According to recent news, the famous American investor and businessman accumulated a record liquidity position of more than $157 billion in his company Berkshire Hathaway.

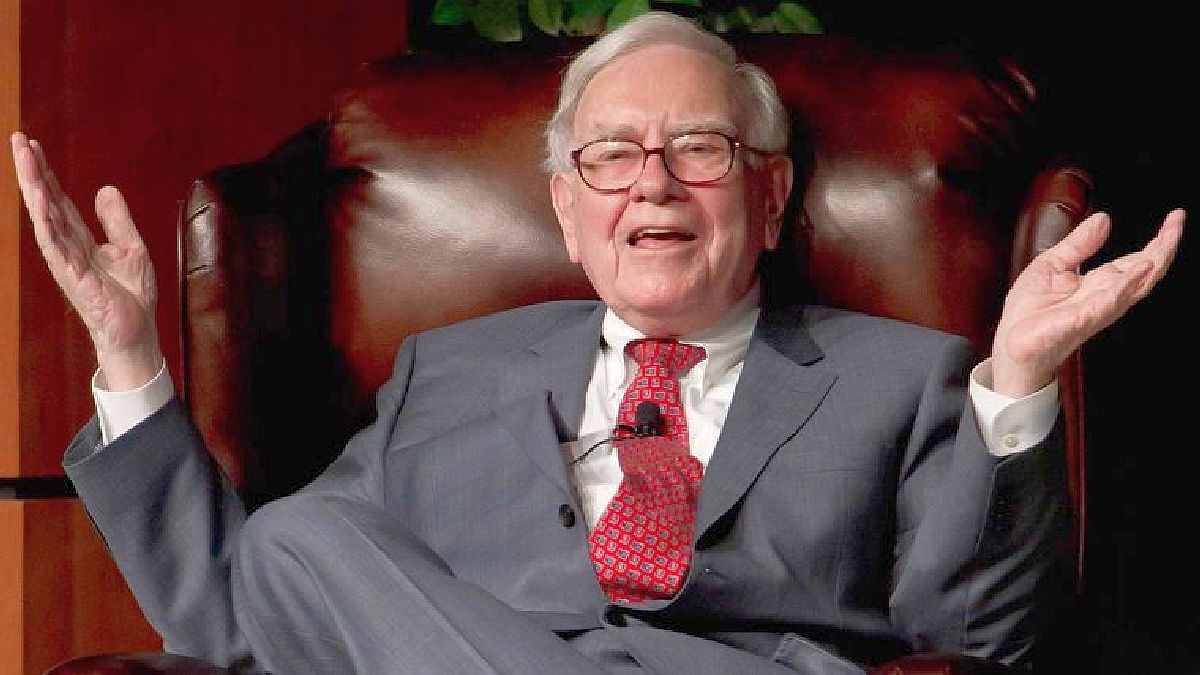

Warren Buffett is one of the most successful and respected investors in the world. Its investment philosophy is based on three core values. However, on this occasion, it made the news but for another reason: reached a record liquidity position of more than $157 billion in its company Berkshire Hathaway.

The content you want to access is exclusive to subscribers.

In its balance, The company detailed that on September 30 it had US$126,401 million in short-term Treasury securities, plus US$25,573 million in cash. and equivalents in its insurance division and another US$5,267 million in railways, energy and services.

Regarding investments, they are five values that make up 78% of your portfolio: Manzanawith US$156.8 billion; Bank of Americawith US$28.3 billion; American Expresswith US$22.6 billion; Coca Colawith US$22.4 billion, and Chevronwith US$18.6 billion.

In the quarter, Berkshire Hathaway suffered accounting losses of US$12,767 million in the quarter (compared to red numbers of US$2,698 million the previous year), mainly due to the fall in Apple shares, its main investment, valued at US$156,800 million at the end of the quarter.

Warren Buffett’s three keys to investing

Invest in value: Buffett looks for companies that have an intrinsic value higher than their market price, that is, that are undervalued. To do this, he analyzes its foundationsits competitive advantage, its ability to generate profits and its long-term growth potential.

Invest for the long term: Buffett is not influenced by short-term market fluctuations, but instead focuses on company performance over the years. Their goal is to own the companies, not speculate with them. Therefore, choose companies that have a solid business model, good management and a vision for the future.

Avoid unnecessary risk: Buffett follows the maxim of “not losing money” and avoids investing in sectors or companies that he does not understand, that have high debt, that depend on external factors or that have low profitability. Prefers to invest in companies that have a high return on capitalthat generate constant cash flows and reinvest their profits in the growth of the company.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.