The result of the PASO with an unexpected triumph for the market of javier mileiadded to the devaluation of the Ministry of Economy last Monday, caused the market to return to readjust your expectations s for the remainder of the year. One of the most important factors is the dollar, and it is in this variable that most analysts foresee at least two exchange rate jumps slightly higher in December.

The Minister of Economy and presidential candidate, Sergio Massa assured that the new value of the wholesale exchange rate at $350 after Monday’s discrete jump will remain “until October 30.” However, throughout the week there was pressure on the contracts of future dollar which marked a different panorama, implying that the market is wary that new devaluations will not occur in the short term.

Thus, there is an expectation of devaluation (in annual effective rate terms) of 122% for September, 218% for October and almost 420% for December.

The market where the largest number of future operations take place is MatbaRofex. There, at the close of the week, the prices expected for the official dollar until the end of the year They were the following ones:

- August: $353.45.

- September: $378.

- October: $435.

- November: $539.50.

- December: $660.

But if the future dollar marked what is to come, the consultants also analyzed the variables that can modify – or not – this idea.

For Ecoviews, the central bank he could honor his word and leave the official dollar alone. “In a way, what he did was bring forward the gradual devaluation of the next two months. Looking at the prices of future dollar contracts, it follows that the market is not the same,” he explained in his last report.

“Our idea that it is coming is based on three issues. First, with this devaluation the BCRA generated an improvement in the real exchange rate that will not last long. By fixing the nominal value of the dollar and with the rising inflation, competitiveness is going to be lower day after day. So what is convenient for exporters is to liquidate as soon as possible. Another issue is that the BCRA will continue to stop import payments if necessary,” they stated.

“The other factor that makes it possible to think that they arrive isl IMF disbursement. Of the US$7.5 billion, the government has to use US$1 billion and US$775 million to repay CAF and Qatar respectively. In addition, it must set aside US$3.5 billion for principal and interest payments to the IMF between September and October. After all this, some US$2.225 million remain available to him, which, according to the minister himself, can be used to intervene in the market.”

Screenshot 2023-08-21 113855.jpg

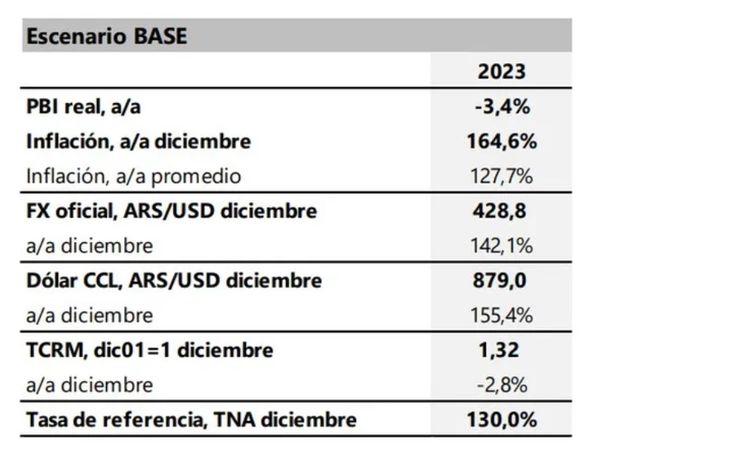

According to the consultant, the The following table summarizes the main variables of our baseline scenario as of December 10 2023. “We do not rule out new corrections as the days go by and the evolution of this volatile situation,” they explained.

Screenshot 2023-08-21 114029.jpg

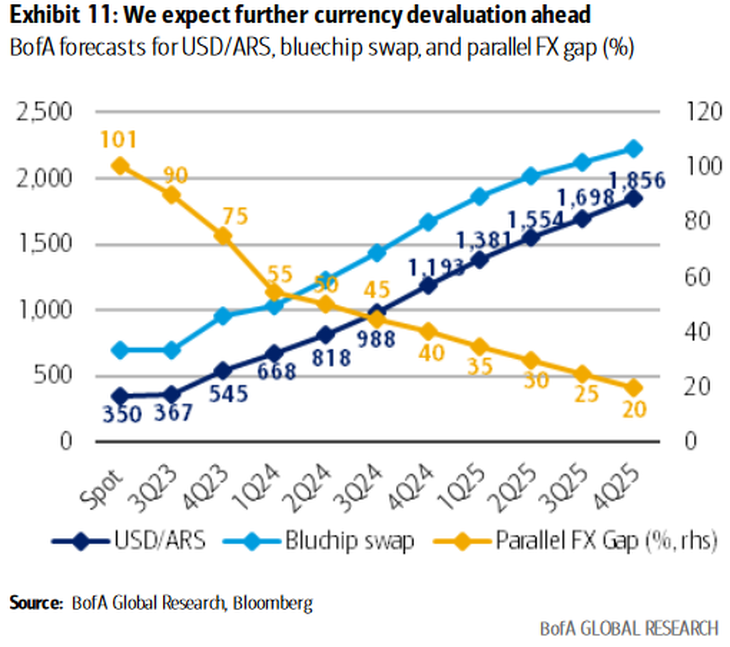

By the end of 2023 BOFA projects an official dollar at $545 while the CCL places it close to $1,000 and an exchange rate gap of 75%.

F36fz6UXYAAYW0G.png

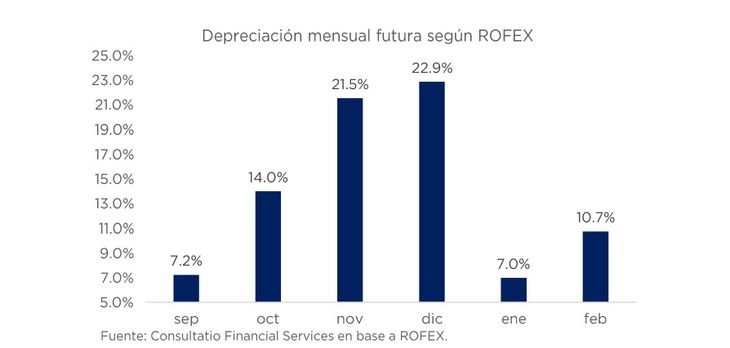

“The government stated that it plans to maintain a fixed exchange rate until October, but the market does not even buy that it can be kept fixed until then.” According to Rófex data, the market stipulates two jumps of more than 20% in the last two months of the year,” explained the Consultant.

Screenshot 2023-08-21 114641.jpg

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.