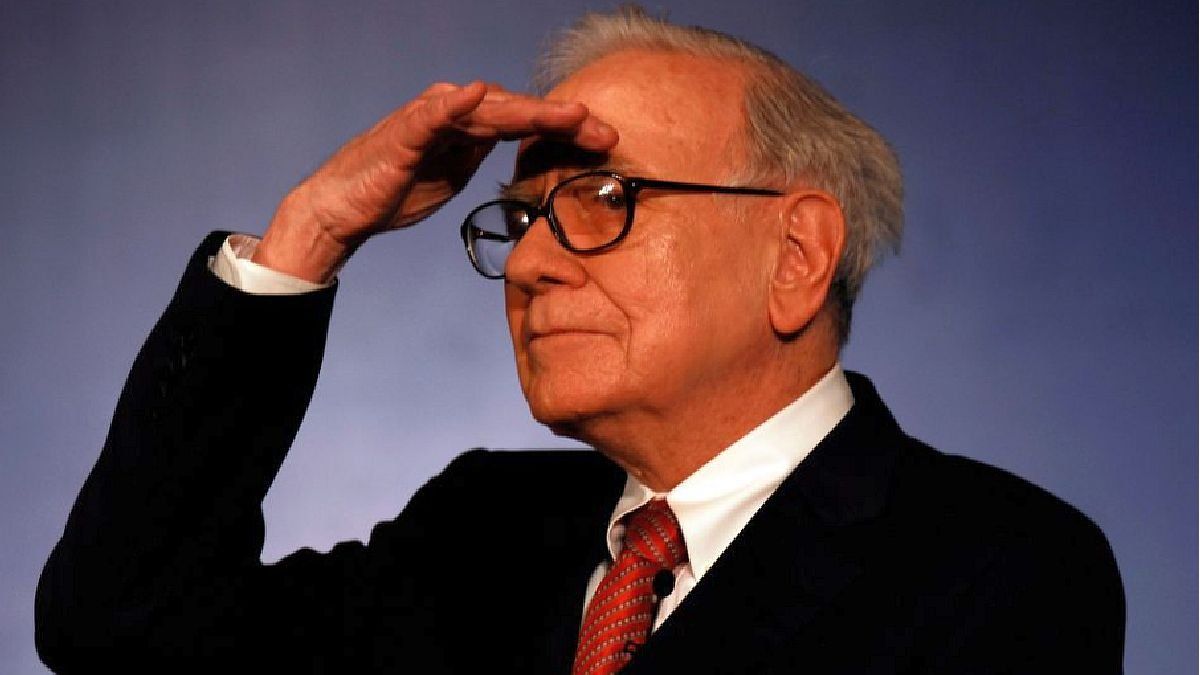

“Even so, we do not believe these companies are trading with an attractive margin of safetywhich is another key pillar of Buffett’s investment approach,” Dziubinski said, according to Forbes.

“In other words, the shares of these three companies do not seem undervalued to us today. That is why we believe that these are actions by Warren Buffett that must be avoided, at least for now,” added Dziubinski.

procter&gamble

The Morningstar Analysterin lashesassigns the company a wide moat and puts the fair value of the shares in 126 dollars. It recently traded at $138. “The Procter & Gamble second quarter results (5% organic sales growth and modest decline in profit margins) suggest it is holding up fairly well to macro and competitive challenges,” Lash wrote.

“But, we are less bullish on stocks at current levelsLash added. “With six months in the rearview mirror, we see little to justify altering our short- or long-term prospects for the business.”

Still, he noted that the company has registered 18 consecutive quarters of organic revenue growth percentage of at least one middle digit.

Procter & Gamble closed Wednesday at $137.66 and the 70-period moving average crossing above the 200-period moving average would give us a bullish signal. Meanwhile, Ei indicators are mixed.

aon

Morningstar analyst Brett Horngives the company a narrow moat and puts the fair value of the shares in 261 dollars. It recently traded at $305.

“Underlying revenue growth remained strong at 5% in the fourth quarterHorn wrote. “The company modestly underperformed its peer Marsh McLennan in organic growth, but for the most part, Aon still appears to be enjoying some tailwinds.”

“Even so, stocks are a bit overvaluedas the market appears to be too focused on the strong growth the company has experienced recently, as opposed to the more modest level of growth we expect in the long term,” Horn said.

Aon-A was off $304.02 on Tuesday and the 70-period moving average is above the last few candles. Meanwhile, Ei indicators are mixed.

Marsh&McLennan

Horn assigns the company a narrow moat and establishes a fair value for the shares of 137 dollars. It recently traded at $163.

“In the fourth quarter, Marsh & McLennan experienced relatively strong underlying growth in both parts of his business, insurance and consulting,” Horn wrote.

“We appreciate the near-term tailwinds the company is enjoying, but we believe a reversal to the more modest growth it has historically enjoyed is inevitable,” Horn said. “We see stocks as overvalued and think the market is too focused on recent performance.”

“Still, Marsh & McLennan’s leadership position in the brokerage industry would be difficult to displace,” Horn said.

Marsh & McLennan closed February at $162.18 and the 200 moving average is over the last three candles. Meanwhile, Ei indicators are mixed.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.