World stock markets ended 2023 with significant gains; a year in which many financial centers broke records or registered strong profits, especially in the last two months.

wall-street.jpg

New York Stock Exchange

2023 will be remembered as the year in which the Federal Reserve, with Jerome Powell at the helm, sought to fight tooth and nail against post-Covid inflation. “The pace of prices, which reached peaks of 10% year-on-year at its peak, successfully fell towards the 3% area towards the end of the year thanks to a strong increase in the interest rate,” pointed out a report from Criteria.

As a consequence of these policies, Volatility in the 10-year Treasury bond rate was significant. “Towards the end of October, it reached maximum levels of 5% and then ended the year at levels of 3.85%. A compression of the rate in the last quarter was an incentive for fixed-income and variable-income assets, which experienced a rally in recent weeks,” they added from Criteria.

Wall Street: how it did in 2023

In Wall Streetthe Dow Jones gained almost 14% in 2023. The S&P 500 accumulated a rise of 24% and the Nasdaq more than 43%. In the United States, the Nasdaq, thanks to megacapitalizations of technology companies such as Microsoft, Apple and Nvidia– shot up more than 43%. The annual profits were especially impressive for Nvidia (+234%), Goal (Facebook parent company, +192%) and tesla (+101%).

This way, The S&P 500 rose for nine straight weeks to end the year, its best streak of gains since 2004. Investors on Wall Street began the year expecting inflation to decline further as the Fed raised interest rates. The offset would be a weaker economy and possibly a recession. But while inflation has dropped to around 3%, The economy has advanced thanks to strong consumer spending and a healthy labor market.

However, Big Tech stocks led the Nasdaq Composite to its best year since 2020 thanks to enthusiasm for Artificial Intelligence (AI). Tech stocks rebounded from a disastrous 2022 and led the Nasdaq to one of its strongest years in the past two decades. After last year’s 33% drop, the gain was also just shy of the index’s 2009 performance.

Those are the only two years with bigger gains dating back to 2003, when stocks were emerging from the dot-com crisis. The Nasdaq is now just 6.5% below its all-time high it reached in November 2021. The so-called “Magnificent Seven” were the preference of investors and pocketed superlative profits.

For their part, the Medium duration Treasury bonds rose 3.6% in the year, while high-quality corporate bonds rose 9.4% in 2023. Much of this gain occurred in December, when High Yield bonds rose around 3.6% and accumulated an annual return of 11.9%. .

“If 2022 was a very bad year for both stocks and bonds, we can say that during 2023 both asset universes turned the page, obtaining juicy returns”summarized from Criteria.

European stock markets: how they did in 2023

In Europe The industry provided the best results: in London, Rolls-Royce, multiplied its price by more than three throughout the year. In France, Stellantis (+59.34%) was the most profitable value while in Germany. Rheinmetall (+54.26%) topped the list of winners.

Emerging markets: how they fared in 2023

For its part, the emerging world had mixed returns in 2023. China presented a year full of challenges due to the strong real estate crisis that is strongly impacting growth. In this context, Its shares fell 19.5% this year.

On the other hand, the Brazilian stocks had a great year with a return of 23%.

The ETF that brings together emerging markets, However, the year ended with a 3.7% returnaffected by the poor Chinese performance.

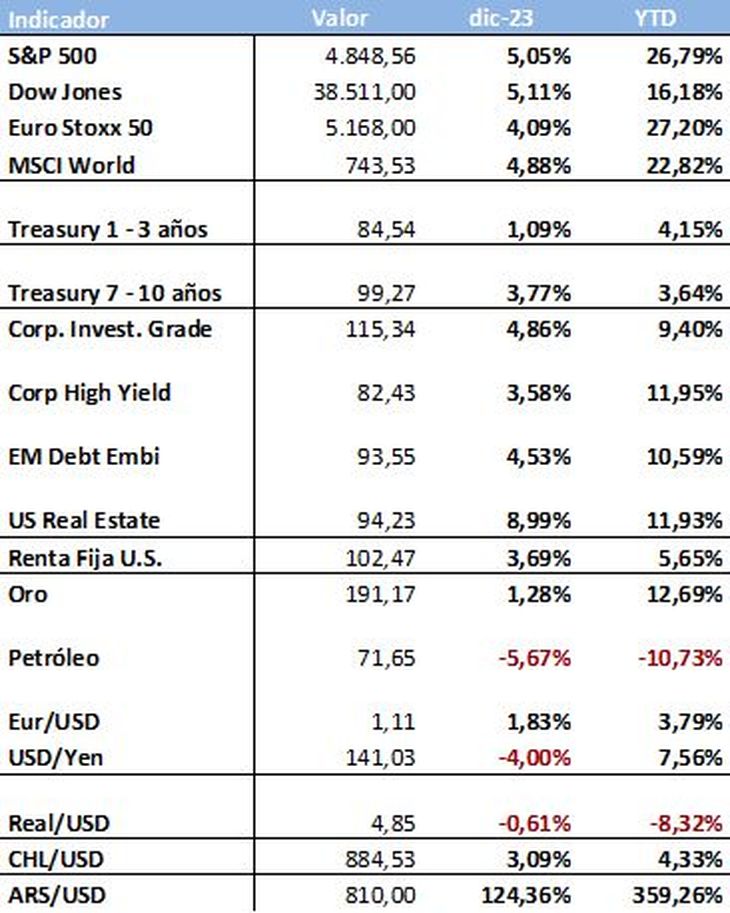

2023 returns in the markets

criteria box.jpg

SOURCE: CRITERIA

Markets: what awaits us in 2024

It should be noted that in 2023 the market also went through “a mini banking crisis, strikes and a worsening of the geopolitical situation”recalled Art Hogan of B. Riley Wealth Management.

Year 2023 began with the expectation of a recession supposedly triggered by the tightening of monetary policy “but that never materialized,” recalled Maris Ogg, financial executive at the consulting firm Tower Bridge Advisors.

“We started with fear of a recession and we end up completely euphoric with the idea that interest rates are going to go down. Now that the market has taken all that into account, it could depend much more on business results in 2024,” he said.

Ogg wait a tougher year ahead for business margins. However, analysts are betting on average profit growth of 12% in 2024.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.