Some of the actions that meet these requirements and that are part of the investor’s portfolio are:

amexpress

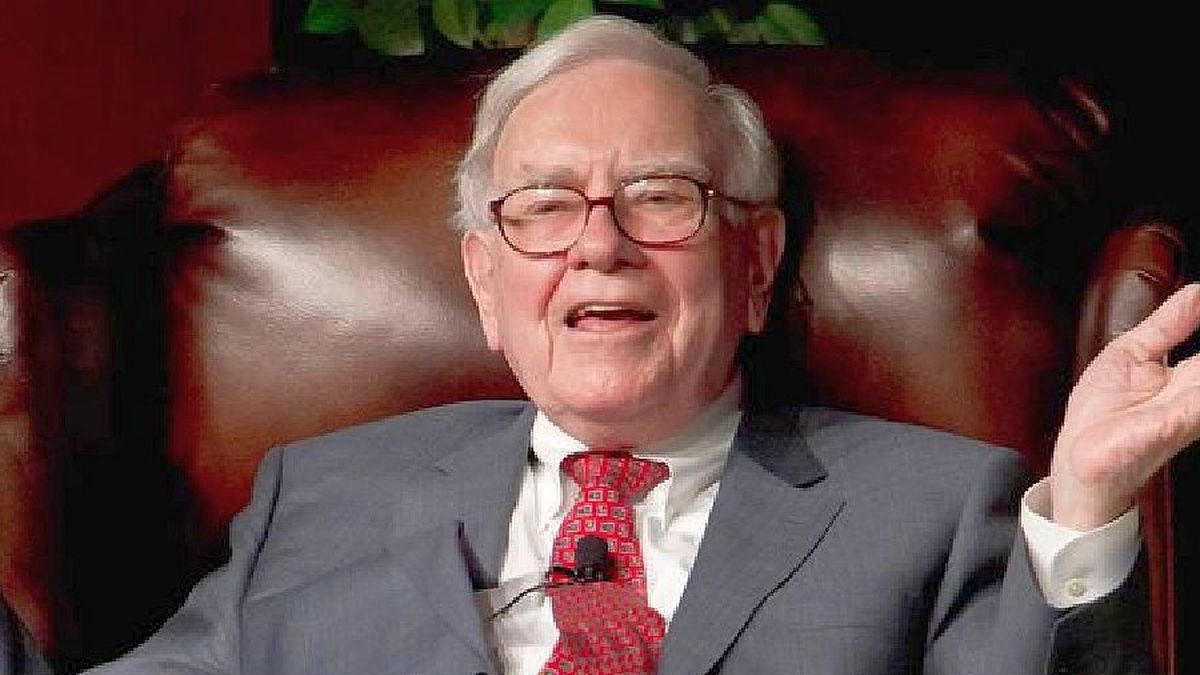

The company can raise its prices, as it did in 2021 with the annual fee for its Platinum card. Inflation also favors you: you charge merchants a percentage of each transaction on your card. If the price increases, the commission is higher. As a result of all this, American Express increased its revenue by 25% in 2022, reaching 52.9 billion dollars. The company is the fourth most heavily weighted stock in Berkshire Hathaway.

Manzana

It is the company that weighs the most in Buffett’s portfolio: 40%. Apple shares have appreciated more than 250% in the last five years.

Chevron

The price of oil rose in the first half of last year. Then it went down, but the invasion of Ukraine may keep the demand. The oil business usually works well in periods of inflation. Perhaps anticipating this trend, Buffett multiplied his presence in the company by 6.5: he started with 4.5 billion dollars in titles at the beginning of 2022 and ended the year at 29.3 billion. Chevron increased its profit by 127% last year, reaching 35.5 billion dollars.

Coca Cola

Your business is holding up well to the recession. His position is consolidated, something that gives him strength to set prices. Buffett has invested in Coca Cola since the late 1980s. Today Berkshire owns 400 million shares of the company. Its market value is about $23.7 billion.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.