The differential rate for credit cards was set at 107%, after rising 19 percentage points from the previous level.

The day after the elections, the central bank(BCRA) made the decision to devalue the official currency by 22%. This measure was also accompanied by a rate hike that affected the entire financial system, including purchases with Credit cards. As a consequence, those who decide to finance their product and service acquisitions with plastics, they will have to pay more for their consumption.

The content you want to access is exclusive to subscribers.

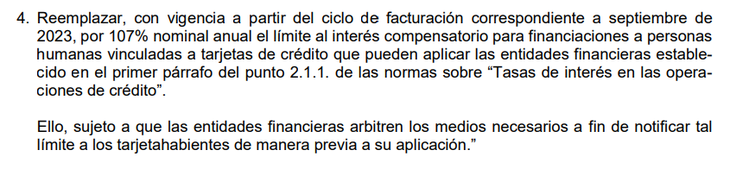

After the BCRA measure, the differential rate for Credit cards fixed on a 107%after going up 19 percentage points compared to the previous level, which was 86%. This is in line with the increase in the yield of the fixed term to 30 days for up to $30 million, which passed from 97% to 118%.

Raise credit card rates.PNG

in dialogue with Ambitthe analyst of F2 Financial Solutions, Andres Reschinistated that “the Rate hikes further worsen the outlook for consumption -which was already threatened by the drop in it purchasing power of salary-, both for the increase in credit as for him greater incentive to save“.

How were the interest rates after the BCRA measure?

- Traditional Fixed Term and Leliq 28 days: the new TNA determined for these instruments is 118%which implies a variation of the twenty-one% regarding the previous TNA which was from 97%. In that way, the Effective Monthly Rate (STEM) was positioned in a 9.73%while the Annual Effective Rate (TEA) reached the 209.4%.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.