The industry of leasing bets on continuing to gain ground this year, based on lower costs of investment financing that offers other alternatives. Already last year the portfolio balance of the sector in the country exceeded $220,000 millionafter 772 contracts were signed in the last quarter.

The data corresponds to the closing of the annual statistics of the Argentine Leasing Association (Leasing Argentina). With the 772 contracts concluded in the fourth quarter of last year, a total of 4,017 was reached throughout 2023. This is the second highest level of activity since the end of the pandemicstood out from the sector.

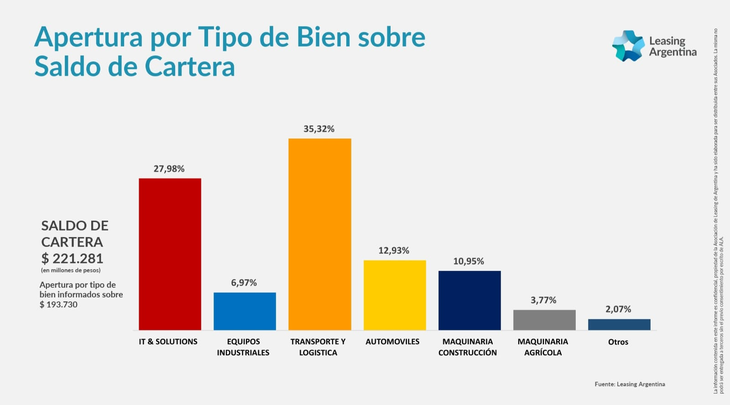

The total balance at the end of 2023 was $221,281 million and implied a nominal growth of 118% annually. Although the growth of this tool was below annual inflation, it performed better than its main competitor, collateral credit (+109%). In addition, it registers a default rate lower than the average of the financial system.

The bet on gaining ground as a means of financing lies in the lower costs and in the fiscal benefits that leasing offers for investors. “In an Argentina where everyone looks for a price, the same thing happens when it comes to financing. Investors seek to pay a lower rate. Therefore, this instrument will be key in this new stage of the country, in order to accompany investment needs with the best costs compared to other types of financing. That is why we believe that It is a year for leasing to grow“, highlighted the president of the association that brings together the sector, Nicolas Scioliin dialogue with Ámbito.

NICOLAS SCIOLI

Leasing works in the following way. A bank or specialized company (giver) acquires a good requested by the client (taker) and delivers it to them for use during a specific period agreed upon in the contract. In exchange, the client pays a fee (fee). At the end of the contract, the policyholder can pay a purchase option that will allow him or her to gain ownership of the asset. The good is not part of the client’s assets during the term of the contract.

As attractions, leasing offers financing to longer terms for 100% of the good, with lower fees than other alternatives (because, for example, VAT is financed free of charge) and tax benefits (such as the deduction of the fee from the payment of Profits, among others) that make the effective rate lower. In addition, it finances complementary costs (import expenses, transportation, etc.), the amount and frequency of the fee adapts to the possibilities and flow of funds of the policyholder. “For this reason, we say that it is the best investment tool,” said Scioli.

In that sense, to continue gaining ground, leasing providers are committed to working with goods suppliers so that they can offer their clients this financing tool. The truth is that it will be a complex year in terms of productive activity, but among the givers they trust that the benefits of this tool and the potential of certain branches of economic activity will allow the business to expand.

Among the sectors or types of goods with the best prospects, Argentina Leasing highlights that inputs for logistics and means of transportation will continue to have an important weight. They also expect a rebound in agricultural machinery (there are expectations for Expoagro) since last year the drought affected it significantly. And finally, they point to sectors with future potential for the country’s development, such as hydrocarbons.

Leasing in numbers

The truth is that, last year, 42.29% of the leasing portfolio balance was allocated to financing the purchase of equipment. Transport and logisticsby 27.98% to the acquisition of property technology and telecommunicationsby 10.95% to the acquisition of machinery constructionby 6.97% when purchasing industrial equipment and by 3.77% to the Farm Equipment.

image.png

In the fourth quarter of 2023, financing via Leasing presented an average arrears of 1.44%, which was lower than the average of the financial system, which stood at 2.67% at the end of November.

On the other hand, in that period, leasing operations generated approximately 9,012 jobs (they ensure that the impact of each contract in terms of jobs created is fully traceable).

Likewise, the SMEs They continued to drive the sector since They represented 46.9% of the portfolio. The leasing providers affirm that for the growth of this tool to intensify, it is important that all companies and investors, especially SMEs, know what financing alternatives they have and the benefits that leasing offers.

Leasing industry ranking

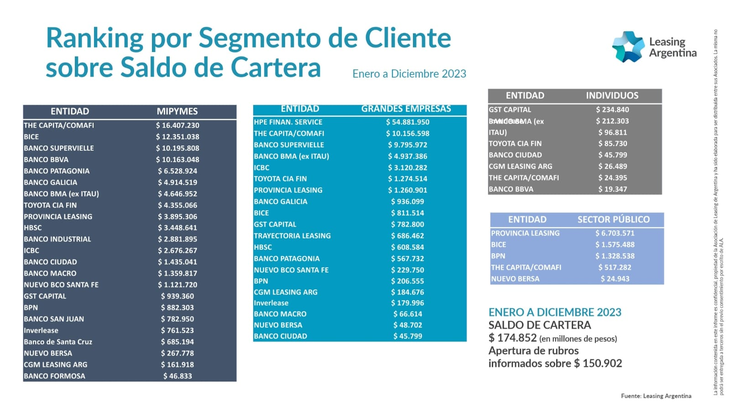

Regarding financing for SMEs, The Capita Corporation (subsidiary of Banco Comafi) was the leader with a leasing portfolio assigned to this sector of $16,407 million, an amount that represents 18% of the total granted to this segment. They were followed by BICE, with $12,351 million; Banco Supervielle, with $10,195 million; and BBVA Bank, with $10,163 million.

In terms of financing large companies, HPE Financial Service led with $54,882 million in portfolio, followed by The Capita Corporation / Banco Comafi ($10,156 million) and Banco Supervielle ($9,795 million).

image.png

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.