This Sunday July 9 The semi-annual interest coupons of the bonds in pesos, dollars and euros of the debt with private bondholders that the former Minister of Economy Martín Guzmán renegotiated in 2020 expired; On Friday, the Central Bank (BCRA) made the draft to pay the maturities in foreign currency and this Monday the funds were credited to the accounts of the bondholders.

These are papers AL29, AL30, AL35, AE38 and AL41; the Globals in dollars 2029, 2030, 2035, 2038, 2041 and 2046 and the Globals in euros 2029, 2030, 2035, 2038, 2041 and 2046. The amount paid for each of them, according to data from the economist Salvador Vitelli, is the following:

WhatsApp Image 2023-07-09 at 15.17.18.jpeg

The total to cancel adds up to US$1,022 million and, although the payment was interpreted as a positive sign by the market because, as the economist and director of MyR Asociados points out, “compliance with debt obligations is always positive, even more so in Argentina, which has a long tradition of violating contracts.

However, he warns that, while the fact It should be a financial administrative decision without any significanceGiven that it is a simple coupon payment of a set of local and foreign bonds in dollars, he explains that this took on special relevance due to “the current weakness of foreign liquidity and international reserves of Argentina.”

A delicate reserve situation

This, according to Rodríguez, makes the market target each debt payment commitment, even more so in a context in which there is no progress, for the moment the new agreement with the International Monetary Fund (IMF) and clarifies that, “even more, in those that cannot be postponed, as in this case.”

In the same sense, Salvador Vitelli, an economist at Grupo Romano, acknowledges that “it is a good decision for the Government to keep ‘performing’ the sovereign doubt and not make it fall”, but, he agrees with Rodríguez that this occurs in a context of fragility of the situation in exchange matters.

That is why, in this context, the market is attentive to the situation of the reserves and what happens with the disbursement of the IMF, that can feed the reserve situation. And that makes a payment of sovereign bonds in dollars and in euros for an amount that is “quite short, compared to what we have going forward,” so relevant.

Bond payment: what worries analysts

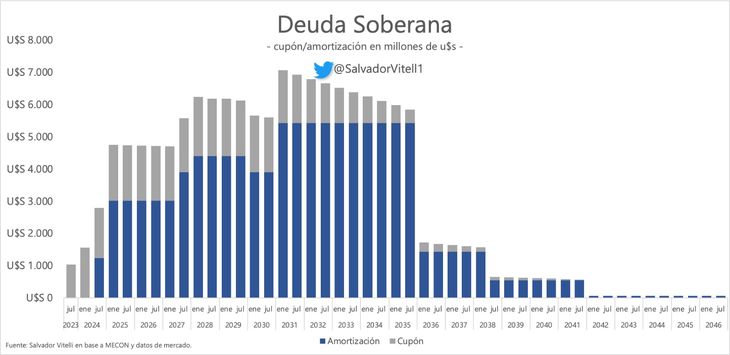

Thus, analysts agree that, although It is a good sign from the Government to have advanced in the payment because the declaration of a default could aggravate the macro situation, the current difficulty for a much lower compliance than those that are to come is worrying. And it is that, from now to 2031, the maturities of coupons and amortization are gradually growing, until reaching US$14,000 per year that year. As the following graph demonstrates:

WhatsApp Image 2023-07-09 at 15.17.13.jpeg

“The bad thing about all this is that we have exchange problems in terms of foreign currency to face a limited maturity like this, since we have payments of up to US$14,000 million in a few years ahead,” summarizes Vitelli in this regard.

Thus, he maintains that for this time, the problem was kicked forward, but the future of the debt worriessince a new maturity is coming for about US$1,500 million in January 2024 and another of almost US$3,000 million in July of the same year.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.