The Secretary of Finance, Eduardo Setti, denied rumors of an exchange or default of the debt in dollars. This is what he said about the rumors.

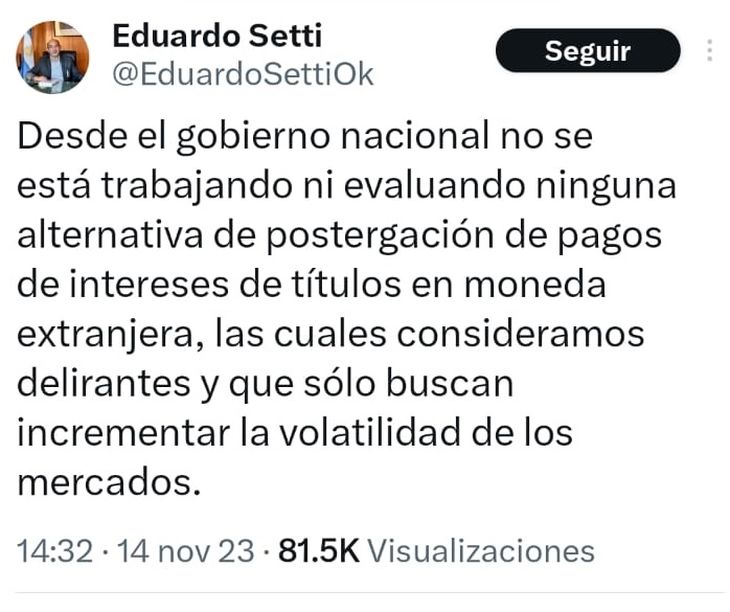

Eduardo Setti, Secretary of Finance of the Ministry of Economydenied through his social network account X (ex Twitter) that, “the national government is not working on or evaluating any alternative to postpone interest payments of securities in foreign currency”.

The content you want to access is exclusive to subscribers.

In response to versions that spoke of a possible voluntary exchange and a possible default that were spread in the last hour, Setti said that “we consider them delusional and that only seek to increase the volatility of the markets“.

Debt: upcoming maturities

This occurs within the framework that, after the payments made to the International Monetary Fund (IMF) in October and November, which totaled some US$3.4 billion, the Argentina must cancel debt maturities in foreign currency for almost US$12,000 million between December and April 2024.

Between December and February the Treasury must cancel maturities for more than US$6.2 billionof which US$3.7 billion are payments to the IMF, US$1.0 billion to other international credit organizations and some US$1.5 billion are in public securities.

setti twitter.jpg

With the reserves of the Central Bank (BCRA) at historic lows (since they are around US$20.9 billion, there is concern about how it will face these debt maturities between now and the next thick harvest, which begins between March and April of next year. .

An incentive is that, as detailed the Ecolatina consultancymost of the public titles They are in the hands of state agencies. Meanwhile, with regard to the maturities with the IMFit is expected that the incoming government will try to negotiate a restructuring of the program with the organization that involves new disbursements to strengthen the Central reserves.

It is worth mentioning that, according to Ecolatina, between 2024 and 2026 the Government must face maturities of more than US$53,000 million (excluding Non-Transferable Bills, Guaranteed Bills and Guarantees), which is equivalent to more than US$17.8 billion on average per year. That is why the renegotiation that is achieved with the organization will be key.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.