A private report analyzes the best options to build the portfolio according to the candidate who wins in November.

The surprise for him electoral result of the PASO and the reaction of the Government to set the exchange rate until mid-September, caused a change in the scenarios that the market analyzes until October. The projections for both the dollar and the inflation, they are not optimistic. In this context, the market seeks coverage through bonds taking into account all the variables.

The content you want to access is exclusive to subscribers.

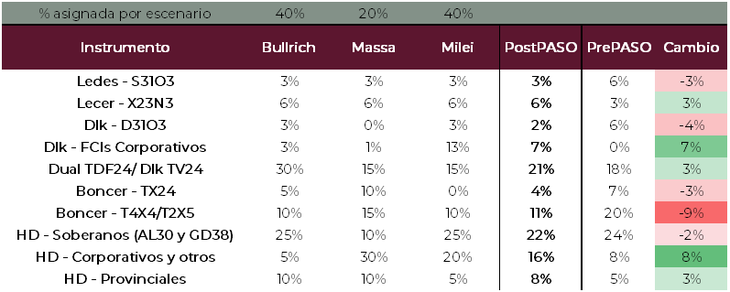

In this context, Juan Pedro Mazza Fixed Income Strategist Cohenpresented a recommended portfolio according to who ends up being the winner in a possible ballotage in November.

For Mazza, the three main presidential candidates share pro-market profiles: all propose a stabilization plan anchored in a fiscal adjustment program that includes a correction in the exchange rate, a tariff disclosure and a (partial or total) lifting of exchange control. They also agree that public debt is manageable and must be honored. In addition, it is unlikely that whoever takes office on December 10 will have a majority in Congress, which will limit the reform agenda. For these reasons, it seems unlikely that we will see extreme measures, such as a dollarizationin 2024.

Within this framework, we expect a similar behavior of the macroeconomic variables in the three scenarios. A devaluation jump by the end of 2023 or the beginning of 2024, with its corresponding transfer to prices (inflation) and reduction in the gap (enhanced by the lifting of financial restrictions). The main difference between the candidates will not be the direction of the ads, but the speed and depth with which they will try to deliver them. In the same way, the risks and the probability of success are different for each case.

In view of all of the above, from Cohen they recommend:

- CER For the remainder of 2023: The post-PASO exchange jump was immediately transferred to prices: we expect inflation above two digits for the August-September two-month period. They favor a combination of the November LECER (X23N3), some October fixed rate (S31O3) and the April 2024 CER bond (TX24).

- Aim to capture a devaluation jump between November and January: The 22% jump is insufficient to correct structural imbalances; in a month or two we will be back where we started. We recommend increasing positions in dollar-linked and dual bonds to 2024, whose rates have moved into positive territory. The dual bond to February (TDF24) and the dollar-linked to April (TV24) stand out, along with corporate dollar-linked FCIs to reduce exposure to the sovereign.

- Maintain positions in Argentine assets: We remain bullish on hard-dollar bonds. From the STEP they fell by 15% and their prices already discount a very pessimistic scenario. Thus, the risk-return ratio remains very attractive.

- Dollarize part of the portfolio as a defensive strategy: We allocate a significant portion of the portfolio to prioritizing stable returns in dollars, minimizing Argentine sovereign risk. Possible vehicles for coverage: corporate bonds, CEDEARs, FCIs in dollars or even dollar bills.

64df9d612f84c7d990b7c817_image_2023-08-18_133336386.png

Bonds: what is recommended according to the different scenarios

- Patricia Bullrich: For this scenario, Cohen proposes dollar-linked bonds. In this case, they overweight sovereign risk: we assign 25% of the portfolio to AL30 or GD38 and 10% to provincial bonds.

- Sergio Massa: CER and coverage, less sovereigns and dollar-linked. They allocate a larger portion of the portfolio for hedging. The portion of hard-dollar sovereigns is less than in the other scenarios, since their performance will be closely tied to Massa’s will and ability to carry out the necessary ordering.

- javier milei: more corporate DLK (less sovereign), more gap and less provincial. They advise a considerable portion of dollar-linked FCIs with a high percentage of corporate instruments and keeping a fifth of the portfolio in dollar instruments without exposure to Argentine risk.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.