During May, the BCRA validated the last rate hike that raised the interest rate for fixed terms to 97% (which implies a yield of 8% per month), the blue dollar slowed down (in May it rose 4.5%) after the sharp rise in April, and inflation that, according to consultants, stood at 9% per month. Given this, Ámbito wondered, What are the Mutual Funds that managed to give the best returns?

The same report maintains that during May there was a “strong dispersion in returns” since “the greater the volatility, the greater the dispersion of returns between similar strategies tends to be. What does this imply? The return of Fixed Income in May is a clear example. Funds that, even identified with low risk (and volatility that , on average, does not exceed 4%), reflected a difference of more than 7 percentage points between the best and worst performers”.

Equity Funds: the big winners

These funds ended May with increases of up to 13.8% but below the performance of April, which was above 20%. According to PPI, the increase was justified by the “electoral trade” since the closure of the electoral front and later of the lists for the general elections is approaching.

These FCI accumulate increases of more than 65% so far this year compared to accumulated inflation that will be around 40% this month.

“To highlight in May, we can mention the marked decrease in the spread between the best and the worst performance, which was a little over four percentage points (the lowest in the month). For its part, volatility exceeds 30%, something logical in this type of strategy,” said PPI.

variable income mayo.jpg

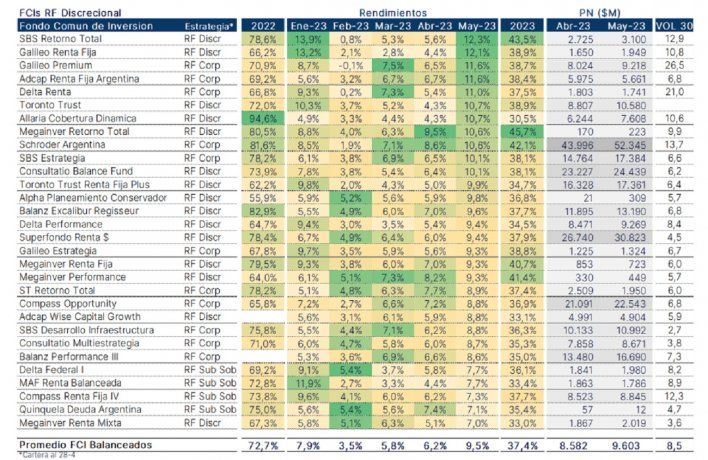

discretionary FCI

This segment includes fixed-income funds that can be differentiated by issuer risk (ie, what kind of bond do they include in their portfolio: sovereign, provincial, private). “A feature that there is also no doubt influences its duration, and volatility,” PPI clarified.

Regarding the return, these funds rose 9.5% in May, with a dispersion between the fund with the highest and lowest rise that was below 5.5 percentage points. To take into account: “Today, the IRRs of this segment are located in the order of 109%, with duration of the order of 0.7 years. Thus cutting its average life compared to April, where it exceeded one year.”

discretionary may.jpg

CER Funds

After two months without being able to overcome the evolution of inflation, this strategy averaged gains of 9.3% in May and outperformed CER by one percentage point.

“Although these strategies focus entirely on inflation-adjusted assets, the duration of their portfolios can determine a different risk-return equation. Thus, the longest options (above 0.5 years) reflected increases above 10%, with a volatility around 6%; and the shortest (less than 0.5 years) presented a gain of the order of 8.5% and volatility below 5%”, recalled PPI.

That is why the spread is widening between the best and worst performing funds within this same category. In May it stood at 430 basis points, against levels that did not exceed 300 points in previous months.

cer mayo background

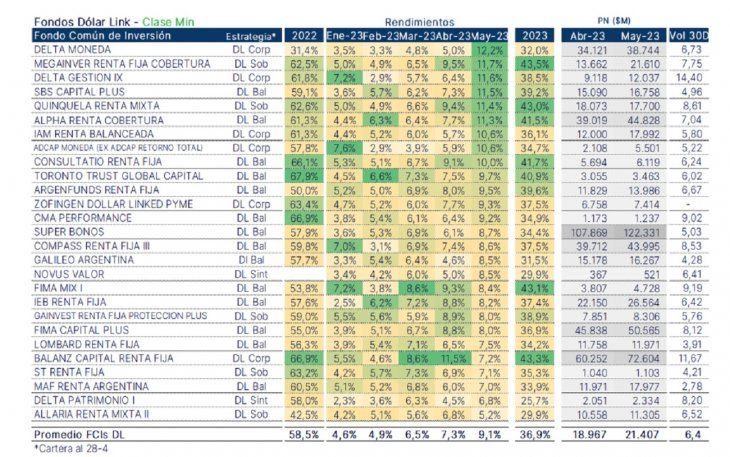

Linked Dollar Funds

“Unlike CERs (which continued to lose flow), the appetite for Linked Dollars is growing,” confided the PPI report. The dollar-linked FCIs closed May once again with net subscriptions of over $40,000 million. His average return was 9.1%above what its reference moved (the BCRA A3500), data that is repeated for the third consecutive month.

