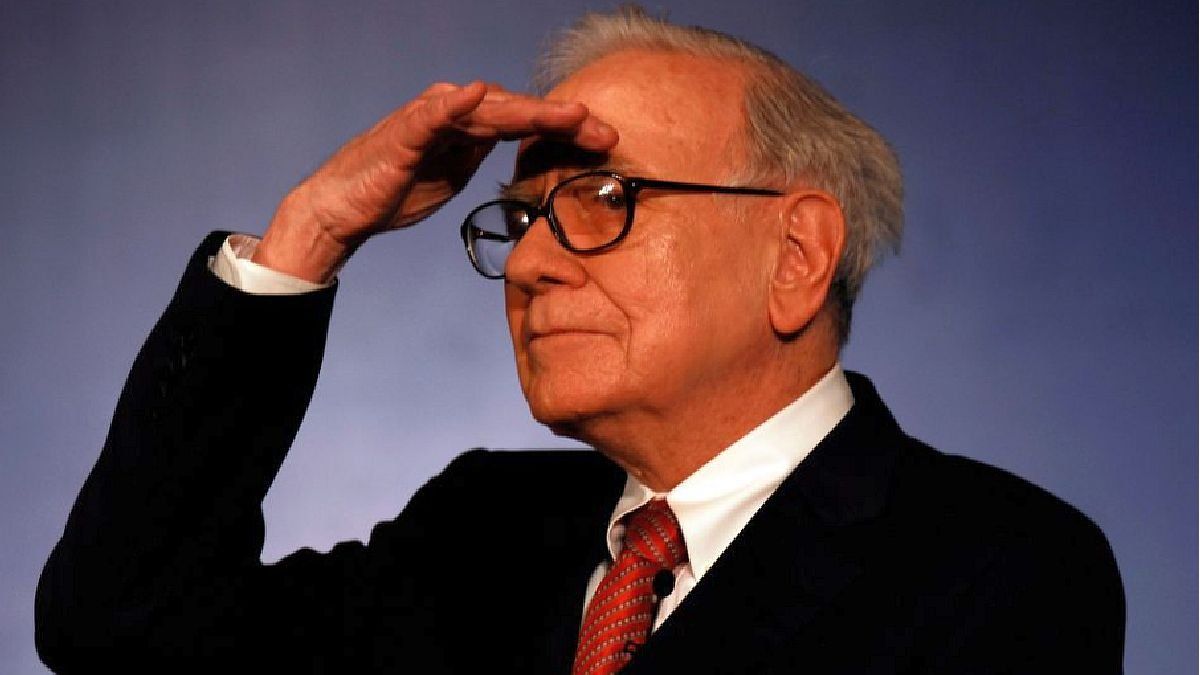

The founder of Berkshire Hathaway invested in this company in 1988 and still owns it in his portfolio. I know the reasons.

Warren Buffettthe founder of Berkshire Hathaway invests for more than three decades in one of the most important beverage companies in the market. The first time he acquired shares in this company was in 1988 but, since then, he continued to choose them.

The content you want to access is exclusive to subscribers.

These are shares of Coca-Cola, buffett carry 34 years buying and holding shares of said company within its portfolio. He currently owns 400 million shares from the renowned soft drink manufacturer. These papers are equivalent to an approximate value of US$22,000 million forks about 8% of the company.

Story of a successful investment

In 1988, Buffett began investing in the beverage company. At that time, the shares were trading at a few dollars per shareTherefore, thanks to the exponential growth that Coca-Cola had, Berkshire Hathaway got massive gains.

In addition, the soda company also issues a dividend worth 0.44 cents per quarterso the company founded by Buffett earns almost $1 billion per year in dividends Besides that.

Why keep these shares in your portfolio?

Yes ok you’re unlikely to see those kinds of returns in Coca-Cola shares due to its size, there are still parts that can generate great value within the industry. An exemplary case is TruBraina startup that creates drinks and supplements focused on cognitive health and is currently valued at a fraction of what Coca-Cola was when Buffett invested in the company in 1988.

Buffett likes Coca-Cola stock for the same reason he likes all the companies he invests in, because they have worth. the soda company owns almost 50% of the US soft drink marketso as long as people consume these types of drinks, Coca-Cola will do well.

Also, Buffett likes “productive assets“in the sense that produce cash and manufacture a product. In this sense, the renowned investor stays away from, for example, cryptocurrencies and continues to opt for Coca-Cola.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.