During July, the FCIs industry exceeded $11.8 trillion, which implies a growth of 12.9%, well above projected inflation of around 7.5%; in this way, the monthly average of the last months, which stood at 8%, was exceeded. In addition, during the past month, Appetite for dollar-linked funds grew, and equity FCIs, which had been the big winners of the previous months, moderated their gains.

Some variables to take into account to analyze whether the funds, and their various variants, performed well: inflation projected for July will be between 7% and 8%, the fixed term interest rate maintained at 8.1% per month, the blue dollar advanced 11.3% last month, and the official exchange rate increased its rate of depreciation at 7.2%.

“If the question is about the future of the coming months, the reality is that the agro-export program will begin to lose weight as August progresses, but the transition between the PASO and the October elections may continue to push caution (and for some investors, therefore, the appetite for quick liquidity). Consequently, liquidity will continue to rule (something that we have been highlighting as a feature since practically the beginning of the year)“They said from PPI.

The winner: the FCI Mixed Income

Portfolio composition when allowing includes both fixed income and variable income instruments (stocks and/or Cedears and, according to ppi, “this allows you to obtain higher returns, at the cost of higher risk and, logically, higher volatility.”

Returns for these strategies in July averaged 8.3%, below the 12% average for May and Junethis due to a more limited performance of the S&P Merval which gained 7.5%. In this context, the dispersion in their performance fell to about 6 points.

mixed income july.jpg

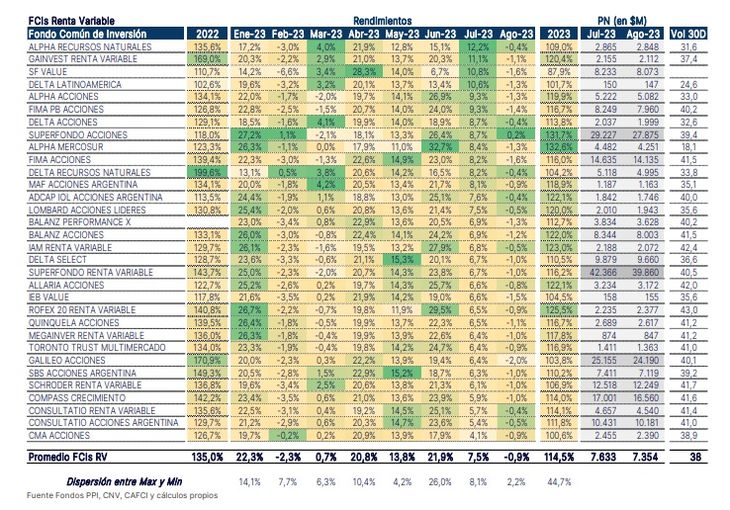

FCI variable income

This type of investment, “ideal for aggressive profiles”, as defined by PPI, is made up of instruments with volatility such as stocks and/or Cedears. They had increases on average of 7.5% during July. In annual terms, they accumulate returns of 116.5%, a few points below the S&P Merval, which advanced 126.1%.

“An important piece of information is the volatility marked by these funds, rising some 5 pp to reach 38 pp, a trait that, specifically, we expect to be maintained and/or rise in the coming months,” said the same report.

variable july

discretionary FCI

“These funds encompass various strategies and various risks, making them funds that can be classified among Corporate, Sub-Sovereign or Discretionary options,” recalled PPI. In the month, they achieved average returns of 7.2%. Its volatility, for its part, was of the order of 7% on average.

discretionary july.jpg

Funds tied to the CER

After two months without being able to surpass its benchmark, the CER, these funds averaged increases of 7.1% in July. “They include in their portfolio assets that adjust for inflation, with the aim of achieving returns that allow them to cover (or beat) the rate of acceleration in prices,” they assured from PPI.

Also from the report they recalled that these funds are exposed -given their composition- practically 100% to sovereign risk. In terms of returns, in July these funds were in the top 4, with an average of 7.1%.

CER julio.jpg

FCI Money Market

Money Markey managed to position itself as one of the best performing categories in July, even in line with projected inflation, something that had not happened in the previous months. In fact, this is evident since in the accumulated of the year its increase is located in the order of 50%.

money market.jpg

FCI fixed income

These funds that incorporate into their portfolio assets with short-term market risk (Sovereign or Corporate Securities, etc.) accumulate an average performance of 55.7%although the product of the different strategies that can be included with a yield spread of close to 5 pp In the past month they accumulated average increases of 6.8%.

fixed july 2.jpg

FCI dollar linked

Unlike CERs that continued with loss of flow, The appetite for Linked Dollars grew, as it closed July with net subscriptions of over $40,000 million. “The exchange rate tensions reflected in the jump in financial dollars (MEP and CCL) – which even led to new restrictions in the last rounds – were data for the flows towards these strategies,” said PPI. In fact, unlike June where they suffered ransoms, in July they more than doubled.

Regarding performance, the category remained in the order of 6.8% on average; below the 7.3% of the official TC and the 8.5% monthly average contributed in May-June (months where it did win against the devaluation of the reference BCRA3500). “If we analyze in detail, the Sovereign options -with a holding of more than 60% of the portfolio in DL, Dual and USD Bonds- had the highest return (+7.4%) and those supported by synthetics the worst (+4, 1%),” detailed PPI.

linked july 2.jpg

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.