Bopreal started. In this context, the question among investors is whether or not it is advisable to add this title to their portfolios. In that context, since Wise Capital They try to answer that question.

The Bopreales are coming, are they suitable? Importers don’t care about convenience: they need to pay abroad and in the Bopreal find the best alternative, so they “should” participate in the bidding. The investor plays another game, but be careful that it is a field that the importer has to know because he is going to have to go as a visitor to sell the Bopreales.

It is an expensive, very expensive bonus. It has an IRR of 16% annually versus 38% offered by those that mature in 2029 and 34% annually by those that mature in 2030.

Furthermore, Bopreal is trading at a parity of 71.2% versus 40% for the 2030s. If we look at the yield curve, Bopreal should be worth around USD44, which implies a drop of 38%. There is no justification for having such an outrageous bonus.

It’s more, the AL30 and GD30 (the 29 perform even better) They allow us to collect 100% of the invested capital in May 2026due to the flow of funds from the bonds, while with Bopreal 1 we would do it in May 2027, a year later. If we did the calculation with Bopreal 3, the recovery would be in March 2026. The advantage is that AL/GD30 has a lot to gain after recovering capital in May 2026, while with Bopreal 1 and 3 it is much less because they are short bonds at developed economy rates. Bopreal 2 does not compete because being a zero-rate bondyou have to value it by the discount and even in pesos. The following graph shows us the evolution of the flow of funds.

WhatsApp Image 2024-02-06 at 12.05.59.jpeg

From the previous graph it could be deduced that we could be in Bopreal and then move to AL30. It is an error for two reasons: One is that Bopreal would be expensive (the IRR and Parity confirm this); and the other is that the normalization of the economy is going to make the price of the AL30 rise a lot; while the Bopreal one must be lit a candle so that it does not fall… especially when we are going to observe that it will become a highly offered bonus.

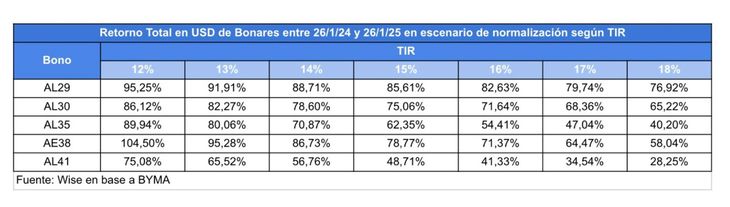

That rise a lot for him AL30 It is an increase in dollars of 65% in twelve months with a normalization of the economy, plus the flow of funds to be collected with the bond.

WhatsApp Image 2024-02-06 at 12.05.59 (1).jpeg

If we think that with the total placement of the Bopreales (USD10,000 million) plus access to the MULC for debtors below USD500,000 and that the historical debt is the rollable working capital, what will be left to solve is approximately USD2.4 billion, with which, those who can wait to access the MULC starting in Mayit wouldn’t be a bad alternative. We do not have an opinion on this because there is a commercial issue in the middle due to the client/supplier relationship from abroad.

WhatsApp Image 2024-02-06 at 12.06.00.jpeg

Just as we alone at Wise Capital said that the placement of Series 1 was going to be successful and that the tenders were going to occur in the last two or three daily calls, We tell you that Series 2 and 3 will also be, but in this case it is feasible that success will not wait until almost the end.

Importers play a different game and many have to participate. Investors are not going to be seduced by around USD70. Wise Capital, as a potential buyer, would look at Bopreales fondly at around USD50 (our actual entry price would be USD44). Above that value there are better investment alternatives, and very superior ones.

This seems secondary, but it is not because we have to ask ourselves at what price we are going to sell the Bopreales. There is a logic that indicates that the CCL acts as a reference… but to the investor this will seem very expensive and if the investor wins the fightpayment abroad, converted into pesos, can be much more expensive than doing it with CCL in the traditional way.

Without a doubt, you have to sit down and decide the best alternatives.. Believing in the only tool can be more expensive than you think when the market has depth.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.