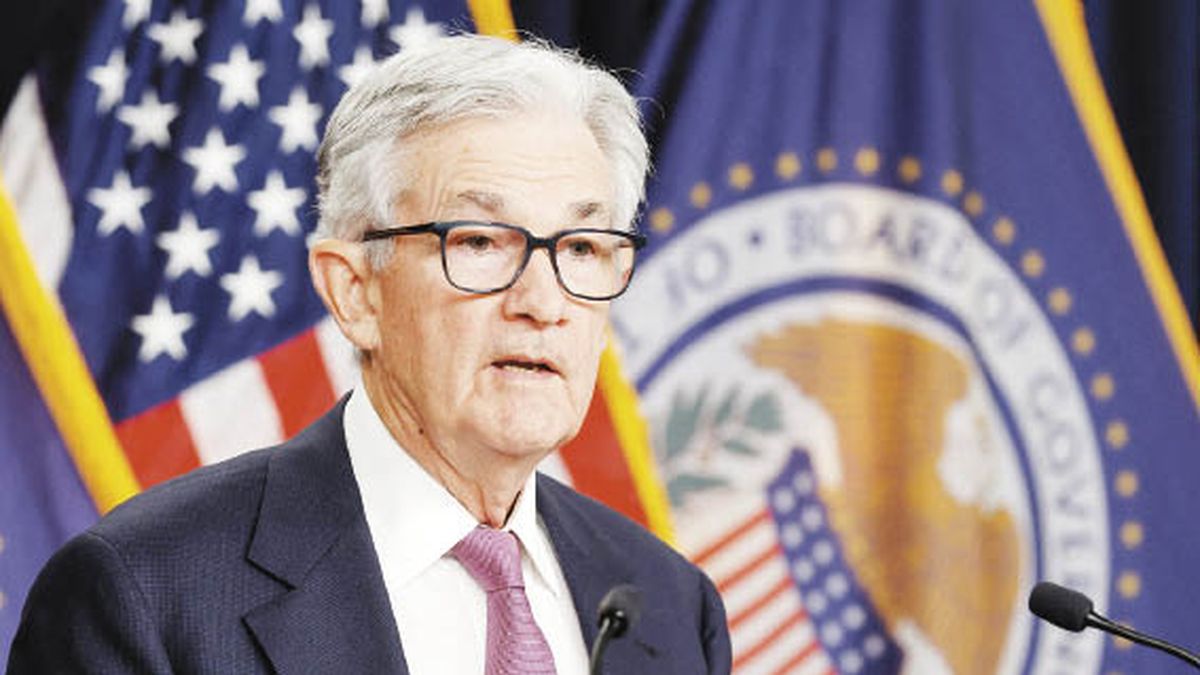

At the most recent meeting last monthUS Federal Reserve officials They expressed a growing conviction about inflation control, evidencing a decrease in “upside risks.” However, they raised the most prominent concern about the potential harm that a monetary policy considered “too restrictive“could cause the economy, as the minutes of the central bank’s December 12-13 meeting revealed.

The minutes indicated that “nearly all participants noted that … a lower target range for federal interest rates would be appropriate by the end of 2024.” This stance was based on increasing uncertainty about the necessary duration of a tight monetary policy.considering the progress made in reducing inflation.

Although “some” Fed officials warned of the possibility of facing a crossroads between the dual objectives of controlling inflation and maintaining high employment rates, most sought to avoid this dilemma and aimed for a “soft landing.” after the recent rise in inflationwhich until November remained just below the Federal Reserve’s 2% target.

Federal Reserve: what’s coming according to the US central bank

“The Fed minutes added more noise to the market, but at the end of the day they did not greatly affect expectations regarding the entity’s future actions.. The members of the entity were erratic in the last meeting, but they showed lowering rates as the most likely scenario, although they did not make progress in indicating a temporary path for this journey,” they comment from Delphos Investment.

“And that is where the biggest differences lie with the market, which already prices a cut at the March meeting with a probability close to 70%. Some members indicated that they only see this possibility at the end of the year. That will be one of the big debates of the current year. In this framework, interest rates did not register major movements, while stocks continued on the path of technical correction. This time, “small caps” stocks were the hardest hit, recording a decline average of 2.7%, followed by the “techs” with an average decline of 1.06%,” adds the brokerage house.

The Fed now hands over the baton to employment data. Today we will have news on this front with the ADP data and new requests for unemployment insurance, but the highlight will come on Friday with the official employment report for December.

The minutes revealed a decline in inflation readings during 2023, especially in the last six months. However, uncertainty remained regarding the precise moment to begin interest rate cuts, while the possibility of further increases in these rates was highlighted.

The ongoing debate among Fed officials revolved around how to safeguard the economy while inflation declines. The “majority” considered that monetary policy was fulfilling its objective by curbing household and business spending to bring inflation back to the established target.

Despite this positive assessment, the need to maintain a restrictive stance in monetary policy was stressed until inflation showed a sustainable decline towards the Committee’s objective. However, caution was emphasized in future decisions, taking into account the emerging risks for the economy and the possibility of inflation that progresses faster than anticipated.

At last month’s meeting, the Federal Reserve kept its benchmark overnight interest rate at the current range of 5.25%-5.50%. The most recent economic projections indicate that most officials expect a three-quarter percentage point decrease in the interest rate throughout 2024. The next Fed meeting is scheduled for January 30-31.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.