The World stock markets fall for the fifth consecutive session this Thursday and the dollar hits its highest level since March while the pound sterling and the Swiss franc plummet in a context in which the movements of central banks in terms of interest rates continue to provide surprises.

The sentiment was already risk averse after The Federal Reserve will indicate that it is likely to have at least one more rate increase left within the framework of the tightening cycle that began at the beginning of last year.

The fall in European stock markets and expectations that Wall Street will do the same mean that the MSCI world stock index is heading towards a fifth day in the redmarking its longest losing streak since March.

Traders were caught off guard by a lurch in the franc in Europe as the Swiss National Bank unexpectedly held rates on hold, something that was repeated in the UK and sterling markets when the Bank of England did the same.

The movements of the banks and what is coming

Yes ok Sweden and Norway stuck to script and raised rates as expected, the latter also surprised by pointing out that he could do it again in December. All of this made Türkiye’s rise look like a model of predictability.

Wall Street was set to open lower and Saxo Bank analyst John Hardy said moves by European central banks showed there is now more uncertainty about when and where rates will peak.

“Different countries are in different gears, in what are real responses driven by the data we are seeing nowespecially for the United Kingdom,” said Hardy after the decision of the Bank of England, which made its first pause after 14 consecutive increases.

“It punctures the balloon of terminal rates and also creates more doubts about the quality of the (economic) landings.” The pound sterling, falling since July, went from $1.23 to a low of $1.2223.

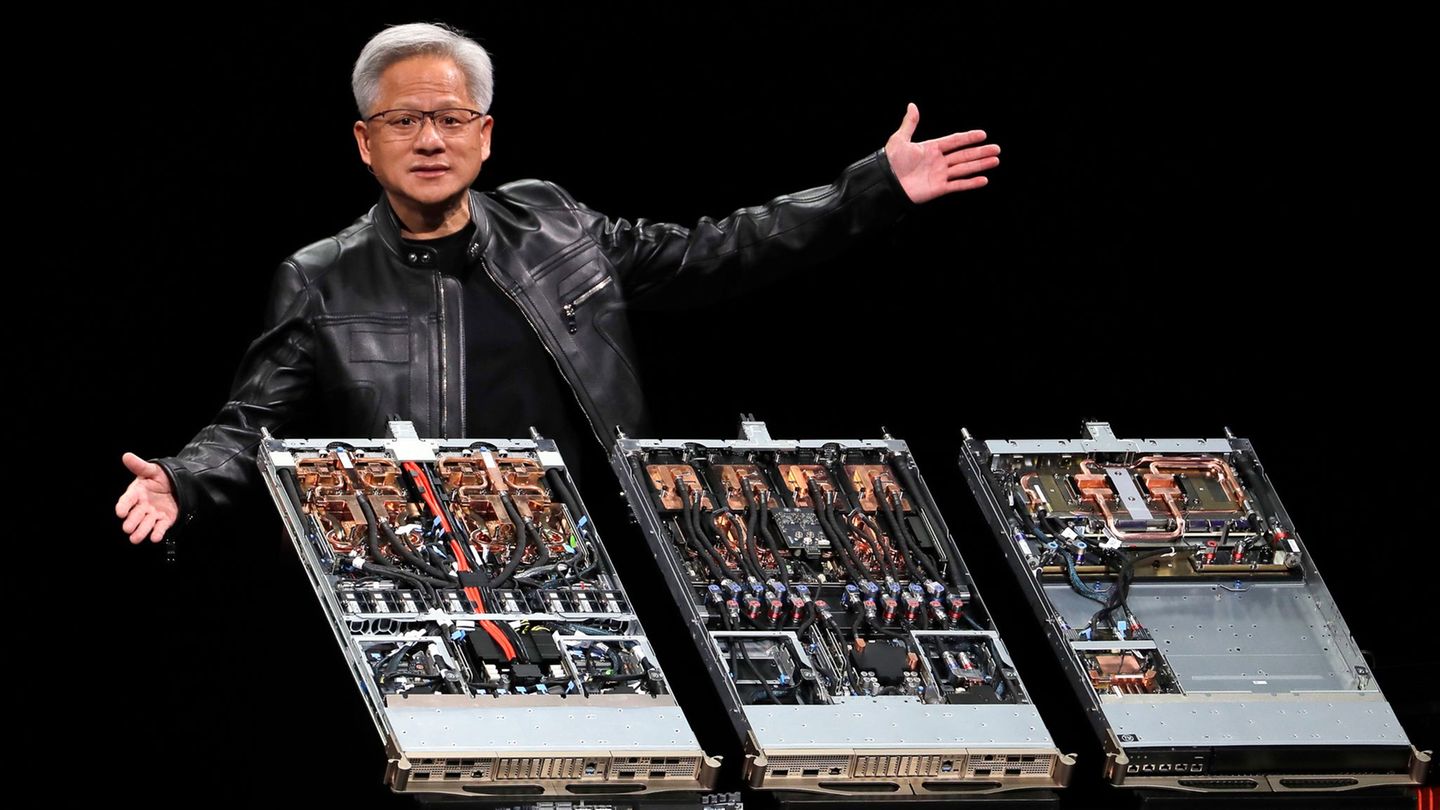

Wall Street is expected to be weighed down by a probable drop in mega stocks rate sensitive, such as Apple, Meta Platforms, Alphabet and Nvidia, most of which have had a difficult month.

MSCI’s broadest index of Asia-Pacific shares excluding Japan fell 1.6%, in its biggest move since early August. Japan’s Nikkei fared only slightly better, with a loss of 1.4%.

In the absence of a crucial Bank of Japan meeting this week, the yield on Japan’s 10-year public debt It was operating at decade highs, in line with its US Treasury peers, which reached their highest level in 16 years after the Fed meeting, at 4.43%.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.