One of Milei’s trusted men until a few days ago made controversial statements about possible solutions for Leliqs and fixed deadlines.

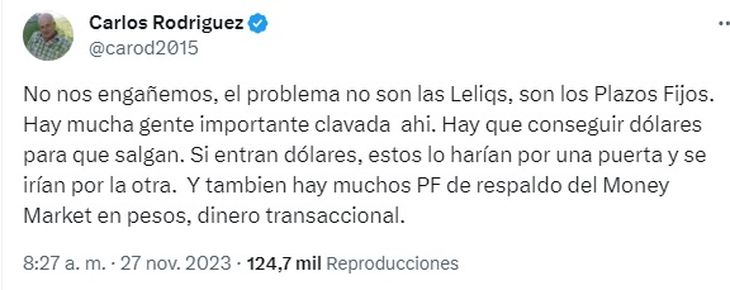

Within the framework of the comings and goings regarding how the president-elect’s economic team will be formed, Javier Mileiand the debate about what to do with the Central Bank Liquidity Letters (Leliq), Carlos Rodriguezwho recently resigned from his role as head of the council of economic advisors of La Libertad Avanza (LLA), came out to talk about the issue.

The content you want to access is exclusive to subscribers.

“Let’s not fool ourselves, The problem is not the Leliqs, it is the Fixed Terms. There are many important people stuck there,” said the economist through his social network possible members of Milei’s economic team is “getting dollars to go out.”

Thus, he opined that “if dollars enter, they would do so through one door and leave through the other.” And he also pointed out that there are many Fixed deadlines that are support of the Money Market funds in pesos, “transactional money,” he summarized.

rodriguez.jpg

In this way, Rodríguez slipped in a veiled criticism of the proposal being evaluated to disarm the famous “Leliqs bomb.” And a large part of the market analysts are suggesting at this time that it is not necessary to do anything other than “turn off the machine” and go towards zero deficit. This is suggested, for example, by the economist Fernando Marull.

Milei’s proposal for the Leliqs

The challenge is how to disarm them without affecting the banks already the depositors, because the Leliq are driven against people’s deposits. Milei analyzes, for the moment, two options that he threw on the table:

- One of them is a disbursement of US$30,000 million by some funds, which implies taking on debt to resolve it,

- another is a market exit, which could be offering the banks some bonus in exchange for those instruments.

For the future Argentine president it is an unavoidable condition to get out of the trap dismantle, even partially, the famous “Leliqs ball”, which is why he anticipated that it will be his first step as a Government to move forward in that direction. Many analysts warn that, if all exchange restrictions are eliminated without solving this problem, all that mass of pesos would go to the market and that would generate a very strong devaluation..

However, others consider that it is not a strictly necessary step, but rather that, with a reorganization of the macroeconomy and a fall in the deficit that could be resolved gradually without the need for a Bonex Plan, as many suggest, or greater debt.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.