a consensus among analysts that, the most prudent thing would be not to increase rates now and wait for the evolution of inflation for at least the next two months.

Everything would indicate that the Central also has the vision of advancing in this direction, but it will have to be discussed at the board meeting, without a doubt, with arguments for and against on the table, until, finally, the decision will be announced this Thursday in the corresponding statement that, possibly, will be issued by the monetary regulator.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.