Several non-leading roles climbed strongly this day. What is behind this rise, are there overvalued shares?

The market reacted unevenly after the elections that took place on Sunday that surprisingly gave Javier Milei from La Libertad Avanza the winner. While the S&P Merval climbed more than 26% in the last 6 rounds, bonds in dollars deepened their declines until this day when they just managed to rebound. But today it drew attention, in addition, the strong rises of non-leading shares.

The content you want to access is exclusive to subscribers.

This Thursday companies like Havanna (+16.6%), Inversora Juramento (+14.9%), GCDI (+14.8%), Morixe (+14.8%), Ledesma (+13.4%), Carlos Casado (+ 12.8%), Ferrum (+12%), and Fiplasto (+11.6%).

Market sources consulted by Ambit they said that investors are looking for coverage through exporting companies. In the particular case of Havana they hinted that the action “it’s totally overrated”, and that it could be a bubble. Not so the case of companies like San Miguel (which accumulates a growth of 203.5% in the year) and Morixe, which advances 154.6% in 2023.

Variable income: is it time to enter?

Santiago Ruiz Guiñazú, Banza strategistopined: “We like stocks that have part of their income in dollars or link dollars, such as Pampa Energía, TGS, the oil companies, the energy sector in general. We believe that there will be a lot of volatility because Argentina is very sensitive to electoral periods and this time will not be the exception.”

“From Adcap we have been constructive with the actions for a long time. In this context we understand that despite a challenging Macro context, companies show positive results and solid balance sheets. We like the energy sector, especially those companies with business in dollars or dollar linked”, Ruiz Guiñazú closed.

Devaluation and equities: what to expect

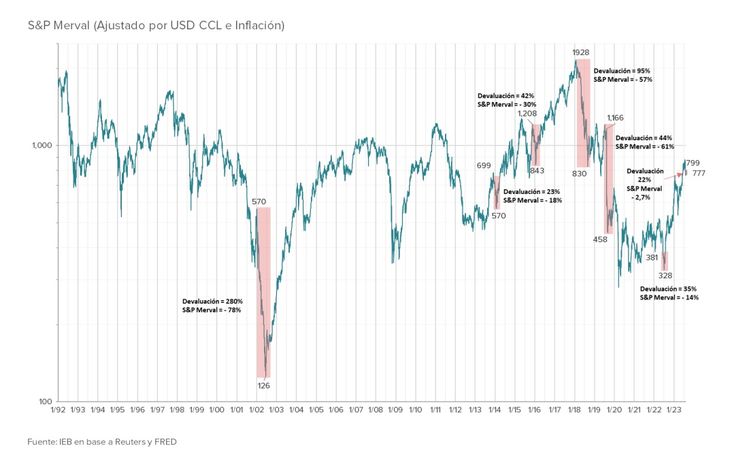

Invest in Stock Market made a report on the effects of a devaluation on the S&P Merval and analyzed that “the drop registered in the index is always less than the devaluation. And the recovery is strongly influenced by expectations”. The devaluation of almost 22% of the official exchange rate carried out by the BCRA on Monday was no exception, that day the index plummeted almost 14% in dollars.

devaluation.jpg

“However, at the close of yesterday’s session, the S&P Merval notoriously recovered the lost ground, remaining at 2.7% of the value prior to the devaluation,” they analyzed. “Of course, disaggregating a bit by sector, one observes that The Oil & Gas sector is the one that has weathered the devaluation the best, while banks, telecommunications and cement companies have suffered more negative effects (especially the case of the banking sector)”.

“Averaging the balance sheet season for Argentine stocks; having reported the vast majority of them except for the financial sector, we can draw some conclusions: the results of the companies, although they were not good, were not as bad as the macroeconomic environment that the country is going through. “, they concluded.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.