A new strong expansion was recorded in the bidding of the Leliqs, in this case of $1,549 billion, due to maturities of $1,575 billion, which is why the stock of these remunerated liabilities of the BCRA continues to collapse. Although, at the same time, the level of one-day Passes grows.

He Central Bank (BCRA) renewed this Tuesday, December 5 less than 2% (1.8%) of the maturities of the Leliqs (Liquidity Bills) at 28 days, at award just $28,648 million, with a rate stable 133% annual nominal (TNA).

The content you want to access is exclusive to subscribers.

In this way, there was a new strong expansion, in this case of $1,549 billion, in the face of maturities of $1,575 billion, which is why the stock of these remunerated liabilities of the BCRA continues to collapse, although at the same time, the level of One-day Passive Repos grows.

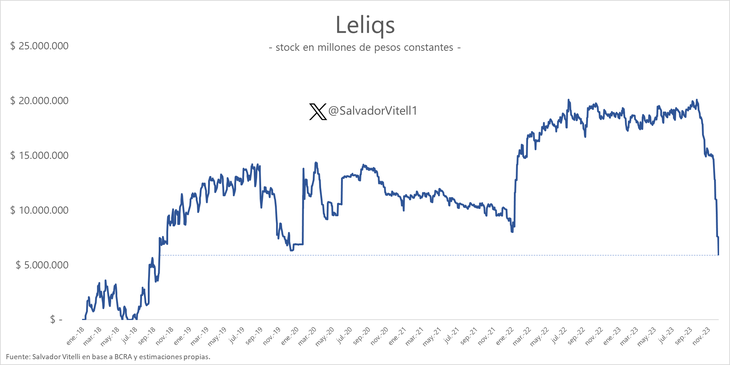

All in all, Leliqs currently amount to about $6 billion, which represents the lowest stock in more than five years (September 2018), according to analyst estimates Salvador Vitelli.

leliqs stock.png

The elected president Javier Milei will take office on Sunday after a campaign with the promise of dollarizing the economy and eliminating the BCRA, with the immediate implementation of a “shock” plan and the liquidation of the “Leliq” because they were considered inflationary.

Already in the last two weeks, Leliqs stock had begun to fall noticeably. On Tuesday, November 21 and Thursday, November 23, Leliq’s ‘rollover’ stood at 39.7%, 10.5%, respectively.

While last week, the refinancing rate was 22.9% on Tuesday the 28th, and just 2.8% on Thursday, November 30th.

passes.jpg

The flight of liquidity from the Leliq It is because with the The new Government expects a strong devaluation in the official exchange rate and that is why other alternatives are resorted to as a safeguard of value.

Another part of the liquidity in dance is directed to the “Repos” or “Pases”, a type of loans to the BCRA for one day.

more passes leliqs.jpg

Stock of Leliqs, more Passes in real terms.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.