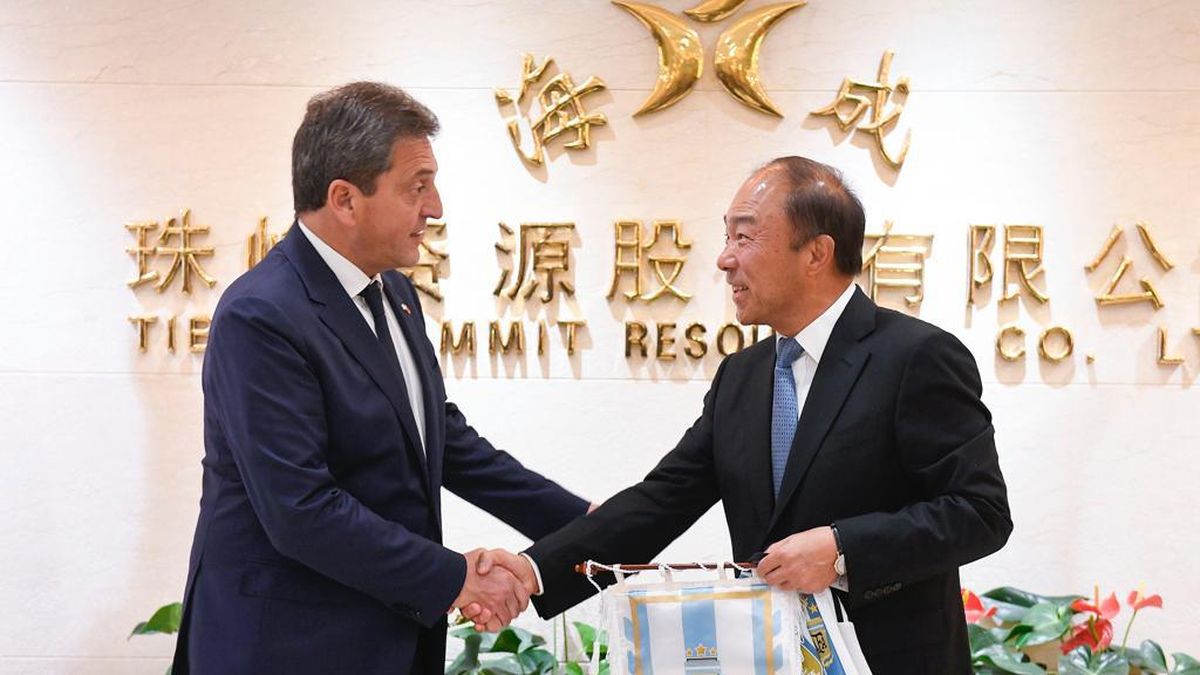

The complications that the exchange market and the Argentine public accounts at the end of April seem, after the actions of the last weeks of the Ministry of Economy, have been neutralized. To the international accompaniment for the renegotiation of the agreement with the IMFthe formalization of the swap with Chinaa relief for the use of Dollars for import.

the analyst Federico Zirulnikeconomist of the Scalabrini Ortiz Center for Economic and Social Studies (CESO)understood that the measures adopted by the portfolio headed by Sergio Massa reached “some stability” since “a couple of weeks ago”, also contemplating that the swap with china “It is a point that adds up when it comes to achieving this relative stability with an inflation floor similar to that of recent months, at least in view of the elections.”

In this sense, the specialist understood that it was important to start intervene in foreign exchange marketssomething that had previously been vetoed by the International Monetary Fund (IMF)“. “The question that remains is what margin it has to continue intervening,” he added in statements to Radio Cooperativa.

“Before June 21, a significant outlay must be made,” he recalled and considered that “the agreement will have to be finalized and there is a latent possibility that they disbursements by the Fundand with that it would already be achieved reach the elections with some stability“.

Subsequently, Zirulnik analyzed that “an election year is a year of greater uncertaintyexchange rate volatility, historically” and that “this year, as a result of the consequences of the droughtit is probable that these characteristics will deepen, and if we add to this that -for the moment- there is no agreement with the Fund or that a Minister of Economy resigns months before the electionsIt would get worse.”

About the financial consequences From this last scenario, he interpreted that “it is one thing for Massa to resign to run as a candidate and put someone there to answer to him, which would not be a problem; but if he slams the door and leaves, the volatility, the uncertainty, They would be further enhanced.”

Finally, the economist argued that the consequences of not renegotiate the agreement with the IMF and failing to meet the payments established for this year would be “greater pressure from devaluation, dollar demand of all sectors and that, in one way or another, would end up having an impact on the greater pressure on the exchange ratepossibly a devaluation, and that would end up moving to prices“.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.