After the National Institute of Statistics and Censuses (INDEC) would disclose the rate of inflation December, which marked 25.5%, it was expected that The Central Bank (BCRA) will make a decision regarding the interest rate offered for fixed terms. The resolution, which was to maintain it, ratified the intention of maintaining the negative rate depending on the economic policy carried out by the Minister of Economy, Luis Caputo.

Then two doubts arise for savers: for those who invested in a traditional fixed term, the unknown is how much they will lose to the advance of inflation. For those who opted for UVA, the question is whether they will be profitable in the future taking into account the rise in parallel dollars.

Something important to remember is that the UVA fixed term has a minimum period of permanence of funds of 180 days (6 months) doubling the previous minimum period.

When calculating the performance of the UVA fixed term, it is necessary to take into account the following information: this instrument expressed in a unit (the UVA) captures the evolution of internal prices 45 days late. In the event that inflation is expected to decrease month by month, past inflation is captured, which makes the instrument profitable compared to the evolution of the CPI.

UVA fixed term: what will the performance be for the coming months

For the next 4 months, those who already have a fixed UVA term from before the new regulations (prior to December 28) or those who have placed it in the month of January (when it was already in force), the first 4 months could tend the following performances, based on the Survey of Market Expectations (REM):

rem.PNG

“Since February, the potential of the UVA fixed term. Not only is it a winner in relative terms compared to the traditional fixed term, but also compared to the CPI growth expectations, even those most pessimistic forecasts about the upward trend in retail prices,” explained Andrés Méndez, Director of AMF in a work prepared for Ambit.

At the same time, he asserted that starting in February, the slowdown in the growth rate of the CPI which, however, will easily exceed the minimum rate for time deposits set by the Central Bank. “If it is not modified upwards (as it was not done this month), the traditional 30-day deposit will be a comfortable loser compared to price developments.”

With this report, it is demonstrated that Those who placed a UVA fixed term will be the big winners. He then stated that by taking the UVA deposit, the inflation of the weeks prior to the placement, a downward trend in prices in the economy month after month, “would generate a greater income from this investment with respect to the evolution of the CPI.” .

Fixed term vs dollar: what role does the exchange rate play in the investment decision?

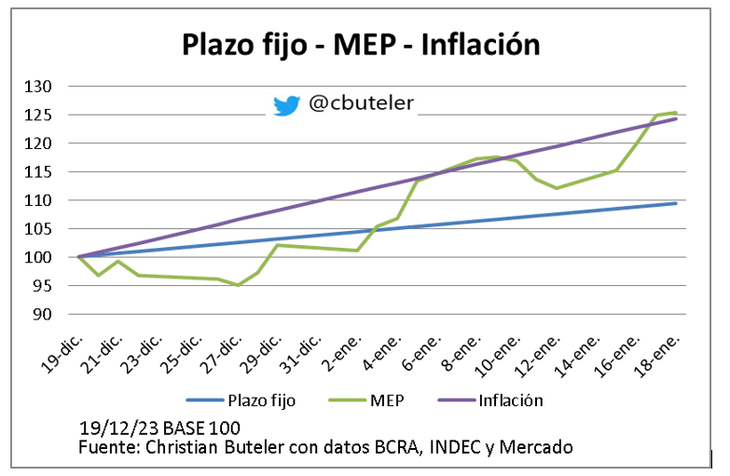

According to the economist Christian Butler, in a month the MEP dollar beat the traditional fixed term. Meanwhile, regarding inflation, the MEP was slightly above the price indicator.

bute.PNG

Méndez added that expectations play a predominant role: it is expected that prices grow nominally at a rate higher than the peso/dollar parity.

“Although this circumstance considers a more extended horizon than these first months of the year, reality indicates that during the second quarter of the year, The supply of agricultural currency increases seasonally as a result of the liquidation of a considerable portion of the gross harvest. Consequently, as the month of March signs are beginning to appear that reflect that the prices of subsequent weeks They will be less ‘nervous’ than those in force until then.”

In this way he analyzed that a blue dollar (or other alternative) at $2,200 would neutralize In the next 90 days any increase expected for UVA fixed terms.

“According to the exchange rate expectations contained in the median of the REM ($/u$s1,100 for next April, assuming a variant regulated by the BCRA), it would imply that the ‘gap’ would have reached 100% again. Given that such a situation is not expected, even less so for the second quarter of the year, it can be deduced that the UVA fixed term will not only beat its traditional brother, but also the dollar in its free meanings and to the evolution of internal prices.”

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.