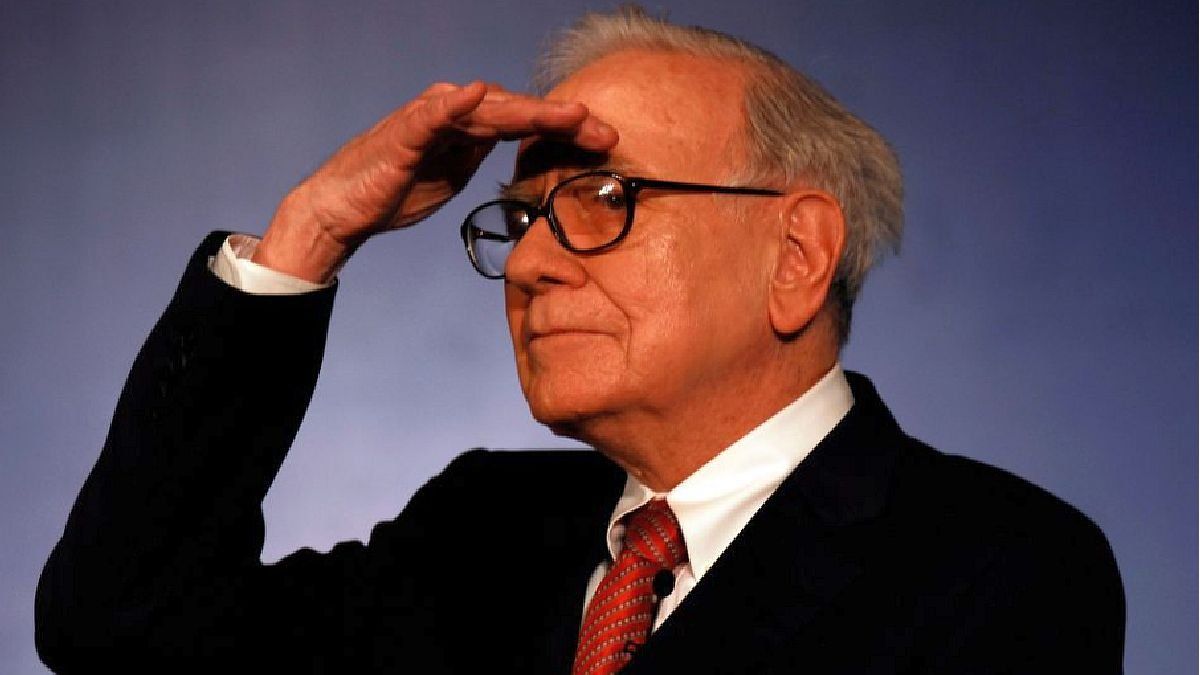

Securities and Exchange Commission documents recently revealed eye-catching updates in the stock portfolios of investment titans including Warren Buffet, Michael Burry and Bill Ackman, and others.

Warren Buffet, Michael Burry and Bill Ackman recently changed their investment strategies. Thus, documents from the Securities and Exchange Commission revealed that Buffett bet on three home builders, Burry chose short positions against the S&P 500 and the Nasdaqwhile Ackman opted for artificial intelligence (AI).

The content you want to access is exclusive to subscribers.

That’s right, the document published by Insider revealed that the ‘Oracle of Omaha’ portfolio, Berkshire Hathaway, bet on three home builders. He invested in Lennar Corp, NVR Inc and DR Horton Inc. The three combined positions are locked in at $814 million, a portion of Berkshire’s $350 billion.

Michael Burry decided to be a bear. He took a defensive stance on the S&P 500 and Nasdaq indices. He elected to take bearish put options valued at $1.6 billion.

Bill Ackman, meanwhile, opted for AI. His Pershing Square fund acquired Class C shares of Alphabet (a US-based multinational technology company whose main subsidiary is Google).and its stake rises to about $1.1 billion at the end of the second quarter.

The recent acquisition underscores Alphabet’s central role in the “cutting edge of AI advanceswith projects such as the Bard chatbot at the forefront”, according to the economic medium.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.