For his part, CCL “free” that is agreed through bilateral negotiations (SENEBI) -where the transactions are not marked on the electronic screens- or via ADRs, it again operated above $ 190.

Likewise, the dollar MEP or Scholarship Regulated also rose 0.2% to reach $ 178.02, which left a spread of 79.3% with the exchange rate regulated by the BCRA.

The advance came less than a month before the elections, when the local scene did not clear up. The twists and turns of the negotiations with the IMF – including the tensions around Kristalina Georgieva -, the social climate and electoral spending have a negative influence on prices.

Meanwhile, the Central Bank returned to the buying side given the latest restrictions that gave it some air at least to go until November. However, the volatile external context is detrimental to emerging countries and Argentina, within this group, is the one that falls the worst.

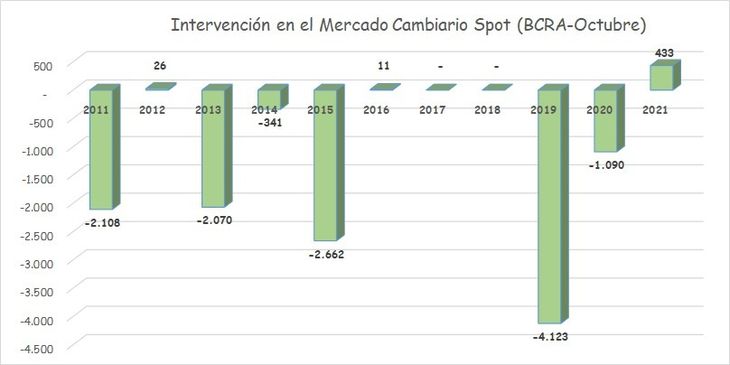

BCRA purchases: it is the best October in a decade

The Central Bank (BCRA) bought another US $ 110 million through its intervention in the wholesale exchange market. In this way, the monetary authority records the best October of the last decade since it acquired, in net terms, US $ 430 million.

The tenth month of the year is usually a sales month; Only in 2012 and 2016 was the BCRA able to end this period with a tiny positive balance. Taking this into account, sources from the economic team warn that it is likely that “in the second fortnight there will be less inflow of foreign currency and greater outflow due to seasonal issues in demand.”

BCRA Purchases 2021

BCRA purchases October 2021

In this context, the North American currency increased nine cents to $ 99.27, compensating the days without activity for the weekend, in the wholesale market in a round in which it exhibited a selling tendency again, as a result of the dominance exercised by the genuine supply throughout the development of the operations. Prices operated again lateralized around the level of regulation established for today by the control authority.

The maximums were recorded at $ 99.28 with the first operations agreed, eight cents above the previous level. Revenues from abroad showed intensity from the beginning of the session, putting downward pressure on the price of the wholesale dollar, which was contained by official interventions with purchases that sustained it at the lows of the day, registered at $ 99, 27. The intervention of the Central Bank compensated for the insufficiency of authorized demand, absorbing all the foreign exchange surplus available in the market.

In the retail segment, the dollar today rose nine cents to $ 104.79 -without taxes-, according to the average of the main banks in the financial system. In turn, the retail value of the US dollar remained at $ 104.50 at Banco Nación.

The savings dollar or solidarity dollar -which includes 30% of the COUNTRY tax, and 35% on account of Profits- advanced 14 cents to $ 172.90. Last week it had racked up 29 cents.

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.