This Thursday, December 7, is the last business day of the Government of Alberto Fernández. Javier Milei will take over on Sunday as new president of the Argentines and a new era will begin. An economic management marked by the pandemic ends, the debt restructuring at the hands of Martin Guzmanthe drought, the scarce reserves and the management of Sergio Massa which culminates with very high inflation rates and very high exchange rates.

Official dollar, blue dollar, CCL and MEP

Alberto Fernández took office with an official dollar at $62.50 and this day, four years later says goodbye with a wholesale exchange rate at $385, an increase of 516%. However, it is important to highlight that during this administration obstacles were imposed on the acquisition of foreign currency and they weighed heavy taxes that gave birth to the tourist dollar, savings, Qatar, etc.

As for the Dolar blue, 4 years ago It was at $70 and closed this day at $990, a 1,300% increase. Regarding the types of financial exchanges, the CCL operated in $76.72 and ends this Thursday in $999, a jump of 1,200%. For its part, The MEP dollar was at $76.22 during the first month of management and ends at $981.31 (an advance of 1,180%).

image.png

In fact Ambit accessed a graph made by GMA Capital that realizes that The Government of Alberto Fernández had on average the most expensive dollar in the last five decades.

Fixed terms and inflation

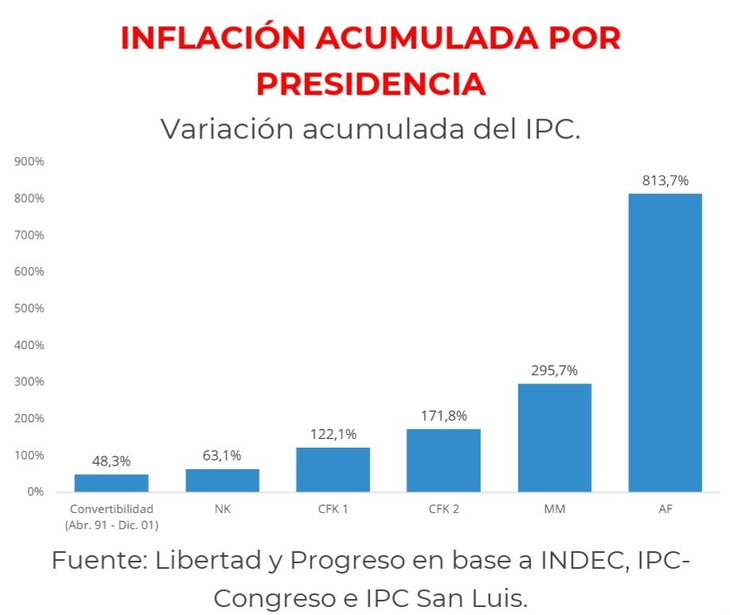

The management of Alberto Fernandez started with a rate of Leliqs in it 63%, the fixed term interest rate at 43% and inflation at 55% annually. He ends his term with a reference interest rate of 133% and inflation that will be 160% in 2023. It should be noted that The accumulated inflation in the Alberto era will be around 814%.

image.png

Stocks and bonds

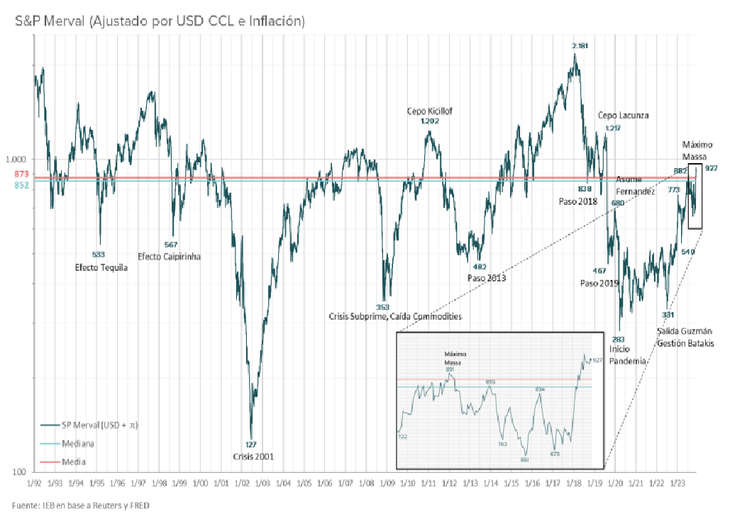

This day the Buenos Aires stock market showed a sustained advance of 5.3% in its S&P Merval index to record levels, to climb a historic 366% in the course of 2023. This year there was a strong electoral trade driven by the expectation of a change of government. So, In the last 4 years, measured in dollars, the selective gained 103%.

image.png

For its part, The country risk closed this day at 1896 points and prior to the start of the Government of Alberto Fernández it was located at 2180 (which implies a decrease of 13%). It should be noted that between September 9 and 10, 2020 in view of the debt restructuring carried out by Martín Guzmán and the issuance of new bonds is that The country risk went from 2,120 basis points to 1,101 units in just 1 day.

Reserves and fiscal deficit

Throughout the administration of Alberto Fernández, Net international reserves plummeted, taking them from US$13 trillion to negative territory at US$-10.5 trillion. with a deepening in the last year due to greater intervention in the exchange market and less capacity to accumulate dollars, for which US$20 billion were lost from the coffers of the monetary authority, reported this day. IEB.

On the deficit side, The outgoing management received a primary deficit of 0.4% of GDP in 2019which In 2020 it increased to 6.4% driven by the extraordinary circumstances of the pandemic. “In any case, in the following years a significant level of primary deficit continued to be observed with a downward trend, until reaching the current level of 1.8% of GDP,” the same report revealed.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.