The Cedears are mirror shares of companies listed abroad, they can be purchased in pesos and their price is tied to the dollar Cash with Liquidation. It is a highly chosen instrument to “cover” from the economic and political turmoil in Argentina. Besides, Cedears ETFs track specific industry sectors or indices, so investing in just one of them also diversifies your investment.

But in this note, we will also explain not only how to put together a portfolio to hedge against devaluation and put those pesos to work, but we will also detail what are dividends and how can you earn money with them.

“Dividends represent the benefit that the shareholders of a company obtain, originating from the profits of the company and which are determined according to the proportion of participation that each individual owns. However, it is necessary to point out that not all companies offer dividends, and those that do distribute different proportions,” he explained. Damián Vlassich, Senior Equity Analyst at IOL investoronline.

Which are the Cedears chosen by experts

cedears IEB.jpg

Investing in the stock market has has a wallet cedears composed of percentages according to the strategy, as well the benchmark occupies 38%, the defensive part 35%, the aggressive part 14% and the tactical part 13%.

“The portfolio has proven not only to be an excellent hedge against devaluations in financial dollars, but has also outperformed our benchmark the S&P 500 (SPY) and even the Dow-Jones (DIA) and the Nasdaq-100 (QQQ), the main Wall Street indices”, they explained from IEB. We see how each strategy is composed.

The benchmark includes 25% of the SPY ETF (which replicates the S&P 500) and 10% of Berkshire Hathaway, Warren Buffett’s company. The defense is made up of 15% of the DIA ETF (replies to the Dow Jones) and 12% of Coca Cola. The “aggressive” segment includes 10% of the ETF QQQ (which replicates the Nasdaq), 6% to Microsoft and 5% to Google. And the tactic has two other ETFs: XLE energy with 7% and the EWZ, the Ishares Msci Brazil, with 10%.

image.png

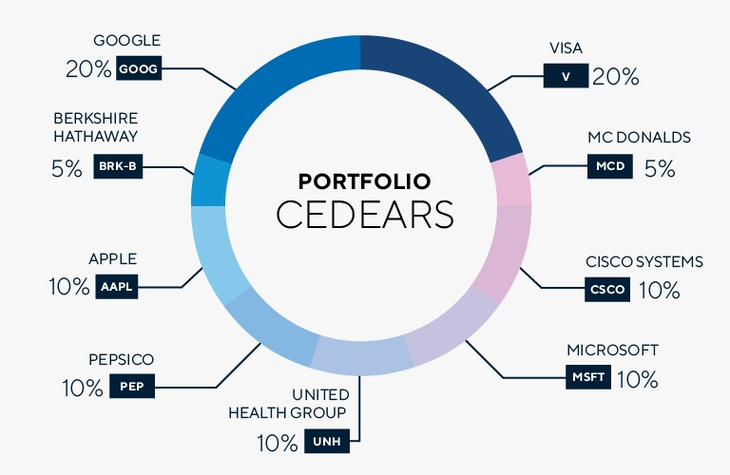

Currently the recommended portfolio of Cedears Criteria maintains a share of 10% on Microsoft and “in different companies whose dividend payments are supported by a strong net cash position and by their expected cash flows”.

In this regard, it is worth asking, is it always convenient to choose companies that pay dividends? “The dividend companies pay not independent of stock price. Ultimately it is the cash flow generated by the company that decides to distribute it in the hands of the shareholders. If we look at what happens to the stock price, when the dividend is paid we see that its price is reduced on the ex-dividend date (date from which those who buy the share do not have the right to receive the dividend)”, explained Criteria.

For this same report, “companies that pay a dividend backed by free cash flow can be excellent long-term investments, such as Visa (V), Apple (AAPL) and Microsoft (MSFT) as favorites to pay dividends from our recommended Cedears portfolio.”

For his part, inverted IOL online He also chose his recommended dividend-paying companies. “The first Cedear in this simple portfolio is Bradesco Bank (BBD). We are talking about the second largest private bank in Brazil and Latin America”, another of them is “Rio Tinto (RIO)one of the world’s largest mining and metals companies.

Thirdly they chose Altria Group (MO), one of the largest tobacco companies in the world, however they clarified, also has diversified positions in alcohol and cannabis. Later, they also included the American company AT&T (T), a provider of telecommunications, media and technology services.

Fifth, they ranked Walgreens (WBA) an integrated healthcare, pharmacy and retail company. Nearing the end of this portfolio, the sixth Cedear, which is IBM, a provider of information technology (IT) products and services. Finally, moving on to the health sector, they finished the simple portfolio with the inclusion of Pfizer (PFE). One of the leading companies in the pharmaceutical industry worldwide.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.