The Government encourages savers to leave traditional fixed terms and this strengthens other instruments as a counterpart. What is this dynamic like and what are the numbers of that trend?

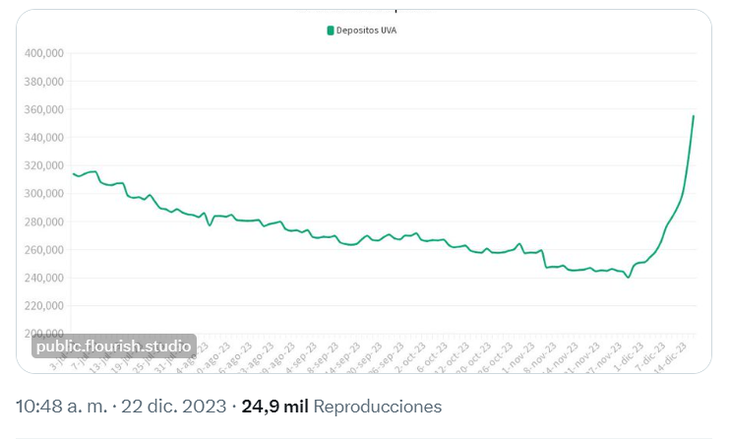

The stock of UVA fixed terms increased a 43% so far in Decemberthat is, the equivalent of $106,000 million, as reported by market analyst Amilcar Collante from his social network account X (ex-Twitter) and this responds to the strategy implemented by the Central Bank (BCRA) for the liabilities disarmament plan (Leliqs and passes). This occurs simultaneously with a dismantling of traditional fixed terms, which also continue to represent more than 90% of the deposits in the financial system, but are declining.

The content you want to access is exclusive to subscribers.

Let us remember that the BCRA ordered a reduction of 23 percentage points in performance of the Fixed deadlines traditional 30-day terms and, in this way, the Annual Nominal Rate (TNA) went to 110% for new deposits made, which is equivalent to a monthly interest of 9.04%. Thus, given that monthly inflation for December is projected to be between 20% and 25%, according to private analysts, this instrument was completely negative with respect to that index.

image.png

And it is that With a 9.04% monthly yield, those who have a fixed term are negative by about 11 percentage points with respect to the expected inflation for December and by more than 3 compared to that of November (12.7%). Likewise, the effective annual rate that they now offer is 186.5%, when until now it was of 253%.

In this way, it is also well below the annual inflation projected for 2023, which will be around 190% and also that predicted by the BCRA’s Survey of Market Expectations (REM), which was anticipated for the December 2023 period. By December 2024, inflation will be 191.8%.

UVA fixed terms gain popularity

With this decision, surely, a large part of the pesos that today are in a traditional fixed term will go to the UVA, which the BCRA is supporting. It happens that the drop in fixed-term rates was accompanied by a message to the banks to encourage the offer of UVA fixed-term loans, tied to inflation.

In this framework, the central bank He urged the banks to continue offering this alternative despite the banks’ request to discontinue the UVA fixed term and then ordered the cancellation of the pre-cancellation rate that these instruments had. The objective is to force the pesos into these instruments that yield +1% inflation, but that have the condition that the saver has to remain in them for at least 90 days.

The same could go towards parallel dollars, but according to Ambit the economist Federico Glustein, “due to the strong inflationary peak that is expected in the coming months (December, January and February) term deposits tied to that variable they are going to be one better coverage for the saver”.

Fixed term: how UVAs work

This strategy occurs within the framework of the plan that the Government launched, together with the BCRA, to dismantle the ball of liabilities that the monetary regulator has on its balance sheet. It is a strategy that consists of making banks switch to Treasury instruments and from Leliq and passive repos and that savers look for other types of alternative investment instruments.

The UVA fixed term remained the only fixed term that pays a positive real rate, adjusted for inflation, through the UVA+1% formula, just as it was said. It is a deposit in pesos for at least 90 days (up to 365) that adjusts the rise in inflation plus a rate of 1% annually.

There are two formats, the traditional and the pre-cancelable. Within this second option what changes is that the BCRA decided eliminate the minimum pre-payment rate for UVA fixed-term loans, which means that the conditions will now depend on the banks. The value of the UVA is updated daily and its value can be consulted on the website of the Central Bank of the Argentine Republic (BCRA).

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.