Banco Comafi reported that starting this Wednesday there will be a change in ratios in Cedears. In this note Ámbito tells you everything you need to know.

Investors alert: Cedears will suffer an abrupt change this week that will impact its prices

Comafi Bankone of the entities that issues the Argentine Certificates of Deposit (Cedears) in Argentina, confirmed that starting this Wednesday there will be a change in conversion rates. Ambit It was proposed to explain why these adjustments will happen, what impact they will have on the client accounts and when the investments will be normalized. But first, let’s explain What are conversion ratios?

The content you want to access is exclusive to subscribers.

When you invest in a Cedar is being acquired a small part of an underlying stock that is not listed on the BYMA. What are conversion ratios then? They are the ones who tell us how many local Cedears constitute an original stock operating in international markets. For example, Apple’s Cedear had a conversion ratio of 10 to 1, this means that 10 local Cedears were equivalent to 1 Apple share.

One market trader explained it this way: “A change in ratio means that They are going to need more Cedears to convert to a stock. For example, if you had a ratio of 5:1 and it goes to 10:1, They will see a loss of 50% since now each Cedear will be worth half. Nevertheless, another 5 will be issued to offset holdings. In this way, in the period of time that the Cedears take to be issued, they will see the account with losses. Don’t be scared, it’s common.”

Thus, it is important to know, in order not to fall into despair, that At the end of this week, the holdings in the client accounts would have to be normalized. This situation was also noticed by the CEO of Cocos Capital, Ariel Sbdar: “On Wednesday, 30 Cedears begin trading ex-coupon due to the increase in the ratio. This means that Wednesday’s price will fall because your holding will increase on Friday. The effect is neutral but Until you receive the new Cedears you will see a lower valuation in your wallet. “It will finish adjusting on Friday.”

Cedears: what are the changes in the ratios due to?

In dialogue with Ambitthe Economist José Ignacio Bano He pointed out that these changes usually happen so that each Cedear is traded for a smaller amount, so retail investors can trade them more: “As the dollar rose a lot and the Cedears are linked to the Cash with Settlement dollar, many became very expensive in pesos”he explained.

Cedears: what the changes in ratios will look like

Let us return to the example of Manzanaif the original ratio was 10:1implied that they needed 10 Cedears to obtain 1 original share. Now the ratio will be 20:1meaning that, starting this week, each Cedears will now be quoted at half the price but instead They will give me new Cedears to complete the same amount.

Bano, therefore, highlighted that the most obvious change will be that, “Investors will observe that in companies in which the ratio of these papers changes, the price will change.” For new investors it will not imply major changes, unless they seek to convert to the original share.

“If you want to make the conversion and take the money outside, it does change for you because since Cedears are a fraction of a share, you are going to have to have just the right amount to get the entire stock“Bano explained. Now, in the case of Apple, you are going to need twice as many certificates.

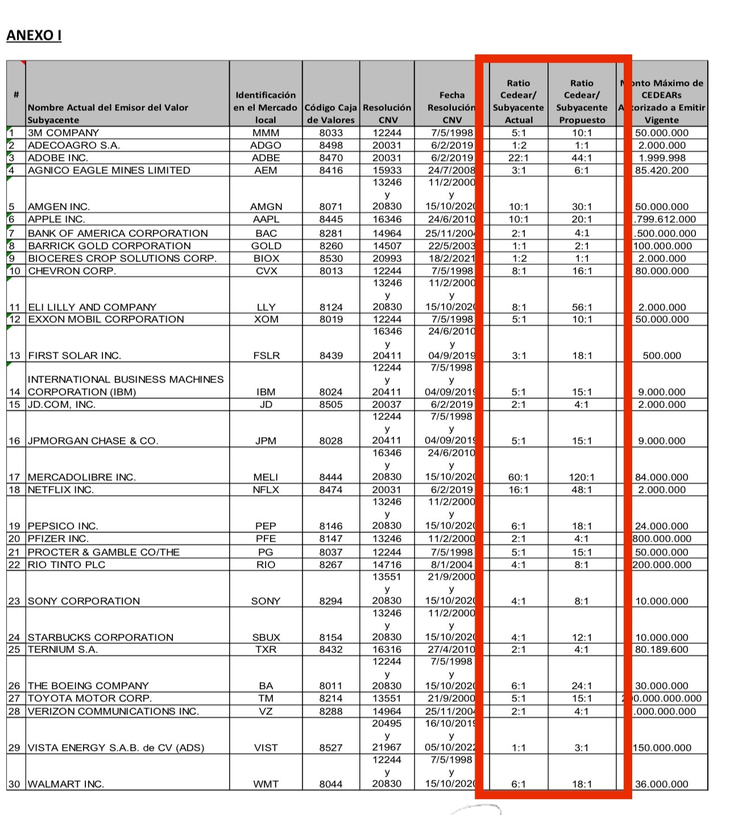

Cedears: what are the roles that change the ratios

image.png

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.