“Although there has been a growing trend in the use of all electronic means of payment for a few years -except for credit cards-, the greatest dynamism was observed among the transfers electronic “, said the BCRA report, whose participation in total operations went from 4% in January 2016 to 23% in June 2021.

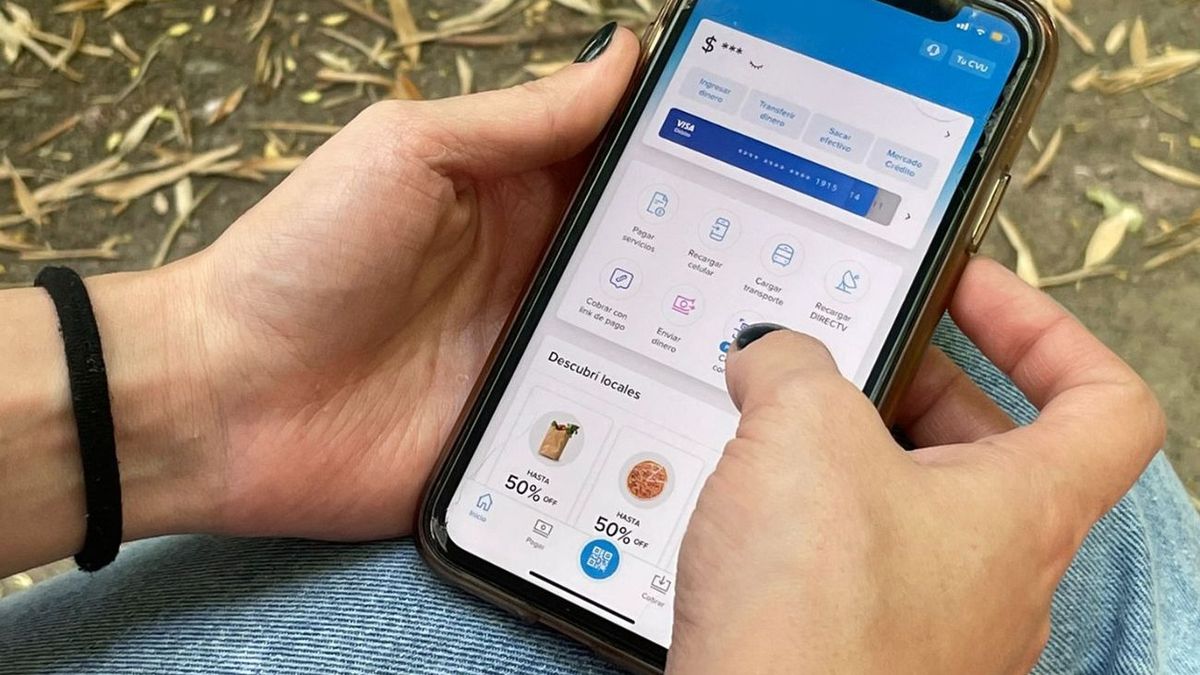

According to the same entity, the effect of the pandemic on consumer habits, the proliferation in the use of electronic wallets and regulatory changes to facilitate the interoperability of payment methods are some of the factors that explain this change in behavior.

“In the first half of 2021, MPEs continued their progress with respect to cash withdrawals, a metric used to approximate the population’s use of cash. In average number of operations, the ratio increased 41% compared to the same period of 2020 and 23% compared to the previous semester; while in terms of average amount, the ratio grew 37% and 19%, respectively, “the document said.

About, For every 100 cash withdrawals made by ATMs or other withdrawal points, in May 2019 there were 169 electronic payment operations, which in May 2020 rose to 221 and in May 2021 they reached 310.

“The expansion of electronic payment methods for users and the incentives for their acceptance by businesses could mean that MSEs continue to gain share over the use of cash,” said the Central Bank.

One of the means of payment that grew the most during this time were payments through QR code, which had variation rates of 136% in amounts and 140% in real amounts. compared to the average values of 2019 and 2020.

Another of the notable data in recent months was the growth in the number of people who simultaneously own bank accounts and payment accounts, such as digital wallets, which accelerated from the outbreak of the Covid-19 pandemic.

“The joint holding of accounts reached 11.5 million people, 36% of the total number of bank account holders, which stood at 31.6 million, which represented 91.1% of the adult population”the report noted.

Payment accounts were consolidated as a complement to bank accounts, rather than as a substitute since “people with only payment accounts reached a total of 1,100,000, which represented only 8% of the total holding of payment accounts “.

At the same time, the operations per adult of transfers initiated from CVU surpassed, as of 2021, those made with prepaid cards.

“This trend could reflect a greater preference of users for payments initiated from electronic wallets, as well as a superior functionality of the former over the latter,” the report said.

Source From: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.