The co-founder of Microsoft and CEO of Berkshire Hathaway provided different keys that will help you grow in the world of finance.

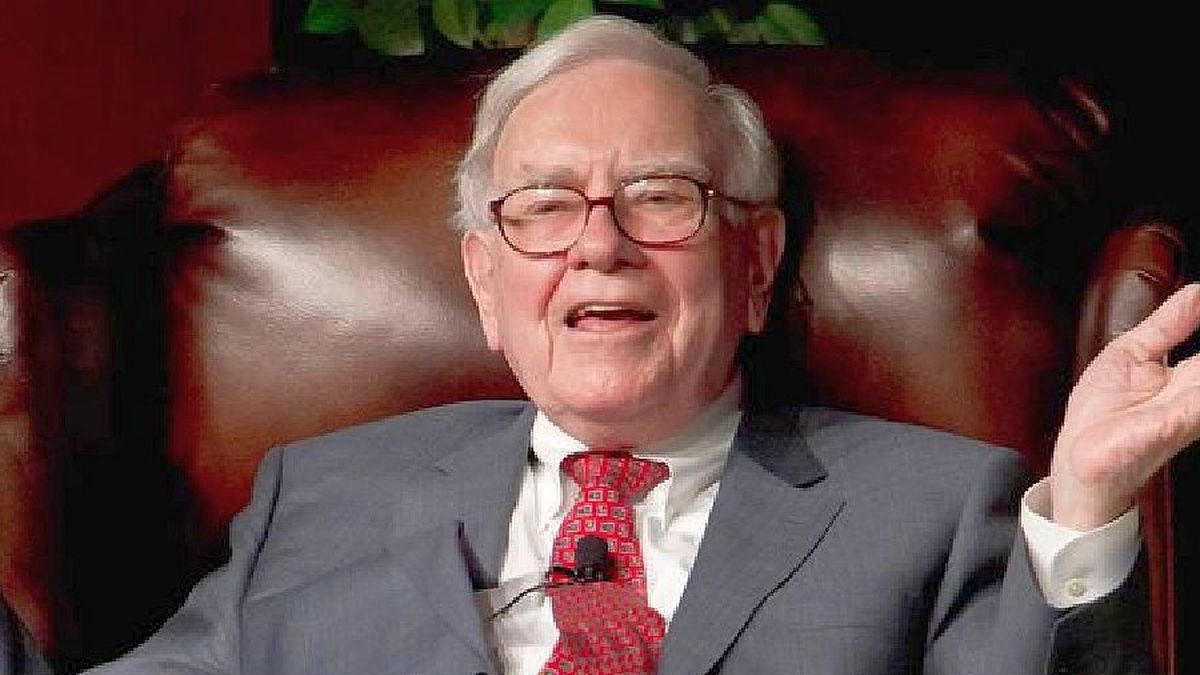

The renowned American investor, Warren Buffettis one of the most successful businessmen of recent times and, thanks to that, he is also famous for his advice for avoid business failure. Within this framework, the executive director of Berkshire Hathaway provided a series of tips that will help you grow in the world of finance and investments.

The content you want to access is exclusive to subscribers.

Within this framework, there are already several principles made public by Buffett that have already become known and have been applied by many investors, but there is one that is fundamental to his vision of the risks preventionthat It doesn’t have as much diffusion.

Warren Buffett 3.jpg

The keys to success according to Warren Buffett

The American investor and businessman proposes six fundamental keys to economic growth:

- Philanthropy and modesty: Warren Buffet conducts a modest lifestyle, in which their solidarity actions are characterized and their donations in order to always maintain contact with the real needs of society.

- Read every day: far from being blinded by his fortune, the millionaire maintains every day a simple but essential action: reading. Journals, books, and financial documents are part of the key to staying informed.

- Analyzing companies and sectors: Buffett dedicates part of his time to analyze the actions of other companies in order to define the growth potential and the quality of a company before investing.

Warren Buffett

- Talk to other investors and entrepreneurs: the Exchange with other professionals and specialists from the world of investment It will help you to acquire other concepts and look beyond your actions.

- Take notes and follow up: during meetings and conferences, taking notes is key in the task of putting together business strategies. This will serve to focus on the long term and “plant” to receive better fruits in the future, with a moderate and analytical mindset.

- Go against the current: being disruptive will allow you to obtain different results from those achieved by other investors. Although at first this can generate bad numbers, it never hurts to put your eye where no one else sees. While everyone is looking for “quick” success, Buffett is focused on long-term results.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.