tesla presented its quarterly balance sheet and the market had no mercy. How did the stock react? What did he say Elon Musk to justify the bad results?

In the third quarter, Tesla’s sales were US$23.4 billion, which implies 9% year-on-year growth.

Let’s see how quarterly sales evolved by each segment:

tesla1.PNG

But, without a doubt, the highlight came from the profit side. The Net income was US$1,850M, which represents a decrease of 44% compared to US$3,300M in the same quarter of 2022.

Tesla experienced a significant drop in its gains from reduction of their vehicle prices to maintain their position in the market. On average, prices decreased by 25% over the last year. That is, it focused on maintaining sales, giving up profit margins.

How did the market react?

tesla2.PNG

After presenting the balance sheet on Wednesday the 18th at the close, on Thursday its shares fell 9.3%. Friday was also red, with a drop of 3.7%. In the accumulated, since the balance sheet was presented, the loss was 13%, showing that the market did not like it.

¿What did Elon Musk say? He justified the poor balance due to the high interest rates, warning that lower prices were ineffective in increasing sales volume. Let us remember that in the US loans are often used to purchase vehicles and, as the cost of financing them has increased, it becomes more expensive and complicated for consumers.

Furthermore, Elon Musk was not optimistic about the new Cybertruck pickup truck either. He commented that it would be profitable up to 18 months after its launch, scheduled for next November.

And as if this were not enough, the economic context forced Tesla to delay the construction of its new factory in Mexico, which will require US$10,000M.

Competence

Tesla is facing increasing competition in the electric vehicle market. And it comes from both new companies specializing in electric vehicles and from manufacturers of traditional cars such as Hyundai, BMW and Ford. These competitors are gaining ground at Tesla’s expense.

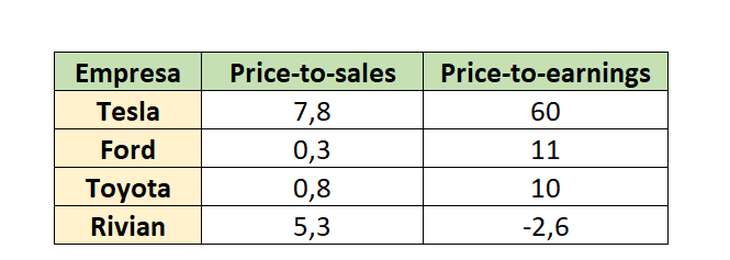

In fact, let’s look at Tesla’s valuation with its competitors, through the Price-to-sales and Price-to-earnings ratios, which take into account how much is paid for each dollar of sales or profits of the company.

tesla3.PNG

As you can see, Tesla’s valuation is still very high compared to its competitors.

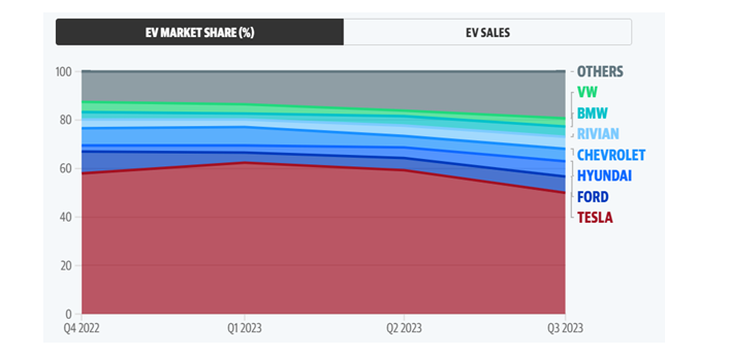

Tesla remains the natural leader in its industry. However, their Market Sharein US electric vehicles, fell to 50% in the third quarter, compared to almost 65% for the full year in 2022.

tesla4.PNG

In the third quarter, sales Rivian Automotive (RIVN) doubled from the previous year, leading its share to reach 5%. In fact, Rivian became the fifth largest seller of electric vehicles in the US in terms of market share, following Tesla, Ford, Hyundai and Chevrolet.

This indicates that electric vehicle competition is growing and that tesla Not alone. Furthermore, the global context in the US does not invite us to be optimistic. Therefore, be careful. The market started to talk…

To learn more about this topic and general content about investments, you can visit our Carta Financiera site: www.cartafinanciera.com

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.