Founded by Jimmy Zhong, the platform was designed to provide a simple and friendly user experience for experienced traders and beginners alike.

In down market periods, investors are faced with declining trading platform options. trading. In this context, an innovative platform for the trading Derivatives betting on futures and options trading is becoming increasingly popular.

The content you want to access is exclusive to subscribers.

CoinCall is already available in the market with the launch of its early access and Latin America is listed as a region of great interest. “Latin America is a strategic market for us and we are excited to launch our new cryptocurrency exchange in the region”said Jimmy Zhong, founder and CEO of the platform. “We offer users a reliable and secure way to access digital asset solutions, which are increasingly becoming an important part of the financial landscape in the region,” the executive said.

Cryptocurrency adoption in Latin America has grown rapidly in recent years, with countries like Brazil, Mexico, Colombia and Argentina to the forefront Factors contributing to this growth include high inflation rates, volatile local currencies, and limited access to traditional banking services. In addition, it is expected that the adoption of cryptocurrencies as legal tender by countries such as The Savior encourage other countries in the region to follow suit, which will lead to an increase in cryptocurrency adoption and investment.

Coincall seeks to position itself as a platform for trading Reliable for both experienced traders and beginners who want to explore the world of options and futures trading. It is not necessary a high level of previous experience in the trading– The Coincall website offers a wide range of educational resources for users to learn and understand the nuances of futures and options trading.

Unlike trading spot, Futures and options are secure contracts based on the fluctuating value of an asset. With futures, investors are required to exchange their assets for a predetermined price on a specific date in the future.

On the other hand, an options contract gives investors the clear choice to trade or not trade their assets for a fixed price on a certain date. Investors are now turning their attention to these contracts to hedge risks and speculate on the future price of the assets. Additionally, since they offer greater flexibility and control than spot trading, more and more investors in the space DeFi are interested in exploring options and futures. The rise of decentralized applications (dapps) has really made it easier for investors to trade their contracts.

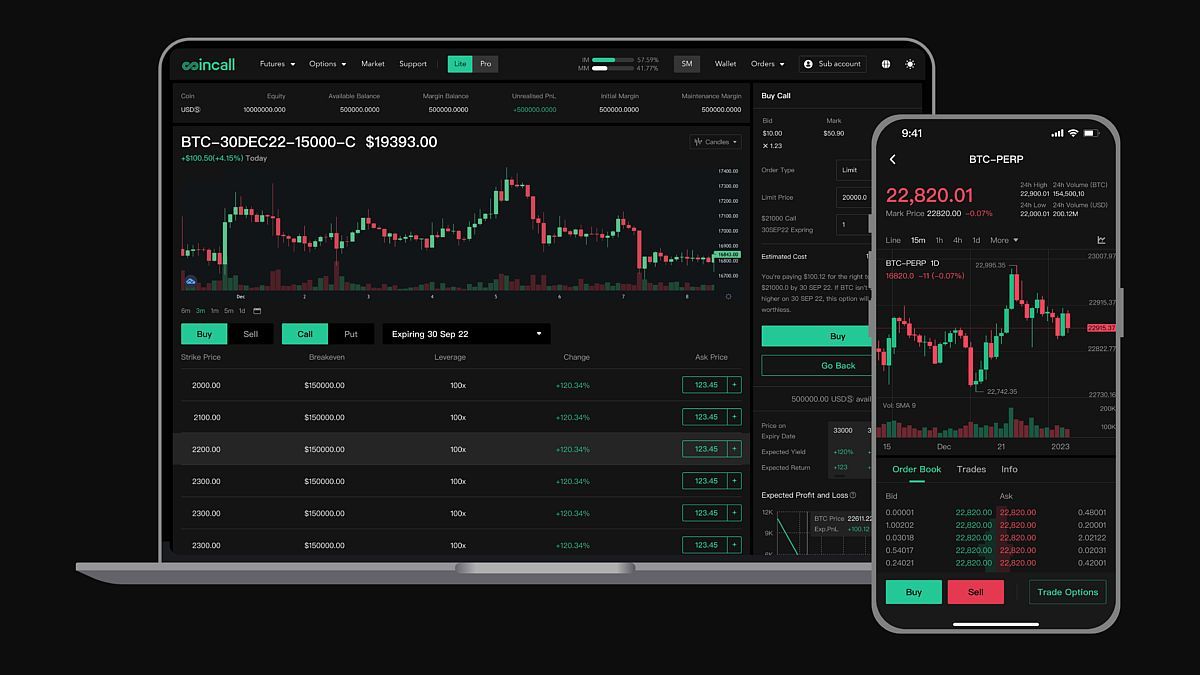

The platform already has 60 employees around the world and plans to double that number by the end of the year. Its main goal is to become the world’s No. 1 exchange for trading cryptocurrency futures and options, with simple operations and affordable trading fees. To achieve this, Coincall has invested in its trading interface. It offers two different interfaces for trading: Lite and Pro. The Lite version offers easy access for traders who are new to the business, while the Pro version will be optimized for maximum customization.

“We believe that this sector will grow exponentially in the coming years, so we can say that we are at the forefront of this trend and well positioned to revolutionize the world of buying and selling crypto derivatives”, Zhong concluded.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.