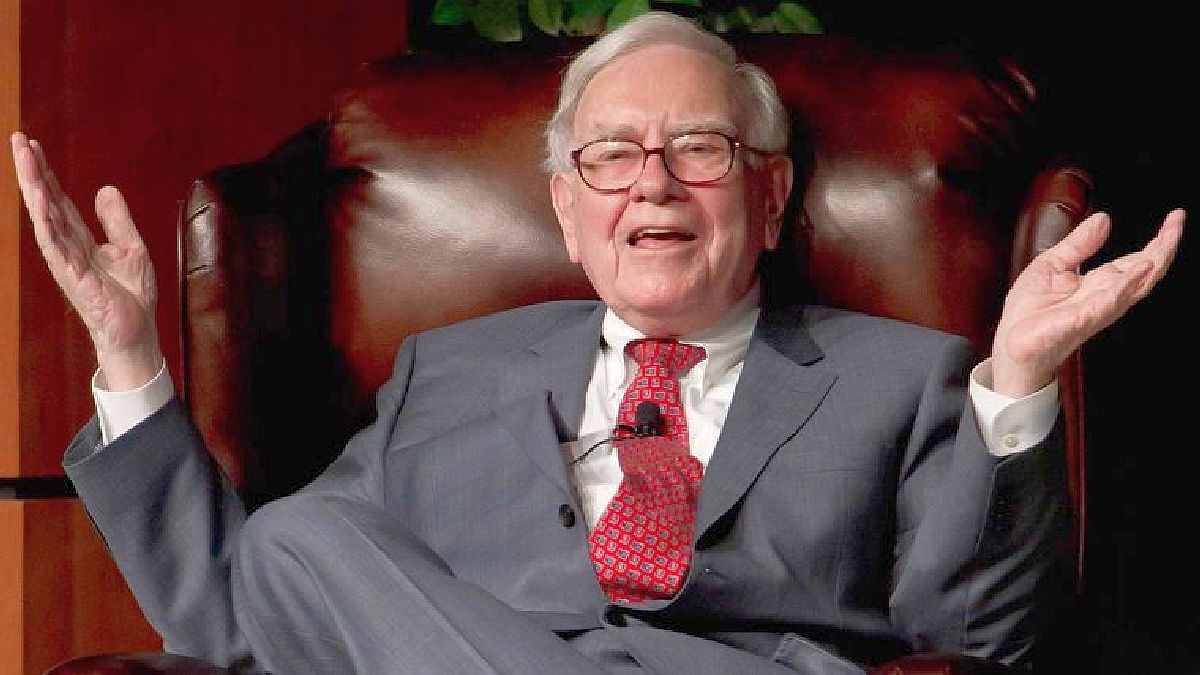

Warren Buffett is recognized worldwide as a symbol of success in the field of investment. With a net worth among the highest in the world, his impressive journey from a young newspaper delivery boy to becoming president and CEO of Berkshire Hathawayhas captivated the financial world during decades.

Unlike many hedge fund managers and investment gurus who jealously guard the secrets of their strategies, Buffett has always openly shared his investing style.

Being CEO of a listed company, Buffett You are required to some extent to report your investments. However, he has gone beyond these requirements and has spoken openly about his decisions as well as his capital. Berkshire.

Copy trading is also a strategy

Thanks to this transparency and information requirements, emulate your investment movements, known as copy trading, has become quite accessible. There are even apps that can automate this process, which begs the question of whether it’s something investors should consider.

It may seem like an obvious statement, but many of Buffett’s famous trades are out of reach of the average investor. So, Is it a good idea to copy him? According to Robert Johnson, a finance professor at Creighton University’s Heider School of Business, it definitely is.

The expert, who has closely followed Buffett’s career as an academic and has been a shareholder in Berkshire Hathaway since the early 1980s, highlights that no need to have original thoughts to be successful in investments. Follow the movements of Warren Buffett and his team at Berkshire Hathaway: It’s a solid strategy.

The teacher offers three fundamental reasons why copying Buffett can generate financial gains.

Trade less frequently

Buffett is not a fan of day trading and emphasizes the importance of maintaining a long term position. His approach involves minimal commercial activity, which is beneficial, since numerous studies indicate that those who operate more frequently tend to obtain less favorable results.

Investment in quality:

The Oracle of Omaha has a predilection for investing in quality actions when they are reasonably priced. Berkshire Hathaway focuses on quality companies instead of chasing trends or betting on fashionable values. Quality companies limit the downside, providing some protection against significant losses.

Safety margin:

As a value investor, Buffett looks for conservatively valued companies and calculates a fair value for a stock. The notion of “safety margin” involves buying shares below their intrinsic value, which provides a cushion of protection against market fluctuations.

Warren Buffett 3.jpg

Lastly, by copying Buffett, It is essential to have patienceas it is not a strategy for those looking to get rich quick. Buffett accumulated most of his wealth after age 50, proving that value investing is a long-term strategy.

Although growth stocks can outperform value ones in the short termhistorical data supports that value stocks will reward the patient investor in the long term. Follow in the footsteps of one of the greatest investors of all time can be a lucrative strategyalthough it requires a long-term perspective and dedication.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.