“The funds with the highest corporate risk holdings -ONs, CPDs, Promissory Notes, etc- moved above the mentioned average in May (+10.3%), and those armed with synthetics below (7.7%). Marking with logical differences also in its volatility, and explaining the reason for the dispersion of 7 percentage points between the fund with the best and worst performance,” the report stated.

It was also clarified that its indicative IRRs currently remain around devaluation with losses of 7.9%, with average durations below one year. “The average life of these funds, which we do not expect to change much, since it accompanies and is validated by the devaluation expectations implicit in the Matba-Rofex dollar futures curve,” PPI clarified.

dollar linked mayo.jpg

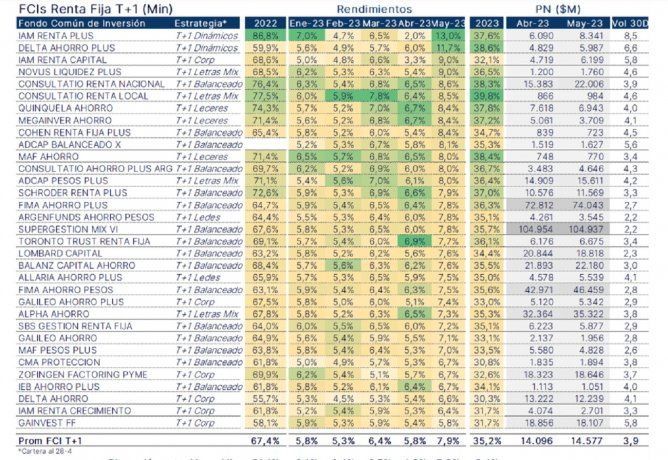

fixed income fund

These funds incorporate into their portfolio short-term financial instruments such as Bills, Negotiable Obligations and/or Financial Trustsand allow capturing higher yields than immediate liquidity funds -at the cost of assuming greater risk-.

As PPI explains: “Its composition, specifically, allows us to find within this segment different strategies with a different risk-return equation; and product of it a possible significant dispersion between the returns of the different funds“.

They offered an average return of 7.9% with a volatility of 3.9%. Dynamic options were the best performers (+12.4%), albeit with nearly double the volatility of other funds. They also have a longer duration (0.6 years). “On average, today their indicative IRRs are close to 127%,” said PPI.

fixed income May 1.jpg

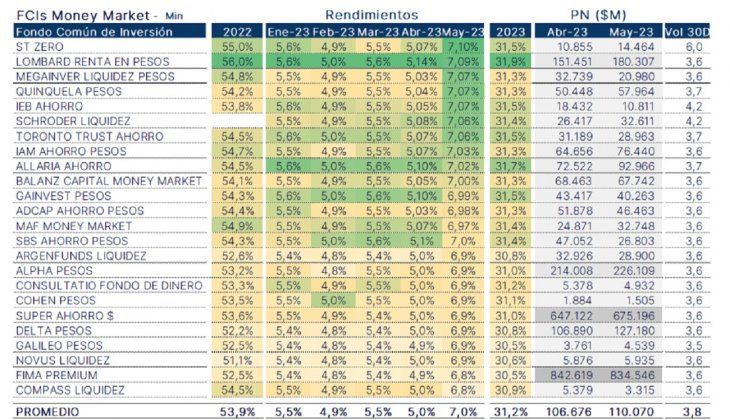

Money Market

Its performance, boosted by the strong new rate hike in the system (in the middle of the month), it went from an average of 5% in April to levels of 6.9/7% in May. Its indicative TNA was around 78/79% per year, which is negative in real terms, and with a wide spread with fixed terms that have a TNA of 97% or against Badlar in banks that offered an average of 90%. during may.

“This last differential (above 10 points) tends to widen at times of sudden rate movements, and although it could shorten slightly in the coming weeks given a rise in the MM reference TNA, it will continue to be high given the expected scenario for flows,” PPI said.

Even the volatility of these funds -in a context of rising rates in the system- rose again to an average of 3.8%, above the 3.4% of the previous month and the 3% of the first quarter.

money market mayo.jpg

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.