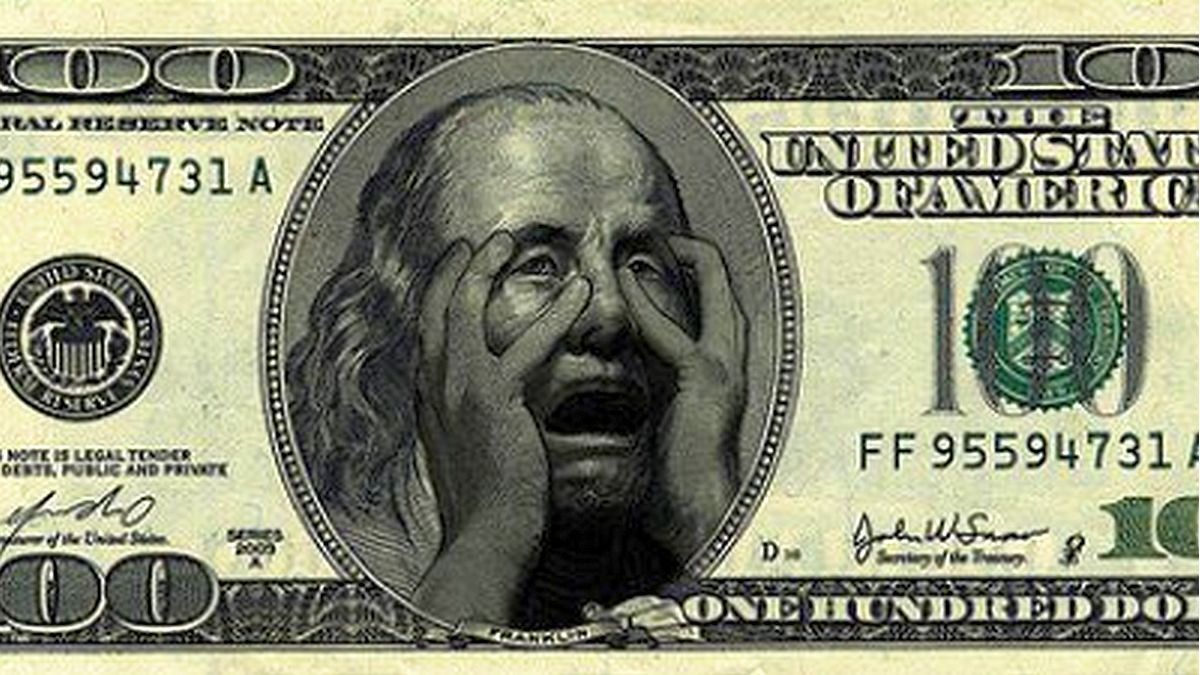

The VIX, which measures investors’ expectations of volatility and uncertainty and serves as a tool to gauge market sentiment.

New York, March 14 (EFE).- The Wall Street VIX index, which measures the volatility of the stock market and is also known as the “fear index”, fell 14.5% this Tuesday, coinciding with the strong stock market rebound of the banks that suffered the most from the closure, the last Friday, from Silicon Valley Bank (SVB), although it remains above the figures prior to the debacle of said banking corporation.

The content you want to access is exclusive to subscribers.

The VIX, which measures investors’ expectations of volatility and uncertainty and serves as a tool to understand market sentimentshot up 27% on Friday coinciding with the closure of SVB, which led to quotas not seen since last January.

When the VIX is low it suggests that investors are relatively bullish and more confident in future market conditions.

The index went from marking 19 points on March 8 to skyrocketing to 26.5 yesterday, to stand today at around 23 units.

Despite the reassurance messages issued by the authorities and the main US financial institutions, the closure of SVB, which was followed on Sunday by the intervention of Signature Bank, aroused the fear of many investors that they were only the first step in a new crisis in the banking sector.

Today’s rise in the financial sector in general and banks in particular, has encouraged many investors to take a breath and return to investing in these corporations.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.