The constant search for cover because of a inflation runaway economy that erodes the savings of Argentines led to the common investment funds (FCI) to dial new growth records year after year. In 2023, the industry reached $26 billion assets under management (AUM), is reflected by an increase of more than 300% compared to 2022 in response to a context in which liquidity.

Its growth rate was very positive, above the annual average of 67% for the last five years; and positive around 100% adjusted for inflation. In fact, the average monthly growth was 13%, beating price dynamics in 10 of the 12 months of the yearaccording to a report by Personal Investment Portfolio (PPI).

The FCI industry currently manages $28.8 billion. “If we take into account that the financial system as a whole captures private deposits for $38.8 billion, we see that the industry today is equivalent 3/4 of total private deposits that the banks manage,” explains Francisco OdoneInvestment Manager of MEGAQM, in dialogue with Ambit.

The analyst adds that, in relation to the Gross Domestic Product (GDP), while the financial system has deposits equivalent to 15% of GDP (Public + Private), the FCI Industry “It already manages assets for the equivalent of 9.4% of GDP”, which implies an increase of 54% in the last year.

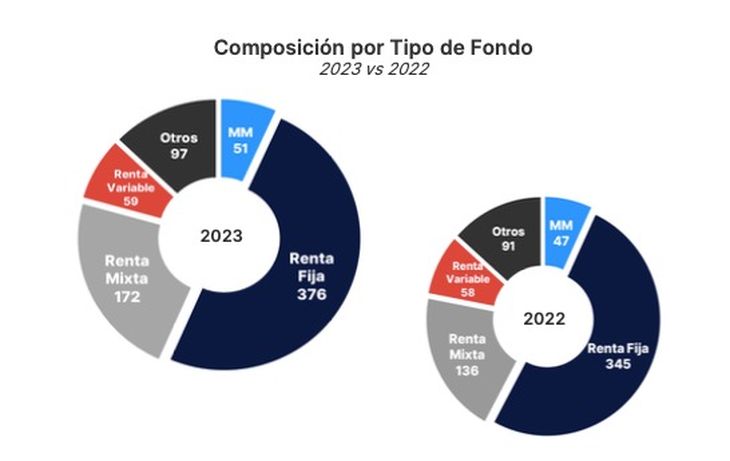

image.png

This growth is explained, according to Odone, because it was possible to become widespread and offer solutions to a context very challenging like the last few months. “With rising inflation, negative real rates and expectations of devaluation”, which led savers and companies to turn to the FCI industry in search of “preserving the value of their pesos and taking coverage”.

Common investment funds by currency

According to PPI, There is no doubt that peso-denominated funds lead the industry. These already exceed 650 options, showing a growth of 13% in 2023, against 4% for funds in dollars, that barely offer more than 100 alternatives.

WhatsApp Image 2024-01-14 at 11.58.53.jpeg

Even when analyzing them by currency and segmentFixed Income concentrates the largest amount of funds in pesos and hard currency. “About the latter, specifically, about 79 out of 100 funds in dollars (80%) are Fixed Income,” the document adds.

More traditional mutual funds

There are various types of FCI, from the most conservative to the most risky. As far as the most conservative ones are concerned, in pesos, there are the Money Market industry funds and the so-called T+1 Fundsindicates in statements to this medium Matias RossiPortfolio Manager of Investing in the Stock Market (IEB).

And he explains that the FCI Money Markets invest in paid bank accounts, fixed terms and they also place the pesos in guarantees or passes“with the advantage that liquidity is immediate”, this means that the ransom is paid on the same day and at the time of its request.

Precisely the objective of these funds is to maintain remunerated liquidity with daily accrual. “Today, Money Markets yield approximately 90% of the annual nominal rate (TNA) and do not suffer from volatility in their share value”says Rossi.

On the other hand, There are the T+1 FCIs that are also subscribed in pesos, and as their name indicates, they have the peculiarity that ransoms are paid 24 hours after their request. That is They are credited the next business day after your agreement.

More sophisticated FCI options

Rossi explains that unlike the Money Market, These FCIs also invest in market instruments such as LEDs at a fixed rate or very short duration bonds.and for this reason the T+1 have a little more volatility in their share. “This is because the objective of these FCIs is to competefor example, at the Fixed Term rate, having the advantage of having the liquidity of the investment in 24 business hours“, Add.

Therefore, the investment horizon in these Funds is a little longer than that of the Money Market, although they are still funds to invest in the short term. “Our FCI T+1 is the IEB AHORRO PLUS,” says the analyst.

Following within the more conservative funds or lower risk, but moving to hard currency, are the so-called Latam Funds. These FCIs have the dollar as the legal tender of the Fund. The portfolios are made up of Treasuries Bills up to 25% of your portfolio (US fixed income bonds), and fixed income assets of both sovereign debt and corporate debt of Latam origin (Chile, Brazil, Uruguay, Paraguay, among others).

“They are all low volatility instruments, with the objective of preserving the investor’s capital in dollars”says Rossi. They yield approximately an IRR of 5%, and their investment horizon is Medium to Long Term to seek to earn the rate points of the different assets in the portfolio. “The FCI IEB DOLLAR FIXED INCOME is our Latam Fund,” he adds.

Experts recommend that the investment plan be designed based on the specific needs of each saver. This is because there is no portfolio that can be replicated for any investor. Today the priorities They involve taking very good advantage of short-term liquidity surpluseseither with the FCI Money Market if the period is very short or “looking for the differential of T+1 funds if the availability period is greater than 10 days”explains Odone from MEGAQM.

Thus, the choice of the FCI will depend on the investor’s risk profile and their financial objectives. Nevertheless, It is crucial to understand the investment horizon and the volatility associated with each type of fund to make the right decisions.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.