This indicator has its origin in the year 2001 and to prepare it, the relationship between the capitalization of the stock market and the gross domestic product (GDP) must be analyzed.

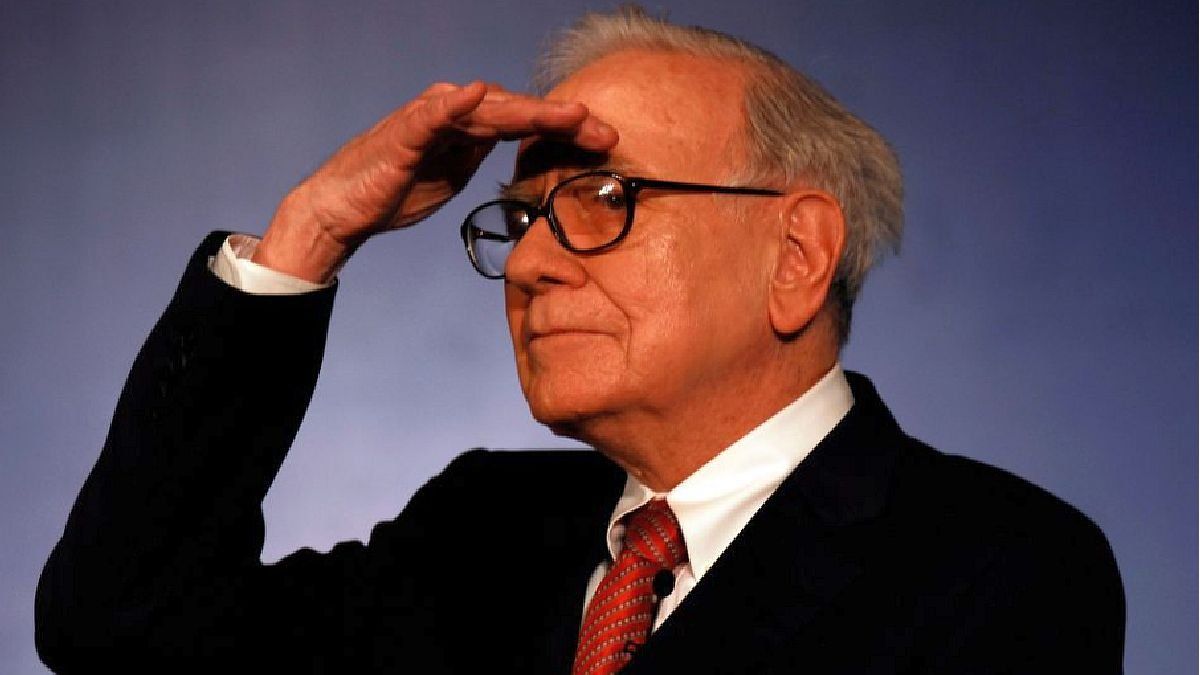

What does the Warren Buffett indicator tell us: time to buy or sell stocks?

Warren Buffett’s famous indicator reveals that stocks on Wall Street are currently overvalued. Said measurement reveals that, when they are above 100%, they indicate overvaluation and at this moment it is at 170%.

The content you want to access is exclusive to subscribers.

This indicator has its origin in the year 2001 and to elaborate it it is necessary to analyze the relationship between stock market capitalization and gross domestic product (GDP)According to him, it is the best way to know if the market is expensive or cheap, if it is undervalued or overvalued.

Therefore, this indicator simply does is to take the market capitalization of publicly traded stocks and divide it by the latest quarterly figure for US gross domestic product. A reading above 100% suggests that the stock is overvalued. At this time they reached 170%.

Besides, Warren Buffett and Berkshire Hathaway updated their portfolios and highlighted new purchases in the homebuilding sector. Warren Buffett took a position in the sector through Lennar Corp, DR Horton Inc and NVR Inc.

What were the stocks that rose the most in the year in the S&P 500

- NVIDIA: +179%

- Meta Platforms: +150%

- Carnival: +108.3%

- Royal Caribbean: +108%

- Tesla: +97%

- AMD: +66.1%

- General Electric: +75.6%

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.