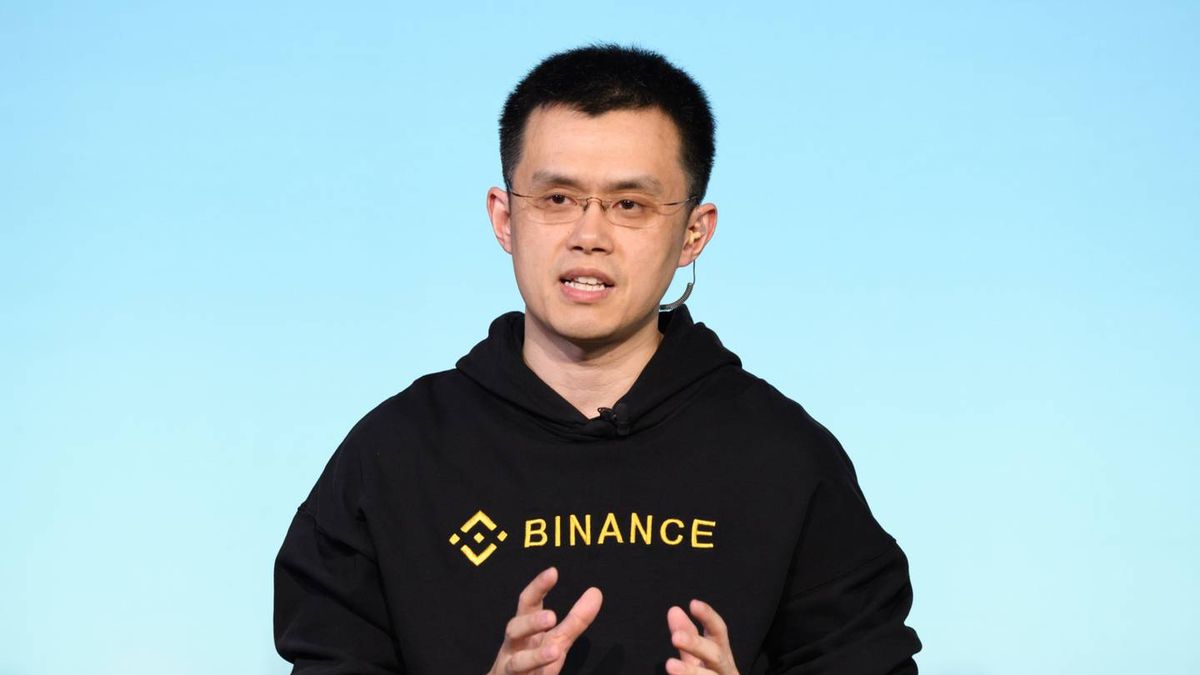

Binance is one of the few ‘cryptos’ that fall this Tuesday after a rumor about a possible Interpol arrest warrant for Changpeng Zhao, CEO and founder of the ‘exchange’. The rumor about Zhao occurs in the midst of a series of problems that the company had, unleashed by the complaint filed by the US Commodity Futures Trading Commission in Chicago federal court against Binance for having breached registration rules to operate negotiations.

The rumor began to spread from Monday at noon from a encrypted tweet Posted by Twitter user @cobie, a well-known personality in the cryptocurrency sphere on the social network. In the message, she pointed out that Interpol had issued a red alert on Zhao.

From the issuance of the alert, the forces of all countries are ordered to locate and provisionally detain a person pending extradition or surrender, or similar legal action. However, it is not an international arrest warrant. In it The Interpol website does not include Zhao on any of its wanted lists..

Quickly, both Zhao as the company did not take long to meet the these rumors, assuring that they were false.

Own Zhao shared a tweet accusing a user of using false images to accuse him and spreading “Fear, Uncertainty, and Doubt” (FUD) at his expense.. The user Zhao pointed to later deleted his post.

“The latest FUD was only reported by cryptocurrency news outlets, probably planted/sponsored by another exchange. Very petty. They hurt the industry and they hurt themselves. hThere are enough outside forces attacking us. Our industry needs to come together at this juncture.”, criticized the CEO of Binance.

For his part, Patrick Hillman, The exchange’s director of strategy pointed out that “one of two things is true”: “1. She is an asshole. 2. An agent of the security forces is illegally leaking the rumor. My bet is the first

Later, the user who posted the encrypted tweet revealed that he had posted the rumor so that only a group of people could read it and accused the leaker of “creating a stir at my expense, removing the context of the rumor”.

The effect, however, was already done. So far this day, the Binance cryptocurrency has lost 0.5% and has been falling for four days.

Binance’s losing streak

Regardless of the outcome, Binance is not going through its best moment.

On March 27, the Commodity Futures Trading Commission (CFTC) filed a lawsuit accusing Zhao and other entities that operate on the platform that it directs of “numerous violations” of the Commodity Exchange Act (CEA) and CFTC regulationsamong which is that of operate illegally in the United States.

“The complaint accuses Binance Holdings Limited, Binance Holdings (IE) Limited and Binance (Services) Holdings Limited (together, Binance) of operating the centralized digital asset trading platform of Binance along with many other corporate vehicles through a intentionally opaque joint venturewith Zhao at the helm as owner and CEO of Binance,” the entity highlighted.

Since then, Binance has lost 16% market share, now standing at 54%.

In addition to the CFTC’s breakthrough, the decision made on March 15, end spot and margin trading with no commission for 13 trading pairs among which included ‘tokens’ such as BNB, BTC or ETH pIt caused a noticeable loss in trading volume.

“In general, Binance excess volume faded largely for the purpose of trading with zero commission, which was reflected in a uniform dispersion in market share among the remaining exchanges”, they explain from Kaiko, while noting that Binance US, the company’s US subsidiary, tripled the market share to 24% in the same period of time.

Recently, A federal judge has once again temporarily suspended the acquisition of bankrupt crypto lender Voyager. by Binance US. the magistrate jennifer rearden has accepted the arguments of the United States Department of Justice as valid and will re-examine the operation, which was initially approved by the Justice.

Also, in recent weeks it has become known that Binance could be willing to pay a large fine to try to settle numerous investigations that are taking place in the United States. In addition, ‘The Wall Street Journal’ had access to various documents that could prove that Binance devised a scheme to circumvent US regulators.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.