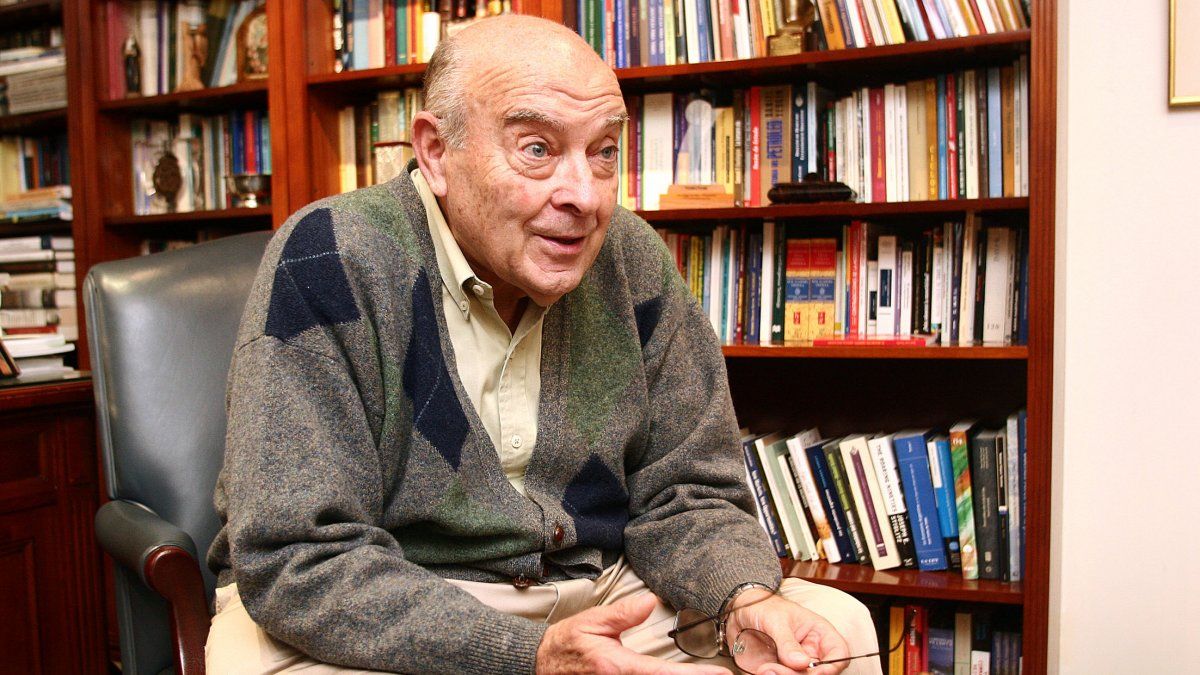

The former Minister of Economy, domingo horseexplained a possible strategy to avoid a “traumatic” departure by unifying the exchange rate and suggested what should be done to avoid an adjustment “by hard”. Also, he referred to a possible government and asked for an economic plan that aims to reduce the fiscal deficit.

After the latest inflation data, which was 8.4% in April, the economist detailed what are the steps to avoid an escalation of the dollar, reduce inflation and adjust the fiscal deficit. “Here it will be possible to stabilize and power will begin to function more normally when a comprehensive economic reform is announced, a new approach to reorganization and a good stabilization plan is put in place,” he said in dialogue with the program “What do we do with the pesos?”, by A24.

One of the first measures he mentioned is free up the foreign exchange market: “It will be necessary to plan a unification and liberalization of the exchange market. What could this government start to do and what would help it finish.”

“I would limit the official market to strictly commercial transactions with export and import goods. And the exchange rate in that market should be adjusted as the Central Bank (BC) has been doing, at 8% per month, which does not seem wrong to me since it is in order with inflation,” explained the former Carlos Menem official.

In this sense, he stated: “The interest rate should be a little higher, but the important thing is that all transactions for real, financial, hoarding, travel and tourism services should be left to a free market where the Central Bank should not intervene”. “That quote would be bigger than all the exchange rates and there would be no commissions involved. A totally free and legal market. There we will know what the true value of the dollar is. And the way to avoid what the BC would have to be very high would be to manage the interest rate“, held.

In addition to this, Cavallo criticized that the government “should anticipate that at some point there will be a unification of the market” and that it should not be “traumatic”, that is, without a devaluation jump in the official market that further exacerbates inflation. “Until then the government will not have many tools to stop inflation. Only at that moment could the possibility of a bi-monetary system or dollarization be raised if the peso cannot be rescued, as Milei proposes”.

Find out more – I followed the price of the blue dollar, official, CCL and MEP in Argentina

However, He avoided making comments related to speculation about the value of the dollar or the possibility of hyperinflation as in 1989, but he did consider that the fiscal adjustment that leads to a deficit must be carried out following a strict plan, since otherwise it would have to be done suddenly. “The adjustment the hard way is simply if the current or future economic team gets out of hand, if they fail to induce expectations so that people see the light at the end of the tunnel,” he explained.

“The best thing is to make orderly and pre-announced adjustments, not blows that ultimately end up hurting the poorest people,” he said and added: “For now, it is necessary to plan in a credible way the elimination of the deficit by reducing expenses. That includes the reprivatization of the restored companies and making a transition plan so that they simply stop losing money and the government does not have to assist them. At the same time, he clarified that It does not expect the future government to implement these measures from day one, but it should aim towards them.

“In addition, there are a large number of programs that need to be reviewed. It What I would ask – of the next government – is that they draw up a very detailed plan for the fiscal adjustment. But don’t come with taxes. Some must be eliminated, such as withholdings, or what the provinces charge, gross and by check”.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.