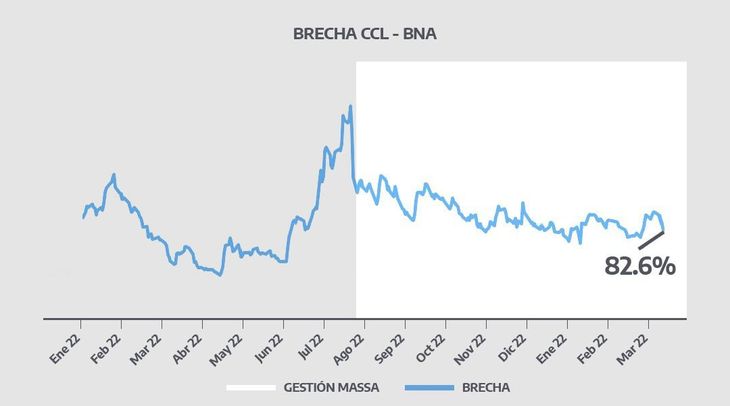

Both the CCL dollar and the MEP fell. In turn, the gap was far from the peak of the middle of last year.

Financial dollars fell hard this week after the package of measures launched two days ago by the Ministry of Economy that includes a sale of bonds in foreign currency by public bodies.

The content you want to access is exclusive to subscribers.

CCL gap

So, The CCL dollar (GD30) fell $13.25 (-3.3%) for the week, the most significant drop since the end of July 2022. For its part, the exchange gap fell nine points: it went from 98.5% to 89.7%, the lowest level in 2 weeks.

At the same time, the MEP dollar (GD 30) registered a drop of $13.12 (-3.2%), the most pronounced in almost eight months. The gap narrowed to 82.6%, from 91.2%.

If July 2022 is taken into account, days before the arrival of Sergio Massa to Economy, the gap narrowed 70 points less. That of the CCL: 65 points (154%, on 7/21/22) and that of the MEP: 69 points less (151%, on 7/21/22).

Anses will maintain dollarization with the dual bond

This Friday, in addition, the Government disseminated the decree that obliges public organizations such as ANSES to exchange their dollar bond holdings for titles in pesos.

In the first, it is indicated that the payments of the interest services and capital amortizations of the bills denominated in US dollars will be replaced, at the date of their expiration, by new public titles whose conditions will be defined, jointly, by the secretariats. Finance and Treasury.

The decree recalls that it was authorized to issue bills denominated in US dollars for US$4,334 million Ten-year term with full amortization at maturity, fully or partially pre-cancellable.

And that it was established that these bills would accrue an interest rate equal to that accrued by the international reserves of the Central Bank for the same period and up to a maximum of the annual LIBOR rate minus one percentage point.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.