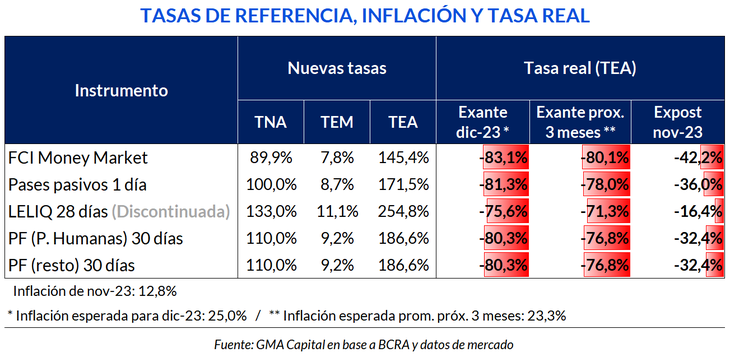

Faced with the inflationary flash and the rate reduction ordered by the Central Bank this month, The performance of traditional fixed terms in real terms became the most negative in almost 34 years, according to GMA Capital estimates.

“We estimate that the peso premium in the last month of the year will lag extremely behind the increase in the cost of living. The cold Excel numbers are merciless with the saver. They show an expected real rate of -77% (TEA), the most depressed since March 1990”the report noted.

One of the ways that the Government decided to reduce the high stock of remunerated liabilities of the Central Bank is voluntarily maintain the reference interest rate below inflation.

This is something that was already going to happen with the original rates in the short term, with price increases of more than 20% monthly.

Fixed-term-trad-vs-infla.png

Fixed term: a very negative December for savers

However, and perhaps taking advantage of the capital control that is still in force, The BCRA went even further, and further lowered the interest rate to a monthly remuneration of 8.7%.

At the same time, The fixed term rate for both human persons and the rest was adjusted to 110% (TNA) -from the previous 133%-which represents a monthly premium of just over 9% -from the previous 11%-.

“With a high degree of certainty, the fixed term will lose against the rise in the cost of living in the coming months,” GMA Capital stated.

graf-rates-liquefaction-ok.png

Investments: what other alternatives are there

Now, companies and people Nor would they find refuge among the more sophisticated alternatives. “In the fixed rate universe, the ‘best’ option is a synthetic strategy (purchase of the dollar-linked TV24 bond and sale of the April dollar future) that yields 12% monthly, but at the cost of assuming duration risk. to 4 months. In a 30-day window, there is no longer a conservative asset that exceeds 9% monthly performance,” they warn from GMA.

Faced with this, the UVA fixed term becomes the only instrument that pay real positive rate, given that it adjusts for inflation, through the formula UVA+1%. Although it is worth remembering that it is a deposit whose The time period has a minimum of 90 days (and goes up to 365).

Blender to lower paid liabilities

Along these lines, GMA maintains that “if inflation in the next quarter accumulated 87% (25% in December, 25% in January and 20% in February) and the Central Bank kept the rate at 100% TNA, The stock of passes and Leliq would be reduced by 32% in real terms. At today’s prices it would imply that this stock, which today represents $26.4 billion, would suffer a pruning of $8.3 billion just due to the effect of liquefaction.”

Although the fiscal anchor promises that there would be no exogenous emission to finance the Treasury and the monetary blender would take impetus from the quasi-fiscal cost, monetary policy operates with delays of several months.

Meanwhile, the realignment of relative prices of the exchange rate, fuel and public service rates are already taking their toll. Thus, as a result of the correction of the inheritance receivedinflation in December and January would already be closer to 25% monthly than 20%, GMA Capital projects.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.